Exploiting the Upcoming M&A Market

By Jeffrey S. Rubin, Managing Director, Marcum Cronus Partners LLC

Overview of the Private Equity Market

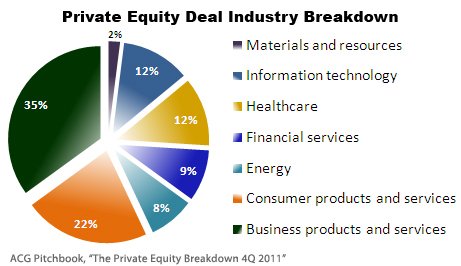

Despite current market turmoil and fears about Europe, select M&A markets have detached themselves from soft consumer and industrial demand, and we have seen M&A activity in these markets begin to increase. Private equity firms will want to take advantage of the opening market and, as they close new funds and stockpile capital, one obvious question presents itself: how to go about spending this money? Being extremely familiar with both the aerospace and defense (A&D) components manufacturing and retail technology industries, we have identified acquisition opportunities unique to these sectors that we believe are ripe for the right financial buyers to exploit.

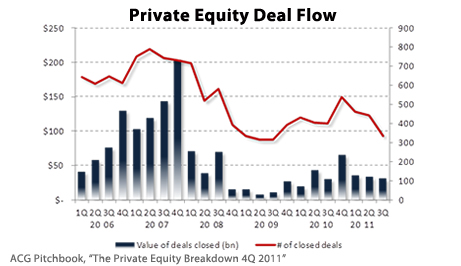

Increased private equity capital flooding the market is expected to lead to a more aggressive, less selective approach to M&A in 2011 through 2012. So far in 2011, the US private equity market has remained on par with post-crisis lows in terms of both deal flow and exit activity. There are, nonetheless, reasons to be optimistic about the private equity market, particularly in the middle-market, going forward.

Private equity coffers are collectively filled with as much as $466 billion of dry powder, with more than 600 additional funds being raised. Moreover, private equity firms are sitting on 4,500 aging portfolio companies, the divestiture of which will most likely lead to reinvigorated deal flow as they look to renew their portfolios. The first half of 2011 has already proven to be the best post-crisis start to a year volume-wise, with $60 billion of capital invested. And, with the evaporation of the easy credit necessary to execute larger deals, this increased activity looks to be headed for the middle-market. Already in H1 2011, middle-market transactions (deals under $500 million) accounted for approximately 90% of private equity activity by deal count.

The Ideal Deal

In these conditions, competition for attractive acquisitions can be expected to pick up. Therefore it will be important to establish what actually makes an acquisition attractive. As a private equity buyer, one will always be looking for the best deal, which is ultimately the biggest bang for one’s buck. In today’s market, that may mean several things:

- Exemplary performance record

- Organic revenue growth

- Flat to rising margins

- Management with a proven track record

- Strong management in marketing, finance and operations

- Foothold in a market that has growth potential

- Most importantly, low multiples

However, such a panoply of superlative qualities is rarely accompanied by an owner willing to sell for a low multiple – one cannot evaluate acquisition opportunities in terms of an isolated multiple without taking into account what that price reflects. A low multiple with respect to the market will be low for a reason, and the key to finding the right opportunity is understanding why a multiple is low rather than indiscriminately hunting for bargain prices; the right acquisition opportunity is ultimately one in which a low multiple can be tied to an identifiable business defect that the buyer is confident a strong management team, with the right guidance, direction and expertise, can resolve. In other words, the right opportunity may not necessarily be that elusive perfect, undervalued business, but rather a solid business model with a remediable weakness that lowers its valuation.

The quality of management, rather than the potential value of a product, is often overly emphasized during the valuation process; the target is viewed as more of a people — rather than a products — business. One area of opportunity to watch will be weak, replaceable management teams in charge of selling a strong, unique product. A growing technology company, for example, may be hindered by a weak finance and operations team while trying to sell a great product developed by a brilliant technology team. A company might be undervalued based on management issues that are unrelated to the product being marketed and on its potential, hitherto untapped, profitability.

The Aerospace and Defense Market

In the current environment, both strategic and financial interest in the A&D M&A market is growing. In general, and past experience has corroborated this, the A&D industry is thought to be rather stable in periods of general market volatility and resistant to macroeconomic weakness; in part, this phenomenon can be explained by the A&D industry’s dependence on long-term government and commercial contracts rather than consumer sentiment. Moreover, the A&D M&A market has historically demonstrated autonomy from sluggish economic conditions. In the wake of the Internet bubble, for instance, this market picked up as the US flexed its Overseas Contingency Operations and increased military expenditures.

Decreased M&A activity in 2008 and 2009 is expected to contribute to an uptick through 2012 as negotiations that had made strategic or financial sense but had been held up by the crisis reopen. We believe that middle-market niche precision manufacturing companies will present especially compelling opportunities in the coming year. As larger A&D firms begin to utilize their own, reduced capacity for major new programs, they will increasingly turn to this group of suppliers for support. The A&D midmarket should therefore see increased activity as the benefits of the original equipment manufacturers’ (“OEM”) consolidation extends their demand for outsourcing.

While the megadeals involving OEM players such as Northrop Grumman, GE, Lockheed Martin and McDonnell Douglas occurred in the 1990s as the result of Secretary Perry’s “Last Supper” push for industry consolidation, the suppliers for A&D OEMs have remained highly fragmented and dependent on a small number of customers much larger than themselves. Customer concentration, lack of size and the necessity to compete with numerous similarly sized manufacturers has left these companies vulnerable to their much larger customers such as GE, Rolls Royce and UTC; these suppliers lack pricing power.

As UTC’s recently announced offer to acquire Goodrich Corporation shows, some aircraft parts manufacturers can be expected to be acquired in the next few years as part of the larger OEMs’ programs to streamline their supply chains and diversify their product portfolios; however, many smaller manufacturers will turn to consolidation amongst themselves in order to achieve the critical mass necessary to maintain their relevance to their customers. In addition to increasing market share, such consolidation will allow midmarket manufacturers to integrate further across aircraft systems and provide more complete assemblies, add broader expertise to their particular niches, and increase the breadth of their capabilities within the after-sales value chain.

Moreover, it is important to keep in mind that A&D is a capital intensive business. As the defense budget slims and OEMs look to reduce expenses, that mandate for cost reductions trickles down and becomes paramount for the smaller suppliers, over whom the OEMs have pricing power. These cost reductions can come from improved plant management, more efficient equipment and engineering breakthroughs. However, because these companies are locked into contracts for standard parts with a select few OEMs, they cannot significantly improve their performance through marketing or design breakthroughs; ultimately it is a question of the capital available to acquire newer and more efficient manufacturing equipment. And, as these companies tend to be small and fragmented, the capital and the contract sizes to justify large purchases of expensive, more efficient equipment are elusive. In this industry, therefore, economies of scale are particularly crucial – a collection of manufacturers struggling to keep up with the pace and specifications of modern demand might, in the hands of the right people and with the right product mix, combine to form a very attractive company.

Some of the defects that detract from a niche A&D manufacturer’s valuation (customer concentration, market share, insufficient capital and undiversified product portfolio) can be remedied through consolidation. And here we see an opportunity to help private equity firms lead this expected roll-up of the industry by identifying a potential target platform acquisition as well as compatible add-ons. Such a program would be a clear example of benefitting from a low multiple driven by defects that can be resolved through the proactive intervention of a financial buyer.

The Retail Technology Market

The retail technology services sector, which is not only very large, but also extremely fragmented, is an area of expertise in which we see an opportunity for profitable consolidation. According to Capital IQ, the US market alone features at least 1,700 software companies that cater specifically to retailers.

As small providers develop unique solutions that are extremely issue-specific, the market has evolved into a medley of small, competing companies distinguished by product type, retail stack and tier. Because retail technology players are generally cornered in particular niche markets defined according to these parameters, organic growth is limited to a certain extent and there is more room to create value through inorganic expansion, which can take several forms.

One strategy to consider is consolidating product type within a tier; this can be done within a certain vertical or even across multiple verticals, although the latter route is riskier due to integration issues between the needs of diverse verticals. The key to this approach is the realization that a retailer’s point-of-sale (POS) application is the hub for all other applications within the enterprise because of its unique position as the data repository. Through the POS, an application can gain crucial knowledge such as how much money customers are spending, what they are spending it on, when they are spending it and even which customers are spending it.

Starting from a POS platform, an acquisitive company has an excellent capability to extend its presence through the rest of a retailer’s or even a tier’s IT needs, especially in the lower tiers. A POS system can provide valuable data that supply chain, sourcing and customer relationship management (CRM) applications can all use. And a smaller retailer will be less likely to devote resources to the difficult task of integrating diverse best-of-breed systems, thereby turning often to vendors who already offer a fully integrated set of products.

Consolidating around a POS system has its perils, however, if that integration occurs across different verticals because of the difficulty involved in catering to different verticals’ needs and interests. For instance, whereas an apparel retailer will be concerned with analyzing categories such as color and size, that kind of functionality would be completely lost on a grocery retailer; and these differences will result in reduced scalability, which is crucial especially to software-as-a-service (SaaS) providers.

A historically effective roll-up strategy that avoids this pitfall is to consolidate along tiers and products within a single retail stack, such as drugstores or fashion retailers. If a software vendor can focus and extend its functionality within a particular industry, it will become a more attractive candidate to customers within that industry than more generalist and unfocused suppliers. Moreover, once a vendor can justify adding functionality demanded by a Tier 1 customer because of the contract size, it can offer that functionality to lower tier clients without developing it specifically for them and further increase its dominance throughout that stack.

Within the retail technology market, there are plenty of opportunities to find companies struggling to maintain elevated growth rates organically. In these cases, we suggest that a roll-up around a POS platform, with the right product mix and along the right parameters, may breathe new life into those flagging growth rates and add unexpected value to companies that are apparently unremarkable on their own. In this, as in the A&D market, the key indicator of success will be the quality of the product itself and its compatibility with any tuck-in acquisitions.

Conclusion

We believe that there are excellent opportunities in diverse industries such as today’s A&D and retail technology sectors. This is particularly true for ambitious private equity shops that approach the market with a certain amount of creativity and are willing to place less emphasis on traditional indicators of future appreciation. Growth rates, management teams and past performance are all effective signs of value, but those can all change or be replaced. What remains essential to a company and ultimately determines its potential is the product that it brings to market. Armed with a great product and the right expansion strategy, we believe that a financial buyer could achieve enviable returns. In particular, we consider consolidation from a core platform, if executed properly, to be an effective mechanism for augmenting value within these sectors.