Discount Rate Sensitivity in Estimating Business Value

By Adam Naida, Analyst, Advisory Services

Finance professionals quantify multiple factors that drive company valuations, including growth rates, pricing multiples, and discount rates. The subjective nature of these inputs and analyses opens the door for manipulation and distortion of a company’s value. Under the income approach, none may be as important as the discount rate.

The discount rate is the rate of return associated with the risk of the investment; the higher the risk, the higher the expected return. The appropriate discount rate should result in a reasonable and defendable value of a business.Without an understanding of the inputs into the selection of a discount rate, an erroneous discount rate and by extension, value determination, could result.

Key Inputs

In this article, I will focus on the equity discount rate. The two most common ways to calculate the equity discount rate are the Capital Asset Pricing Model (CAPM) and the Build-up Method (Build-up). The CAPM is the market equity risk premium (ERP) multiplied by beta,1 derived from comparable public companies plus the applicable risk-free rate. The CAPM is subject to scrutiny due to the selection of comparable public companies used to determine beta. The Build-up has four major components: (1) the risk-free rate, (2) ERP, (3) size risk premium, and (4) company-specific risk premium. In some instances, an industry risk premium may be warranted, but we will not consider one in this article. The focus of this article is the Build-up.

Developing an Equity Discount Rate Using the Build-Up

Using the four components discussed above, we will build an equity discount rate using a valuation date of December 31, 2018.

Risk-Free Rate

The risk-free rate is representative of the rate of return available in the market for an investment free of default risk and represents the minimum required return for an investor. Typically, a United States Treasury Bond matching the expected holding period is used as the risk-free rate. Using a 20-year Treasury bond, the risk-free rate is 2.89%.

Equity Risk Premium

The ERP reflects a benchmark’s return in excess of the risk-free rate over a period of time. There are multiple ERPs that can be selected. The two most common are the historical long-term ERP and supply-side ERP. The long-term historical ERP is calculated as average annual return of the stock market minus the average annual return of the long-term government bond. The supply-side long-term ERP is calculated by taking the historical risk premium minus the price-to-earnings ratio, using the previous three-year average earnings.2 In this example, the supply-side ERP as of the valuation date is 6.14%.

Size Risk Premium

Smaller companies require a higher rate of return than larger companies, as they are viewed as riskier investments. There are multiple tools available to professionals to develop a size premium, including the Center for Research in Security Prices (CRSP) Deciles Size Study and the Risk Premium Report Study. For this example, assume the company falls in the CRSP Deciles Size Study 10th decile size premium, which includes companies with market capitalizations ranging from $2.455 million to $321.578 million. This results in a size risk premium of 5.22%.

Company-Specific Risk Premium

For a company-specific risk, let’s assume that we are valuing a company that has had strong performance in recent years, established management, and a diversified customer base, all positive factors that reduce risk and decrease the risk premium. For these reasons, a company-specific risk premium is not warranted.

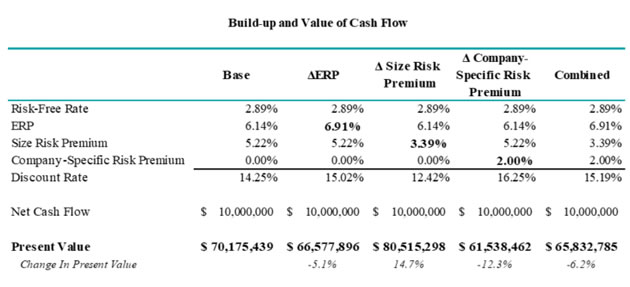

Based on these assumptions, we have developed an equity discount rate of 14.25%. Further, assume that the company’s net cash flow next year is $10 million and has no expected growth. If the net cash flow is discounted back by the discount rate, the resulting present value is $70,175,439.

Discount Rate Input Sensitivity

Changing any input of the equity discount rate will influence the value of the company. The following section changes each premia assumption and presents the impact on value.

Equity Risk Premium

If we change the ERP from supply-side to the historical long-term rate of 6.91%, the discount rate adjusts to 15.02%. This small change in ERP decreased the value to $66,577,896, which represented a negative 5.1% change.

Size Risk Premium

Now let’s consider the micro-cap size premium instead of the 10th decile. The micro-cap size premium represents a market capitalization-weighted portfolio comprised of all 9th and 10th decile companies and, as of valuation date, was 3.39%. The change represents a 1.83% decrease from the 10th decile of 5.22%. The change in size premium results in an increased value of $80,515,298, representing a 14.7% change.

Company-Specific Risk Premium

Finally, the last component, and arguably the most subjective, is the company-specific risk premium. The premium is a risk adjustment for factors that are specific to the company being valued. In our base scenario, no premium was selected based on the strong performance of the company. Now let’s consider if the financial performance had been strong, the management was established, but the company had a high customer concentration. Based on this information, we decide to increase our company-specific risk premium to 2.0%. The 2.0% change results in a discount rate of 16.25% and the value decreases to $61,538,462, which represents a negative 12.3% change.

Combined Adjustments

In the previous scenarios, we have viewed each input in isolation and noted the positive and negative effects on value. Making all of the changes above in the same Build-up, we derive an equity discount rate of 15.19%. Discounting this back results in a value of $65,832,785, which represents a negative 6.2% change. The table below shows the value in each scenario.

Conclusion

In each scenario, small changes in each input influence the calculation of value. Therefore, when looking at a company, considerable analysis must be performed to ensure the discount rate is defendable and reasonable for the company. Marcum business valuation and litigation support professionals have the experience and knowledge to determine reasonable and defendable discounts rates through their depth of experience and knowledge of the valuation process.

RESOURCES

1. Beta is defined as a measure of the volatility, or systematic risk, of an individual stock in comparison to the unsystematic risk of the entire market.

2. Duff & Phelps’ 2018 Valuation Handbook – U.S. Guide to Cost of Capital™, © 2018 Duff & Phelps, LLC. All rights reserved.