Contributions and Exchanges – It’s All in the Details

By Angela Modrick, Supervisor, and Janet McDaid, Director, Managed Accounting Services

Contribution or exchange? Answering this question has been a longstanding effort for nonprofit financial executives. For contributions, an added complexity is the need to determine if donor conditions or restrictions are present in the agreement.

With so much room for interpretation of various factors, the Financial Accounting Standards Board (FASB) issued clarifying guidance on the topic to help decision-makers in the field approach the issue with a similar method, thus improving the consistency of reporting across organizations.

Effective Date: FASB ASU 2018-08 is effective for annual periods as indicated below and applies to contributions both made and received. Early adoption is permitted.

- Recipients – beginning after December 15, 2018

- Resource Providers – beginning after December 15, 2019

The Big Picture

Whether you label the revenue as a gift, pledge, or donation, the new FASB rule applies to you. If an agreement is an exchange transaction, then revenue recognition rules apply. If an agreement is determined to be a contribution, there are further determinations to be made about whether conditions or restrictions exist.

Similarly, grants, membership dues, and sponsorships could be contributions entirely, with or without conditions or restrictions; they could be exchanges; or they could be a combination of the two. The details of the agreements are what drives the determination, rather than how you, or even the donor, may classify the revenue.

Contribution or Exchange?

Contributions:

- Are unconditional asset transfers in a transaction that is voluntary and nonreciprocal with another entity who is not an owner;

- Lack the intention of exchanging goods or services of value to the donor; and

- Where the resource provider has full discretion on the amount of the assets to transfer.

Exchanges:

- Are reciprocal transfers in which each party receives and sacrifices goods, services, or assets that are of approximate commensurate or matching value; and

- Where parties have indicated they will exchange goods or services as part of the transaction, and there is evidence that penalties will be assessed for failing to comply with the terms of the agreement.

Determination – Who Receives Benefit and How Much

Under the new guidance, the type of resource provider – government entity, foundation, or corporation – is not a factor in determining whether the agreement is an exchange or contribution.

Fulfilling the nonprofit’s mission or making the donor happy does not meet the standard of commensurate benefit when determining if an exchange or contribution occurred.

Further, in determining whether an agreement represents a contribution or exchange, benefit received by the general public is not considered benefit received by the donor, including foundations and the government.

Contributions – Additional Determinations

Once you have determined that you have a contribution, you need to consider if it contains conditions or restrictions. Per the standard:

- A condition impacts whether or not the recipient will be entitled to the contribution at all, dependent on achieving a barrier set by the donor.

- A restriction provides funding that is unconditional, but the donor limits how or when the contribution may be used.

Is My Contribution Conditional?

A donor-imposed condition exists when there is both a barrier and a right of return or release of the donor’s obligation. A barrier is a measurable requirement that the recipient must overcome for the recipient to be entitled to the funding and may require certain units of output, a specific outcome, or a specific level of service. Additional indicators that funding is conditional include an agreement or document that clearly identifies when the condition is met or where the recipient has limited discretion over how the activity is conducted. The clarified guidance states that the ability or likelihood of meeting a condition is not a factor in determining if a contribution is conditional. Further, in situations where it is uncertain if a contribution is conditional, the clarified guidance states that such a contribution should be considered conditional.

What is Not a Condition?

The standard details certain items often found in agreements, that are not considered conditions:

- On its own, with no barrier included, a right of return of assets transferred or a right of release of obligation in agreements does not make funding conditional. Some foundations include theses as a matter of policy, but as long as no barrier is included, a right of return or release does not make a contribution conditional.

- Administrative or trivial stipulations do not constitute a restriction. For example, reporting requirements are not considered a condition since this is considered an administrative requirement not related to the purpose of the grant.

Is My Contribution Donor-Restricted?

Donor-imposed restrictions can exist even when donor-imposed conditions do not. To identify restrictions, consider how broad or narrow the purpose of the agreement is. If the resources may be used only for a specific program or project, or only during or after a specific time period or date, the contribution is likely restricted.

Where to Go From Here

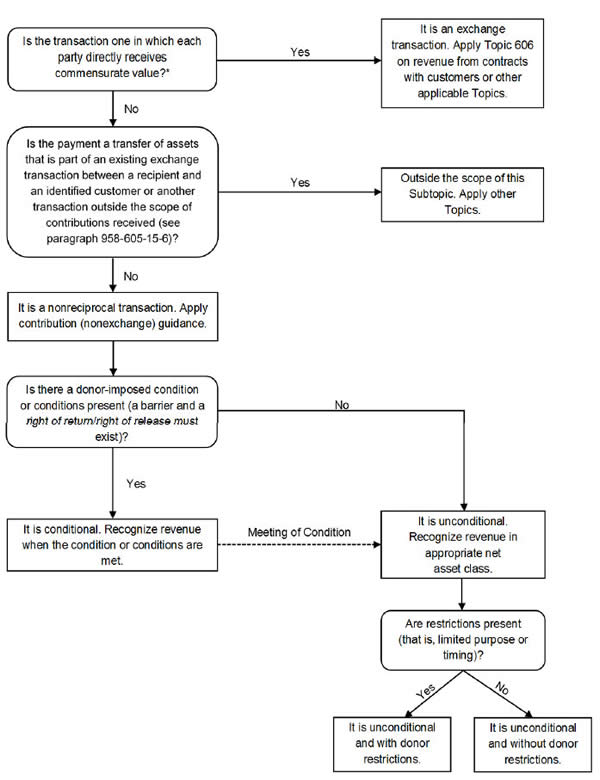

The FASB’s flow chart included below can be a useful guide. Once you determine if an agreement represents a contribution or exchange, know that the FASB guidance points to one of two different sets of accounting standards. For revenue from contributions, follow nonprofit financial reporting guidance (Topic 958), and for revenue from exchange transactions, adhere to the revenue recognition guidance (Topic 606).

The flow chart is sourced from the FASB Accounting Standards Codification® and is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, Norwalk, CT 06856, USA, and is reproduced with permission.

There’s much to consider in deciphering agreements to determine the proper accounting method. If you’ve got a perplexing agreement and would like assistance in making determinations, we can help. Please contact your Marcum manager or partner, or Angela at [email protected] or Janet at [email protected].