November 24, 2015

2015 Tax Reference Tables

Inflation/Cost of Living Tax Updates

| Tax Benefit | 2015 | 2016 |

| Personal/Dependent Exemption | $4,000 | $4,050 |

| STANDARD DEDUCTION | ||

| Married FIling Joint | $12,600 | $12,600 |

| Single | $6,300 | $6,300 |

| Married FIling Seperately | $6,300 | $6,300 |

| Head of Household | $9,250 | $9,300 |

| Maximum Earned Income Tax Credit for Low/Moderate Income Workers | $9,250 | $9,300 |

| Foreign Earned Income Deduction | $100,800 | $101,300 |

| Maximum Taxable Social Security Earnings Base | $118,500 | $118,500* |

* According to www.SSA.gov

2015 Corporate Tax Rates

| OVER | BUT NOT OVER | THE TAX IS | OF THE AMOUNT OVER |

| $— | $50,000 | 15% | $— |

| $50,000 | $75,000 | $7,500 + 25% | $50,000 |

| $75,000 | $100,000 | $13,750 + 34% | $75,000 |

| $100,000 | $335,000 | $22,250 + 39% | $100,000 |

| $335,000 | $10,000,000 | $113,900 + 34% | $335,000 |

| $10,000,000 | $15,000,000 | $3,400,000 + 35% | $10,000,000 |

| $15,000,000 | $18,333,333 | $5,150,000 + 38% | $15,000,000 |

| $18,333,333 | — | 35% | — |

Phase-Out of Itemized Deductions the “Pease” Limitations

Subject to limitations certain itemized deductions are phased out once AGI exceeds certain thresholds:

| FILING STATUS | AGI THRESHOLD FOR PEASE LIMITATION 2015 | AGI THRESHOLD FOR PEASE LIMITATION 2016 |

| MARRIED FILING JOINTLY | $309,900 | $311,300 |

| MARRIED FILING SEPERATELY | $154,950 | $155,650 |

| SINGLE | $258,250 | $259,400 |

| HEAD OF HOUSEHOLE | $284,050 | $285,350 |

2016 Individual Income Tax Rates*

| RATE | SINGLE | HEAD OF HOUSHOLD | MARRIED-JOINT | MARRIED-SEPARATE |

| 10% | $0 – $9,275 | $0 – $13,250 | $0 – $18,550 | $0 – $9,275 |

| 15% | $9,275 – $37,650 | $13,250 – $50,400 | $18,550 – $75,300 | $9,275 – $37,650 |

| 25% | $37,650 – $91,150 | $50,400 – $130,150 | $75,300 – $151,900 | $37,650 – $75,950 |

| 28% | $91,150 – $190,150 | $130,150 – $210,800 | $151,900 – $231,450 | $75,950 – $115,725 |

| 33% | $190,150 – $413,350 | $210,800 – $413,350 | $231,450 – $413,350 | $115,725 – $206,675 |

| 35% | $413,350 – $415,050 | $413,350 – $441,000 | $413,350 – $466,950 | $206,675 – $233,475 |

| 39.6% | Over $415,050 | Over $441,000 | Over $466,950 | Over $233,475 |

2016 AMT Exemption

| 2015 AMT EXEMPTION | 2015 | 2016 |

| MARRIED FILING JOINTLY | $83,400 | $83,800 |

| MARRIED FILING SEPERATELY | $41,700 | $41,900 |

| SINGLE | $53,600 | $53,900 |

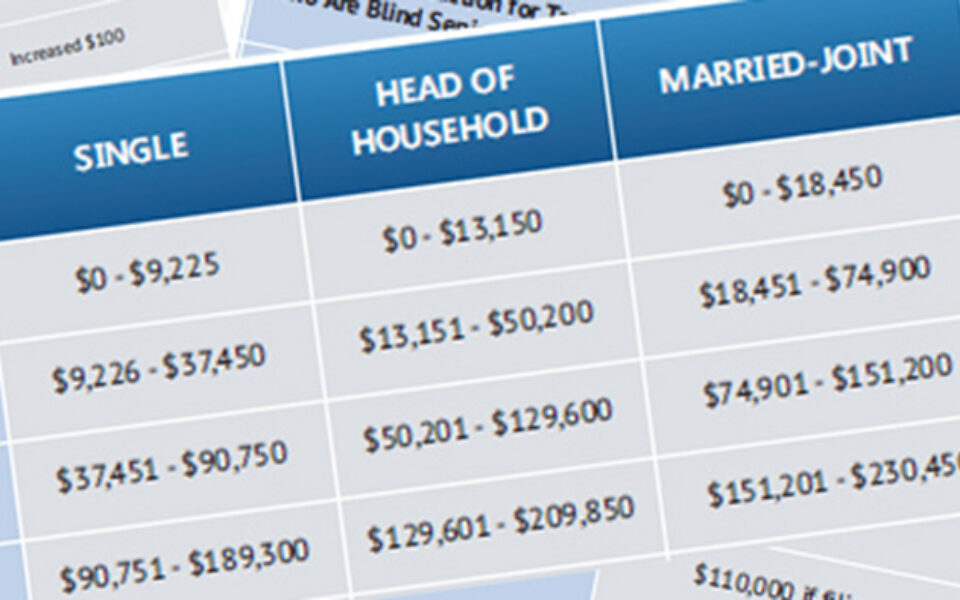

2015 Individual Income Tax Rates

| RATE | SINGLE | HEAD OF HOUSHOLD | MARRIED-JOINT | MARRIED-SEPARATE |

| 10% | $0 – $9,225 | $0 – $13,150 | $0 – $18,450 | $0 – $9,225 |

| 15% | $9,226 – $37,450 | $13,151 – $50,200 | $18,451 – $74,900 | $9,226 – $37,450 |

| 25% | $37,451 – $90,750 | $50,201 – $129,600 | $74,901 – $151,200 | $37,451 – $75,600 |

| 28% | $90,751 – $189,300 | $129,601 – $209,850 | $151,201 – $230,450 | $75,601 – $115,225 |

| 33% | $189,301 – $411,500 | $209,851 – $411,500 | $230,451 – $411,500 | $115,226 – $205,750 |

| 35% | $411,501 – $413,200 | $411,501 – $439,000 | $411,501 – $464,850 | $205,751 – $232,425 |

| 39.6% | Over $413,200 | Over $439,000 | Over $464,850 | Over $232,425 |

Taxable Income Threshold

| FILING STATUS | TAXABLE INCOME THRESHOLD FOR THE 20% RATE FOR LONG-TERM CAPITAL GAIN AND QUALIFIED DIVIDENS |

| MARRIED FILING JOINTLY | $464,850 |

| HEAD OF HOUSEHOLE | $439,000 |

| SINGLE | $413,200 |

| MARRIED FILING SEPERATELY | $232,425 |

| TRUST & ESTATES | $12,300 |

Dollar Limits for Retirement Plans

| PLAN TYPES | 2015 LIMITS* |

| Defined contribution plans | $53,000 |

| Defined benefit plans | $265,000 |

| Deferred contribution plans – 401(k), 403(b) and 457 plans: Under age 50 Age 50 and older |

$18,000 $24,000 |

| Simple plans: Under age 50 Age 50 and older |

$12,500 $15,500 |

| IRA, traditional and Roth: Under age 50 Age 50 and older IRA AGI Phase-Out (married) IRA AGI Phase-Out (single/HOH) |

$5,500 $6,500 $98,000 $61,000 |

| OTHER THRESHOLDS | 2015 LIMITS |

| SEP Annual compensation limit |

$265,000 |

| Key employee in a top-heavy plan |

$170,000 |

| Highly compensated employee | $120,000 |

| Social Security Wage Base | $118,500 |

2015 Estates and Trusts Tax Rates

| OVER | BUT NOT OVER | THE TAX IS | OF THE AMOUNT OVER |

| $ — | $2,500 | 15% | $ — |

| $2,500 | $5,900 | $375.00 + 25% | $2,500 |

| $5,900 $ | 9,050 | $1,225.00 + 28% | $5,900 |

| $9,050 | $12,300 | $2,107.00 + 33% | $9,050 |

| $12,300 | — | $3,179.50 + 39.6% | $12,300 |

2016 Gift & Estate Tax Exemption

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| GIFT TAX EXEMPTION | $5,000,000 | $5,120,000 | $5,250,000 | $5,340,000 | $5,430,000 | $5,450,000 |

| ESTATE TAX EXEMPTION | $5,000,000 | $5,120,000 | $5,000,000 | $5,340,000 | $5,430,000 | $5,450,000 |

| GST TAX EXEMPTION | $5,000,000 | $5,120,000 | $5,250,000 | $5,340,000 | $5,430,000 | $5,450,000 |

| HIGHEST ESTATE & GIFT TAX RATES | 35% | 35% | 40% | 40% | 40% | 40% |

Additional Updates:

- The Annual Gift Tax Exclusion amount is scheduled to remain $14,000 in 2015 and 2016.

- The Kiddie Tax thresholds, which apply to unearned income of minor children has increased to $2,100.

- Proposed Transportation Fringe Benefits for employer provided transportation benefits are $250 for parking and $130 for transit.