Is Your Organization on a Calendar Year? ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities Changes Things for 2018

This article is the second in a series of articles discussing ASU 2016-14, Presentation of Financial Statements of Not-for-Profit Entities.

Topics covered in this article are:

- Presentation of net assets

- Underwater endowments

- Investment returns

- Statement of cash flows

Enhanced liquidity disclosures will be covered in the next newsletter article coming January 2018.

Here’s How:

For fiscal years starting after December 15, 2017, not-for-profit (NFP) organizations will be required to present expenses both by function and nature. (Refer to the first article in this series for detailed information on this change.) Under ASU 2016-14 Presentation of Financial Statements of Not-for-Profit Entities guidance, net assets are no longer classified under three separate classes, but under two. This change has special implications for endowments with underwater funds. (Section I) In addition, investment returns no longer need to be grossed up, and are listed net of expenses. (Section II) Finally, a not-for-profit may select to present either the direct or indirect statement of cash flows without completing a reconciliation for the direct method. (Section III)

I – Net Asset Classification – Move from Three to Two Classes & Effect on Underwater Endowments

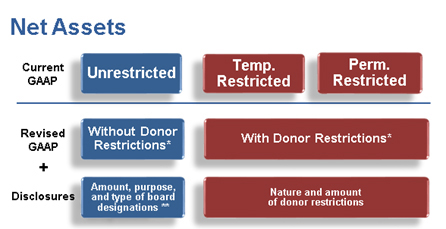

Under current GAAP, there are three separate classifications of net assets: unrestricted, temporarily restricted, and permanently restricted. Under the new guidance, net asset classifications are reduced to two. Please see the chart below:

Source: Financial Accounting Standards Board

*NFPs may choose to disaggregate further

**Additional disclosure requirement for board designations

These new classifications do not preclude an NFP from disaggregating the net assets, for example, showing board designations or the type of donor restriction (time or purpose) on the face of the financial statements, or disclosing this information in the footnotes. It is also acceptable for an organization to continue to track temporarily and permanently restricted net assets separately in its books; they would just be combined as Net Assets with Donor Restrictions for the financial statements. In addition, while the net asset classification presentation is simplified, there is no change in the accounting for net assets.

Net Assets without Donor Restrictions – Board Designated Net Assets

The Financial Accounting Standards Board (FASB) has published the following definition for “Net Assets without Donor Restrictions” as follows: Net assets without donor restrictions subject to self-imposed limits by action of the governing board. Board-designated net assets may be earmarked for future programs, investment, contingencies, purchase or construction of fixed assets, or other uses. Some governing boards may delegate designation decisions to internal management. Such designations are considered to be included in board-designated net assets.

Net Assets with Donor Restrictions

The definition of net assets with donor restrictions is as follows: The part of net assets of a not-for-profit entity that is subject to donor-imposed restrictions (donors include other types of contributors, including makers of certain grants).

ASU 2016-14 requires that an NFP disclose the composition of donor restrictions at the end of the period, as well as how such restrictions affect the use of the organization’s resources. For example, an NFP would list net assets with donor purpose restrictions as of the end of the period. If the purpose restriction coincides with the organization’s mission and activities for the following year, the NFP could disclose that those net assets are available for the organization’s use in the short term.

Endowment Net Assets Underwater

Under current GAAP, net assets underwater are accounted for as unrestricted net assets. ASU 2016-14 requires that all endowment net assets, including endowment net assets underwater, will be included in the “With Donor Restrictions” net asset classification. Current GAAP requires disclosure of aggregate amounts by which funds are underwater. This is not changing. However, organizations now must also disclose the aggregate of original gift amounts (or level required by donor or law) for such funds, the fair value, and any governing board policy, or actions taken, concerning the appropriation from such funds which are underwater.

II – Investment Returns

FASB finds that the net investment return is the most relevant information for the users of financial statements. Therefore, ASU 2016-14 requires investment returns to be reported net of external and direct internal investment expenses. Further, disclosure of the components of these costs is no longer required in the footnotes of the financial statements. This action increases comparability of investment activities by NFPs regardless of whether investments are managed by internal staff, outside investment managers, or a combination. It also eliminates the difficulties in identifying embedded fees and costs, as well as the inconsistencies in reporting them by NFPs.

Internal expenses may include the salary and benefits of a chief investment officer, which may result in a change accounting procedures related to salary allocations. However, costs related to accounting for investments would remain part of administrative costs.

III – Statement of Cash Flows

The first bit of good news is that ASU 2016-14 does not require that NFPs present the statement of cash flows on a direct basis. Rather, it remains an option. The second bit of good news is that if an NFP opts to present the statement of cash flows on the direct basis, then the indirect reconciliation is not required. A win-win for all of us.

Are You Ready?

ASU 2016-14 early adoption requires that organizations implement all of the changes included in the new standards. Please note that the above changes cannot be adopted early unless your organization implements all of the changes required by ASU 2016-14.

If your organization is considering early adoption, needs to modify its budget process, or if you just need to talk through your plans, we can help.