Sweeping Legislation: Summary of the Tax Cuts and Jobs Act

The New Legislation Provides For Some Of The Most Sweeping Changes To Tax Law In Decades.

The Tax Cuts and Jobs Act of 2017 (TCJA) makes significant changes to:

The Internal Revenue Service and the Treasury Department have provided guidance in some areas of the new law through proposed regulations, notices, press releases, and revenue procedures. However, due to the scope of the new law, many questions remain about its application in specific situations. This article will examine many aspects of the new law and where things stand as of this writing.

INDIVIDUAL TAXATION

Rates: The TCJA makes a number of changes to the tax law which impact individuals. Most of these provisions are effective for 2018and are scheduled to expire after 2025. The House of Representatives recently passed several bills comprising Tax Reform 2.0 which would make many of these individual tax provisions permanent. However,given the current composition of the Senate, these bills are unlikely to pass.

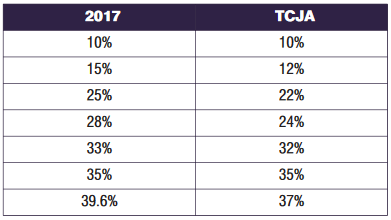

The new law establishes seven income brackets; many of these are reductions of previous rates.

Many of the new rates apply at different income brackets than the prior rates. For example, the 39.6% bracket applied in 2017 to taxable incomes of $418,400 for single filers and $470,700 for joint filers. In 2018, the top tax rate of 37% rate will apply to taxable incomes of $500,000 for single filers and $600,000 for joint filers. While the maximum rate will apply to fewer taxpayers, it is impossible not to note the significant marriage penalty at this highest tax bracket. Two unmarried individuals living together can make$500,000 of income each before being subject to the top tax bracket,while married taxpayers filing a joint return are subject to the top rate on income over $600,000.

Preferential rates still apply to long-term capital gains and qualified dividends. However, the maximum 20% rate no longer begins at the highest ordinary income bracket for 2018 and later. Under the TCJA,the 20% rate applies for taxpayers with taxable incomes over $425,800 for single filers and $479,000 for joint filers. This is essentially where the 20% rate would have applied under prior law, inflation adjusted.

Simplification and Changes to Deductions:

One of the stated goals of the TCJA was simplification of the tax system. However,simplification can have positive or negative consequences, depending on your particular situation. The impact of these rules cannot be generalized and must be determined on an individual basis.

Standard Deduction and Personal Exemptions:

The law increases the standard deduction to $24,000 for joint filers, $18,000 for head of household filers, and $12,000 for single filers. The additional standard deduction for the elderly or disabled is retained. However, the law eliminates the deduction for personal exemptions and dependents.

This increase is expected to reduce the number of taxpayers who itemize deductions. The benefit of the larger standard deduction is offset to some extent by the repeal of personal exemptions. For example, non-itemizing joint filers with two dependents receive an increase in the standard deduction of $11,300 ($24,000 under TCJA vs. $12,700 in 2017), but lose the benefit of four personal exemptions worth $16,200 ($4,050 each). This produces a net increase to taxable income, though the rate reductions may still produce an overall reduction in tax due. If there are no dependent children, then the loss of the personal exemptions is worth $8,100, and there is a net reduction in taxable income. As this illustrates, you cannot determine the impact of the rule changes without applying them to your personal situation.

Other Changes to Popular Itemized Deductions:

- State and Local Tax (SALT) Deduction: The itemized deduction for an individual’s state and local income and property tax is now limited to $10,000. This limitation does not apply to deductions related to a trade or business or to investment assets. The change in law primarily affects high-tax states and has spurred these states to attempt to create "work-around legislation." A common approach by these jurisdictions is to permit a taxpayer to make a contribution to a designated charity in exchange for a tax credit which can be used to offset income or property taxes. This is intended to convert the income tax deduction (potentially limited under the SALT rule) into a charitable contribution deduction. In response, the IRS issued proposed regulations requiring the charitable deduction to be reduced by the amount of any tax credit which exceeds 15% of the total contributed. However, the Service subsequently issued a release stating that a "business-related payment" to charity or government entity does not have to be reduced by an associated tax credit. This has spurred interest in "business-related payments."

- Personal Casualty Losses: A deduction is limited to personal casualty losses resulting from federally declared disasters through 2025.

- Mortgage Interest: A deduction remains on mortgage interest related to debt to acquire a primary or secondary residence. However, for acquisition indebtedness in place after December 14, 2017, the deduction is limited to interest on up to $750,000 of debt. For debt in place before December 15, 2017, the existing $1 million limit still applies. Significantly for many taxpayers, the interest deduction on home equity debt not used for acquisition or improvements to the residence is repealed.

- Moving Expenses: The moving expense deduction previously allowed in calculating adjusted gross income is disallowed beginning in 2018 (except for members of the armed forces for certain expenses). Employer reimbursements for such expenses will no longer be excluded from employee income. However, the IRS has recently issued guidance that a 2018 employer payment or reimbursement for a 2017 employee moving expense will not be included in the employee’s income. Employers who have treated such payments as employee income for income tax and payroll tax purposes should make corrections per IRS instructions.

- Miscellaneous Itemized Deductions: Are no longer allowed. This category of expenses includes tax preparation fees, unreimbursed employee business expenses, repayment of social security benefits, trustee fees for an IRA if billed separately, and repayments of income under a claim of right.

- Alimony Payments: Will not be deductible for any divorce decree or separation agreement executed or modified after 2018. The corresponding income inclusion rules for such alimony are eliminated. Payments made under old agreements remain deductible and/or taxable per prior law.

Not all of the changes to deductions affecting individuals are negative. Among the favorable changes are the following:

- For 2017 and 2018, the medical expense itemized deduction is allowed for amounts in excess of 7.5% of adjusted gross income for all taxpayers.

- The distribution rules for Section 529 education plans are changed so that up to $10,000 of elementary to high school costs annually will constitute qualified costs.

- The Pease Limitation, which previously reduced certain itemized deductions for high earners, was repealed. The impact is less significant given the adjustment to itemized deductions discussed above.

Child Tax and Non-Child Dependent Credits:

The TCJA provides a greater benefit for those eligible for the child tax credit. This credit is increased to $2,000 (versus $1,000 in 2017) per eligible child. Additionally, the law sets higher adjusted gross levels at which the benefit phases out. The refundable portion of the credit is increased from $1,100 to $1,400.

The TCJA establishes a new Non-Child Dependent Credit of $500 for a dependent who would not be eligible to be covered under the child tax credit. This can include children who are 17 or older, or even older dependents. The IRS recently issued guidance which impacts this credit. Generally, a person for whom this credit would be taken cannot have income in excess of the personal exemption amount.

Since the personal exemption amount has been reduced to zero, this would make a person with any amount of earnings ineligible. The Service has concluded that in applying this rule, the former personal exemption amount ($4,050 under prior law) should be used.

Alternative Minimum Tax (AMT):

Despite attempts to eliminate the AMT for individuals, the AMT is still in effect. However, the TCJA increases the exemption amounts used in calculating this tax. In addition, the thresholds at which the exemptions amounts become subject to phase-out are significantly increased. These changes, along with the elimination of miscellaneous itemized deductions and the limitation placed on SALT deductions, will cause many taxpayers who previously were in AMT to no longer be subject to this tax.

BUSINESS TAXATION

The centerpiece of the Tax Cuts and Jobs Act was the changes made to the taxation of business income. The intention of these changes is to spur economic growth through a reduction in business taxation. Highlights of these changes include the following:

C-Corporation Rates and AMT:

- Tax rates for C-corporations are changed from a progressive rate structure of up to 35%, to a flat 21% rate, for tax years beginning after 2017. The special treatment of personal service corporations is eliminated.

- The Alternative Minimum Tax is repealed for businesses for 2018 and later. C-corporations with an AMT credit after 2017 can recover these amounts over a period of up to four years. The AMT credit is available to offset regular income tax, and then 50% of the excess credit is refundable for 2018, 2019, and 2020. Any remaining credit is recovered in 2021.

Qualified Business Income Deduction:

Since most business in the United States is not conducted through C-corporations, Congress recognized that it needed to provide relief to businesses which operate as sole proprietors (including single member limited liability companies), partnerships, and S corporations – commonly referred to as "flow-through entities." The result is a rather complicated set of rules under new section 199A of the Code, under which a 20% deduction is allowed on qualified business income (QBI). A taxpayer in the top 37% tax bracket, after this deduction, pays an effective 29.6% tax on qualified business income. Part of the reason for the complexity under this section of the Code is that while Congress wanted to provide a tax benefit to these businesses, it believed that reduced tax should not extend to amounts received for services.

- For those with taxable income under $315,000 for joint filers and $157,500 for other filers, the 20% deduction applies to all qualified trade or business income.

- For those with taxable income over $415,000 for joint filers and $207,500 for other filers, the 20% deduction applies to qualified trade or business income. However, two separate limitations apply: (i) the deduction is limited to the greater of (a) 50% of W-2 wages or (b) 25% of W-2 wages and 2.5% of the unadjusted basis of investment assets (UBIA) used in the business; and (ii) certain "specified service trades or businesses" do not qualify for the 20% deduction.

- For those with taxable income between the amounts above, a complex set of phase-out rules apply, so that a portion of specified service trade or business income qualifies for the deduction, and the W-2 or W-2/UBIA limits apply in part.

For the Section 199A deduction, "specified services trades and businesses" (SSTBs) includes the field of law, accounting, consulting, financial services, and performing arts; performance of services that consist of investing and investment management trading, dealing in securities, partnership interests, or commodities; and a catch-all provision which includes any trade or business where the principal asset is the reputation or skill of one or more of its employees or owners.

REIT dividends and publicly traded partnership distributive income are eligible for the new 20% deduction, but are not subject to any of the limitations discussed above.

The IRS and Treasury recently issued proposed regulations which provide significant guidance on the operation of the new section 199A deduction, including:

- Determining if the activity constitutes a trade or business.

- Whether businesses can be aggregated for purposes of calculating the limitations on the deduction.

- Defining the meaning of "specified trades and services," including providing an extremely limited interpretation of businesses falling within the catch-all.

- Banning the "crack-and-pack" strategy. This is where operations or property is pulled from a specified service business (e.g., personnel, IT services, real or personal property rental) and placed into a separate business which then provides the services or leased the property to the related SSTB. The intention is to convert a portion of the SSTB income into income qualifying for the deduction. The proposed regulations treat the related entity as part of the SSTB in whole or part.

However, the proposed regulations provide a number of planning opportunities and considerations:

- The choice of flow-through entity becomes a significant issue. Depending upon whether the limitations apply, an S corporation (which can pay wages to owners) may produce better or worse results than a partnership or a sole proprietorship.

- Partnerships may consider amending agreements to convert guaranteed payments into an allocation of net income, to qualify these amounts for the deduction. The regulations do not require that a partnership make a "reasonable" guaranteed payment to service partners.

- While the typical crack-and-pack strategy is barred, some planning can still be done for separate qualifying businesses from a specified service trade or business, where both provide goods or services to unrelated parties.

A threshold question created by the new law for all businesses is whether they should be conducted in a pass-through form (which has been popular since the Tax Reform Act of 1986) or through a C- corporation. While the corporate tax is reduced to 21%, this decision requires an analysis of a number of other factors, including the double-tax problem when shareholders look to take funds from the C- corporation as dividends or liquidating distributions. Additionally, certain corporations may be limited as to the amounts which can be accumulated under the accumulated earnings tax rules.

Bonus Depreciation and Section 179 Expense:

All businesses will benefit from the rules increasing the amount of capital costs which can be expensed.

- For assets acquired after September 27, 2017, and before January 1, 2023, bonus depreciation of 100% is allowed. The percentage of bonus depreciation is scheduled to be reduced in 2023 and later years. Property qualified for the bonus depreciation includes qualified film, television, and live theatrical productions. Additionally, used property is now eligible for bonus depreciation.

- Section 179 expensing is increased to $1 million for tax years 2018 to 2022. The allowed deduction is reduced when acquisitions of section 179 property exceed $2.5 million for the tax year. These dollar amounts are indexed for inflation after 2018. Property eligible as section 179 property includes property used to furnish lodging and qualified real property improvements including roofs, heating, ventilation, air-conditioning, fire, and security systems.

The rushed legislative process produced a drafting error which impacts real estate. It was the clear intention of the law (as expressed in the Conference Committee reports) that commercial real estate qualified improvement property would be eligible for 15-year depreciation and 100% bonus depreciation. However, due to the drafting error, the language including this type of real estate improvement as 15-year property was never written into the statute. This inclusion would have made the property automatically eligible for bonus depreciation. As a consequence, for property placed in service after 2017, the law does not permit bonus depreciation, and 39-year depreciation applies. The IRS in its proposed regulations on bonus depreciation has indicated that a legislative correction is needed to correct the error.

Accounting Simplification Rules:

- Cash Basis:

- C-corporations and partnerships with C-corporation partners, and certain farming entities, will be permitted to use the cash basis where average gross receipts for the prior three years is $25 million or less. Previously, the gross receipts level was set at $5 million.

- Businesses where sales are an income-producing factor are normally required to use the accrual basis with inventories. Prior IRS authority permitted those with average annual gross receipts of $1 million, or $10 million for certain taxpayers, to elect to use the cash basis of accounting. The TCJA increases the threshold to $25 million.

- Uniform Cost Capitalization: Businesses, including manufacturers and other producers of property, are exempt from using the uniform cost capitalization rule if they have average gross receipts of $25 million or less.

- Percentage-of-Completion: The law’s exception from the use of the percentage-of-completion method for certain long-term contracts to be completed within a two-year period applies to taxpayers with average gross receipts of $25 million or less. This exception permits the use of cash basis or even the completed contract method.

If an election is made to take advantage of an accounting simplification rule, a Form 3115 (Change of Accounting Method) must be filed. The Service has issued guidance indicating that these method changes will be permitted under the automatic change rules. This means that IRS consent is not required.

Use of one of these methods can cause a significant decrease in current year income. However, effective planning must consider the impact of the change over a number of years. Additionally, a number of technical rules must be analyzed to determine that you qualify.

Commonly owned businesses may need to be aggregated in determining the level of average gross receipts. Additionally, certain businesses with tax losses and owners who are not active in the business may not be eligible.

TCJA Limits on Certain Business Deductions:

The TCJA contains rules which may limit the utilization of the deduction for business interest, net operating loss (NOL) carryovers, and net business losses. Additionally, the deduction for business meals, entertainment, and transportation has been significantly amended.

- Business Interest Limitation. Under new IRC section 163(j), every business, regardless of form, is subject to a disallowance of the deduction for net interest expenses (i.e., business interest expense in excess of business interest income) which exceeds 30% of adjusted taxable income. For years beginning before January 1, 2022, adjusted taxable income is business taxable income without considering the deductions for depreciation, amortization, or depletion.

The law contains several exceptions:- A small business exception excludes a business whose average gross receipts do not exceed $25 million from this limitation. However, as with the accounting simplification rules discussed above, certain commonly controlled businesses will need to be aggregated to determine if this income requirement is satisfied.

- Certain businesses can elect out of this interest limitation. They include electing real property trades or businesses or electing farming business. The cost of this election is that the business is required to use the Alternate Depreciation System (ADS) instead of the normal cost recovery rules. ADS requires the use of longer lives and the use of a straight-line method. Of greater significance, those required to use ADS cannot take bonus depreciation on the acquired assets.

- Certain floor plan interest is excluded from this rule.

- Certain regulated public utilities and electric cooperatives are not subject to this rule.

- Net Operating Loss Deductions. The new law repeals net operating loss carrybacks (with a few exceptions) and limits the use of an NOL carryforward to 80% of taxable income of the year to which the loss is carried. However, the carryforward is for an unlimited period. This means that NOLs created in 2018 and later cannot zero the income for a year to which they are carried. Prior NOL carryforwards are not subject to this limit.

- Non-Corporate Taxpayer Business Loss Limitation. Net business losses which are allowed against non-business income will be limited to $500,000 for joint filers and $250,000 for other filers. The unused business losses are treated as a net operating loss carryforward to future years. This means that current business losses may not be able offset other current year income. These taxpayers may have taxable income and an income tax obligation, despite incurring real cash losses.

- Meals and Entertainment. For amounts paid or incurred after December 31, 2017, business-related entertainment expenses are no longer deductible. Meals while traveling away from home on business remain 50% deductible. A significant change applies the 50% limit to meals provided on the employer’s premises for the convenience of the employer or in an on-premises cafeteria through 2025. In 2026, these amounts will be nondeductible.

Entertainment expenses are nondeductible. This includes tickets to a ballgame, a theater performance, or concert.

Some discussion exists concerning whether business meals survived at the former 50% limit or would be considered nondeductible entertainment. IRS recently issued a Notice confirming that business meals remain 50% deductible with respect to a current or potential business customer, client, consultant, or similar business contact. However, proper documentation should be maintained to establish that this is a business meal and not general entertainment. This includes meals furnished during or at an entertainment facility, so long as they are separately purchased from the entertainment or are separately stated from the cost of the entertainment. - Transportation. Employers cannot deduct the cost of qualified employee transportation benefits (these amounts are nontaxable to the employee). In addition, a deduction is disallowed for the cost of providing any transportation, or any payment or reimbursement, to an employee in connection with travel between the employee’s residence and place of employment, except as necessary for ensuring the safety of the employee. We are waiting for IRS guidance to determine what items are covered under this latter provision.

Businesses should project their expected operating results to determine the potential application of these rules. These limitations can produce substantial cash flow issues.

Meals and entertainment costs should be reviewed to determine which are deductible under the new law. Deductible amounts, along with appropriate documentation, should be properly recorded so they are treated correctly on the income tax return.

Like-Kind Exchanges.

Due to the increase in bonus depreciation and section 179 expense election discussed above, Congress felt that changes to the section 1031 like-kind exchange rules were appropriate. After 2017, the like-kind exchange rules, which defer recognition of gain or loss on the swap of like-kind property, only apply to real property.

QUALIFIED OPPORTUNITY ZONES

The TCJA creates a new investment vehicle which has a tax advantage. For a taxpayer who sells appreciated assets, tax on the gain can be deferred by investing the gain, within 180 days of the sale, in a qualified opportunity fund. The deferral of the gain runs until the earlier of the date the investment in the fund is sold or December 31, 2026. If the investment is held for five years, the amount of gain taxed is reduced by 10%. If the investment is held for seven years, the taxable gain is reduced by 15%. Tax on any additional gain on the investment, if held for 10 years, can be completely eliminated.

The investment vehicle can be organized as a corporation or partnership and must hold at least 90% of its assets in qualified opportunity zones. As of this writing, all states have designated communities which qualify.

ESTATE AND GIFT TAXES

Despite the push to eliminate the "death tax," the final bill retained the estate and gift tax. However, for 2018 through 2025, the basic exclusion amount for each person is increased to $11,180,000 (about twice the previous amount). A comparable increase applies to the generation tax exemption.

There was some discussion that the law might eliminate the "date-of- death basis rule," whereby property included in a decedent’s taxable estate receives a tax basis equal to its fair market value on date of death. Consideration was given to a carryover basis approach and to a gains tax. However, the date-of-death basis rule remains the law.

This increase in the exemption will make many estates non-taxable. For these persons, income tax planning involving the date-of-death basis rule may be of greater significance.

Those with large estates may look to leverage the higher basic exclusion amount so as to transfer more asset appreciation out of their estates.

The basic exclusion is scheduled to revert back to the former $5 million dollar level, inflation-adjusted, after 2025. It is not clear that this will ever happen. However, planning must take into account the possibility of reversion.

INTERNATIONAL TAXATION

- 100% Dividend Exclusion: C-corporate shareholders are allowed a 100% deduction for the foreign-source portion of dividends received by a U.S. corporate shareholder from specified 10%-owned foreign corporations. Since the distribution is not taxable, neither a foreign tax credit nor deduction is allowed for foreign income taxes related to a qualifying dividend. This exclusion does not apply to non-corporate taxpayers.

- Section 965 Deemed Repatriation: A U.S. shareholder in a Deferred Foreign Income Corporation is required to include its pro rata share of the undistributed, non-previously taxed post- 1986 foreign earnings. This deemed repatriation applies based on the year-end of the foreign corporation. Many taxpayers dealt with this tax in 2017. However, an inclusion may apply in 2018 for fiscal year foreign corporations. The intention of the law is to produce a 15.5% tax rate on the portion of foreign earnings and profits held in cash and an 8% tax on the balance. However, this is actually done through the mechanism of a deduction allowed with respect to the included income, based on an assumed 35% tax rate.

The resulting tax ("transition tax") can be elected to be paid over an 8-year period in installments of 8% of the net tax liability for five years, 15% in year 6, 20% in year 7, and 25% in year 8. Shareholders of S corporations which hold interests in a foreign corporation are permitted a special election to defer the tax until certain "triggering events."

The Service has a Frequently Asked Questions (FAQ) section on its website dealing with section 965 issues. Proposed regulations have also been issued. The Service recently issued a legal counsel opinion stating that an overpayment in a year for which there was a deemed repatriation could not be applied as a credit to a future year’s income tax or be refunded, but must be applied against the unpaid balance of the transition tax, despite the election to pay the tax in installments.

- Global Intangible Low Tax Income (GILTI): The law has a new inclusion into income of the amount by which "tested income" of foreign affiliates exceeds 10% of such entity’s basis in tangible overseas capital investment used in the business. This is intended to prevent companies from using foreign entities to hold and use intangible property. For 2018 through 2025, corporations can claim a deduction for 50% of the GILTI inclusion. The deduction decreases to 37.5% thereafter. However, this deduction does not apply to non-corporate taxpayers.

The Service has issued proposed regulations on the computation of the GILTI inclusion, but it does not address the interaction with the foreign tax credit. - Base Erosion Alternative Minimum Tax (BEAT): This is an alternative minimum tax of 10% (12.5% after 2025) on modified taxable income determined by disallowing the deduction of payments to certain related foreign parties.

It is unclear whether the GILTI and BEAT will survive challenge by the World Trade Organization. The GILTI can be argued to be an improper subsidy. The denial of deductions under BEAT can be viewed as selective tariffs.

ACTION STEPS

This has been a brief description of the most significant parts of the new Tax Act. There are many ways that this new law can impact your personal and business taxes. While analysis will evolve as the IRS issues additional clarification and explanations of the law, the tax professionals at Marcum suggest immediately beginning a review of how these new rules may affect you or your business personally.