Are You Budgeting for Calendar Year 2018? ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities Changes Things

This article is the first in a series of articles discussing ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities.

Topics covered in this article are:

- Required statement of functional expenses

- Cost allocations

- Allocation disclosures

Here’s How:

For fiscal years starting after December 15, 2017, not-for-profit (NFP) organizations will be required to present expenses both by function and nature. Under ASU 2016-14 Presentation of Financial Statements of Not-for-Profit Entities guidance, functional expenses may be presented in the statement of activities, the notes to the financial statements, or in a statement of functional expenses.

If your organization is a 501c (3) or (4), expense reporting by function is something that your accounting department prepares every year for the IRS Form 990. However, effective calendar year end 2018 or fiscal years ending in 2019, all nonprofits are required to present their expenses based on the function and nature of the expense in their financial statements. Because the Financial Accounting Standards Board (FASB) is looking for consistency, they have clarified what expenses are permissible to be allocated in ASU 2016-14. They have also defined financial statement functions.

The minimum disclosure by function requires NFPs to disclose program service expenses and supporting activity expenses. Supporting activities generally include management and general fundraising, as well as membership development activities. For the natural classification, we recommend summarizing major categories of expenses such as payroll and fringe, occupancy, professional fees, travel, and other (unless other exceeds 10% of total expenses).

The new guidance is more prescriptive with regard to which management and general expenses can and cannot be allocated to programs, membership development, and fundraising. This is important for NFPs that budget by department because only those costs which benefit more than one function may be allocated. This would include items similar to the examples provided in the guidance which include, but are not limited to:

- IT

- Occupancy

- Supplies

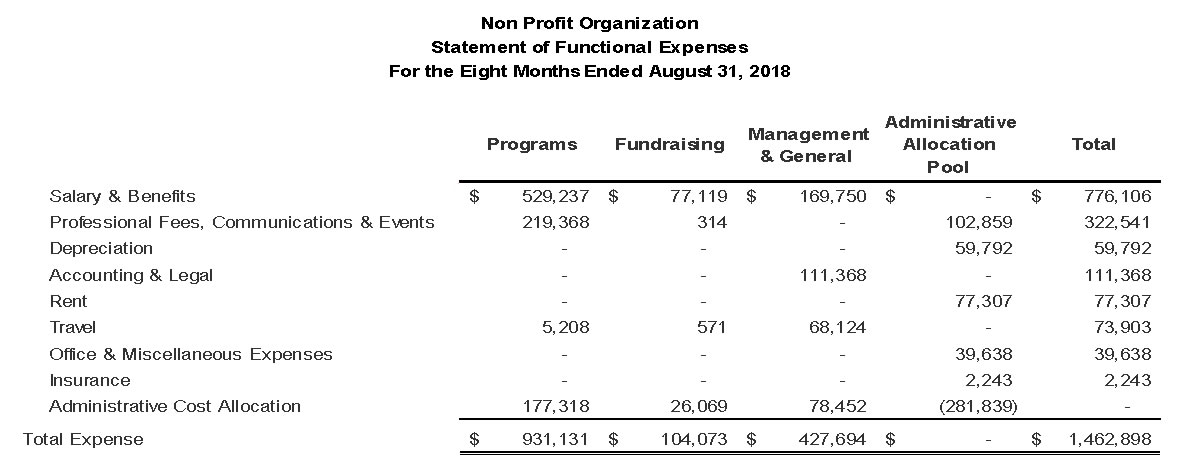

We recommend placing costs allowed to be allocated into a segregated class of management and general entitled “allocation pool” as in the example below:

The guidance specifically prohibits allocating the following costs as they are considered purely management and general costs:

- General oversight (payroll or consulting costs related to the general oversight of the organization)

- Business management (payroll or consulting costs related to the general management of the organization)

- General record keeping, payroll management, and budgeting

- Administering government, foundation, and similar customer sponsored contracts including billing, collecting fees, and grant and contract financial reporting

- Producing and disseminating the annual report

- Employee benefits management and oversight (human resources)

- All other management and administration except for direct conduct of program services fundraising activities, or membership development activities. See the Accounting Standards Codification (ASC) paragraphs 958-720-55-171 to176 for examples of which activities would constitute direct conduct or supervision of program or support functions.

Not only will NFPs have to change how expenses are allocated (if they are currently allocating), they will also have to disclose their allocation methodology in the footnotes to their annual audited financial statements. The disclosure should provide the rationale behind the allocation process.

Here’s Why:

The FASB sought to make NFPs more comparable through their financial reporting. By being more prescriptive in what costs can and cannot be allocated and requiring the reporting of expenses by function and nature, FASB believes that this objective can be met.

Are You Ready?

ASU 2016-14 early adoption requires that organizations implement all of the changes included in the new standards. However, please note that the above changes are allowable under current guidance, so organizations are free to implement them now.

If your organization is considering early adoption or if it needs to modify its budget process – or if you just need to talk through your plans – we can help.