New Derivatives Disclosures for 2013 Financial Statements- Are you ready?

Over the past several years, the financial statement disclosures requirement for Funds that invest and trade in derivatives has increased significantly. In the quest for more transparency by regulators and investors, the reporting requirements have become more detailed, more complex and definitely more time consuming for financial statement preparers and reviewers. In 2009, FAS 161 (now ASC 815) was effective which required enhanced disclosures about an entity’s derivatives and hedging activities and how they affect financial position, financial performance and cash flows of an entity. This added several quantitative tabular disclosures to the financial statements for derivatives volume, year-end positions and gains and losses. All derivative instruments, including options, require descriptive disclosure of how and why an entity uses derivatives, the type of risk exposure it is subject to, and how it manages that risk. If those disclosures weren’t enough, new guidance for Disclosures about Offsetting Assets and Liabilities (ASU 2011-11) was issued in December 2011. This update was further amended with ASU 2013-01, which clarified the scope of the type of instruments that ASU 2011-11 was applicable to. ASU 2011-11 and 2013-01 (the “ASU Updates”) are effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods. An entity should provide the required disclosures retrospectively for all comparative periods presented. The Updates include not only derivatives positions held at year-end, but also repurchase agreements, reverse repos, security borrowing and security lending positions that are either (1) offset in the financial statements or (2) subject to an enforceable master netting arrangement or similar agreement. Investment managers should understand the magnitude of these disclosure requirements and allocate adequate resources to ensure proper implementation of the new guidance and required disclosures as we enter audit season.

Background and Presentation on Balance sheet

There are basically 2 ways to present derivatives on the statement of financial position (balance sheet) – gross or net. Gross reporting is simply to look at derivatives, regardless of counterparty, and put all the positions with a positive balance as an asset and all the positions with a negative balance as a liability. In gross reporting, collateral is included as a separate line item on the statement of financial position or included in a “due to/from broker” account. Under net reporting, an entity must look at its derivatives by counterparty and net all balances with that counterparty together (assets, liabilities and collateral). Gross vs. net reporting on the statement of financial position is an accounting election that is made by management, and the guidance specifically states that once an entity makes the election, it should remain consistent. Prior to the implementation of the ASU Updates, many Hedge Funds would report their derivative position gross because it is less complex as it removes the analysis to determine if net reporting is allowable. Now with the new guidance, whether an entity elects to report gross or net on the statement of financial position, the entity is required to do a netting analysis and disclose both gross and net amounts in the financial statement footnotes.

In order to perform a netting analysis, the Fund should obtain and read through all counterparty agreements for all financial instruments held at year-end to determine if they are enforceable master netting arrangements, which allow for the right to setoff of assets and liabilities. ASC 815-10-45-5 states that “A master netting arrangement (MNA) exists if the reporting entity has multiple contracts, whether for the same type of derivative instrument or for different types of derivative instruments, with a single counterparty that are subject to a contractual agreement that provides for the net settlement of all contracts through a single payment in a single currency in the event of default on or termination of any one contract.” The right to setoff must be enforceable by law and there should be the intention by the reporting entity and counterparty to settle the contracts net. Many derivatives contracts are governed by International Swaps and Derivatives Association (ISDA) agreements, which allow for the net settlement of payments in the normal course, as well as in the event of bankruptcy or default. ISDA agreements will generally meet the definition of a MNA.

New Tabular Disclosure

The following quantitative information should be included within a table in the notes to the financial statements:

- The TRUE gross amounts of the derivative assets and liabilities

- The amounts offset in accordance with the guidance (ASC 210-20-45 and ASC 815-10-45) to determine the net amounts presented in the statement of financial position

- The net amounts presented in the statement of financial position

- The amounts subject to an enforceable master netting arrangement or similar agreement not otherwise included in (B). Such amounts are :

- related to recognized financial instruments and other derivative instruments that either:

- Management makes an accounting policy election not to offset, or

- Do not meet some or all of the guidance in either ASC 210-20-45 or ASC 815-10-45.

- related to financial collateral (including cash collateral)

- related to recognized financial instruments and other derivative instruments that either:

- The net amount after deducting the amounts in (D) from the amounts in (C).

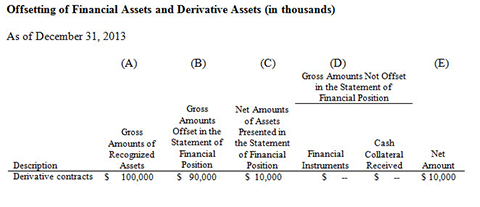

Note: The tables below are examples included in the ASU Updates

A similar table would be provided for liabilities. In the example above, the entity qualifies for and makes an accounting policy election to offset their derivative positions on the statement of financial position. The reporting entity has a derivative asset (fair value of $100 million) and a derivative liability (fair value of $80 million) with Counterparty A. $10 million in cash collateral has also been received from Counterparty A for a portion of the net derivative asset. The derivative liability and the cash collateral received are set off against the derivative asset in the statement of financial position, resulting in the presentation of a net derivative asset of $10 million. In this example, cash collateral of $10 million would be described qualitatively outside of the table.

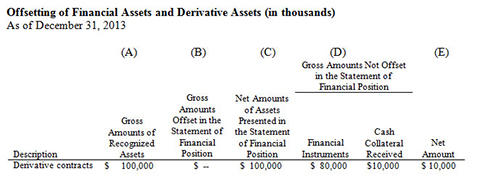

Conversely, the following table demonstrates the disclosure requirement when derivatives are presented gross on the statement of financial position:

In this example no reconciliation is needed and column A would equal column C or simply an entity could simply eliminate col A and B and re-label column C as “gross amount of assets presented in statement of financial position”. Also, the collateral is listed on a line item on the table, so in this example qualitative disclosure would not be necessary.

The ASU Updates provide two options for how entities may group the quantitative information disclosed for items (C) through (E) above. An entity may group information by type of instrument (e.g., derivatives, repurchase agreements and reverse repurchase agreements). Conversely, the entity may group the disclosures by counterparty. If the entity elects the counterparty option, it does not need to identify the names of specific counterparties; however, it should disclose individually significant counterparties separately, and it may group all other counterparties into a single amount. Entities making this election still must present the information in items (A) through (C) by type of instrument.

In addition, the level of disaggregation is not specified in the ASU Updates. An entity must use its own judgment in determining how detailed the schedule should be depending on the breadth, scope and materiality of its derivative activity. The guidance gives an example of a sophisticated entity and aggregates by type of instrument (derivatives, repos, security lending) and then categorizes the derivatives by underlying risk, which is the same way other derivative tables are organized as per ASC 815 – such as interest rate risk, foreign exchange rate risk, equity and commodity risk, etc. Or, an entity can categorize by types of derivative instrument (futures, forwards, credit default swaps, interest rate swaps, etc.), and then further disaggregate as to how the derivative is transacted (exchange traded or over the counter).

Qualitative Disclosure Requirements

The Updates also require new qualitative disclosures listed below:

- In the significant accounting policies footnote, include whether or not the Fund elects to offset its derivative assets and liabilities.

- In a footnote where the quantitative tables would be, include the conditions that allow for the right of set off such as:

- A master netting arrangement with derivatives counterparties exists

- Amounts owed to/from each party are determinable

- There is intent to set off

- Set off is enforceable under law

- Discuss the nature and method of the set off, for instance, collateral held by the counterparty on behalf of the Fund is being used to net against liabilities or payment obligations of the Fund and visa versa.

- Other disclosures include a description of the collateral and whether or not it is restricted.

How Can Funds Prepare for these new Disclosures Requirements?

The good news is that the Updates only apply to positions held at the end of the year, but unfortunately, it’s too late now to close out of all your December 31, 2013 positions. At this point, an Investment Manager should perform an assessment of what type of derivative positions were held at year-end and who were the counterparties. Review each counterparty agreement to determine if they are master netting arrangements and if there is an enforceable right to set off. This may require consultation with the Fund’s legal counsel. Document which derivative contracts have the right to offset for each counterparty, which derivatives are centrally cleared with each counterparty and the gross and net amounts per counterparty. Lastly, understand how these arrangements may affect the financial statements and discuss these items with your administrator or financial statement preparer to ensure all details are captured and disclosed appropriately. Given the heavy lifting that was performed by financial statement preparers for the implementation of FAS 161 back in 2009 (now ASC 815), these new requirements should not be as onerous. For more guidance on implementing these new disclosure requirements, reach out to a Marcum Assurance professional.