Top Ten Items Contractors Need to Know about the Tax Cuts and Jobs Act

The New Act Provides for Many Positive Changes for Contractors.

The Tax Cuts and Jobs Act of 2017 is arguably the most significant piece of legislation passed during the Trump presidency to date and included the most substantial changes to the tax code in more 30 years. The bill was touted as a simplification of the tax code that would offer both American businesses and individuals tax incentives and tax savings. However, both time and budgetary constraints necessitated that the bill be written, rewritten, and passed quickly. As a result, the final piece of legislation included many significant provisions that still need clarity, and out of necessity, includes a lot of “give and take” in terms of tax incentives offered. Following are the top 10 changes that will affect contractors in 2018 and beyond.

FLAT 21% TAX RATE FOR C- CORPORATIONS AND CHANGES TO CORPORATE NET OPERATING LOSSES

“The Give”: Lower Corporate Tax Rate

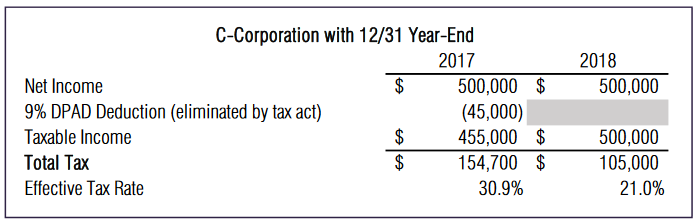

Effective in 2018, C-corporations will be subject to a flat 21% tax rate rather than four brackets ranging from 15% to 35%. (Fiscal year filers will utilize a prorated blended rate schedule based on year- end). For the construction industry, this generally translates to a tax cut for corporations with net income in excess of $120,000. The examples below help to illustrate the effect of the new rates:

“The Take”: Net Operating Loss (NOL) Limitations

While there are no changes to a corporation’s NOLs generated prior to 2018, losses arising in tax years ending after December 31, 2017, will no longer be permitted to be carried back and will be available to be carried forward indefinitely. In addition, utilization of post-2017 generated NOLs will be limited to 80% of taxable income. In income years where NOLs are utilized, in 2018 or later taxable income will not be able to be reduced to zero by post-2017 losses.

Recommendation:

Business owners should analyze the potential savings of converting to a C-corporation compared to their current entity structure to determine which entity type is most beneficial.

ADDITION OF THE 20% QUALIFIED BUSINESS INCOME (QBI) DEDUCTION AND ELIMINATION OF THE 9% DOMESTIC PRODUCTION ACTIVITIES DEDUCTION (DPAD)

“The Give”: 20% QBI Deduction

Owners of pass-through businesses such as S-corporations, LLCs, partnerships, and sole proprietorships will be entitled to a deduction equal to 20% of the business income on their individual tax return. For single taxpayers with taxable income exceeding $157,500 ($315,000 Married filing joint), this 20% deduction can be limited for companies with minimal payroll expenses and capital expenditures. The deduction is limited to the greater of:

- 50% of W-2 wages, or

- 25% of W-2 wages plus 2.5% of the cost of qualified business assets.

Such limitations should not impact most construction contractors but may impact other commonly owned, ancillary businesses (real estate, for example). An election can be made at the individual taxpayer level to mitigate this potential problem and make more of the ancillary income qualify for the QBI deduction.

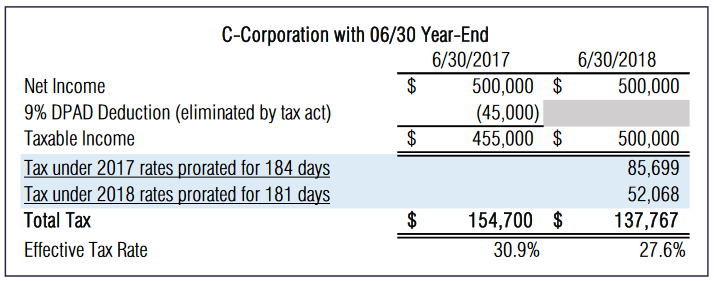

The chart below reflects a comparison of a married couple’s tax liability with pass-through net income of $500,000 and no itemized deductions, and the effect that QBI will have on their 2018 income taxes:

“The Take”: 9% Domestic Production Activities Deduction (DPAD)

For tax years ending after December 31, 2017, the Act eliminates the Domestic Production Activity Deduction, a popular deduction typically available to manufacturers, contractors, engineers, and architects. Note: While the gap between the new corporate and individual tax rates may make a high-earning C-corporation appear desirable, many factors need to be considered before making such a decision. Thedouble taxation of distributions from the corporation (i.e., dividends or property/cash distributions upon sale of the company’s assets) can quickly negate any lower front-end tax rate. Entities need to review all relevant facts and circumstances before deciding to form or convert to C-corporation status.

Recommendation:

Individuals owning multiple businesses should determine the availability of making an election to aggregate if the QBI deductions will be limited.

EXPENSING 100% OF THE COST OF DEPRECIABLE ASSETS

“The Give”: Accelerated Depreciation

Equipment purchased after September 27, 2017, and before January 1, 2023, may be entirely expensed under new bonus depreciation rules. Prior law allowed for the deduction of 50% of the cost of new assets and was scheduled to phase out by 2020. The new tax law allows assets – either new or used – to qualify for the 100% deduction as long as it is the business’ first use of that asset.

The Section 179 deduction (which allows the write-off of purchased assets) has been increased from its current limit of $510,000 to

$1,000,000. Assets purchased to improve nonresidential real estate, such as roofs, HVAC systems, and fire protection systems, now qualify for this special deduction. Previously, such improvements were required to be depreciated over a longer period. Between bonus depreciation and Section 179, most assets acquired by a construction company will be fully deducted in the year of acquisition.

“The Take”: Like Kind Exchanges and Qualified Improvement Property

A trade-off to the 100% depreciation is the elimination of “like-kind exchanges” on trade-ins of equipment. Previously, a business owner could trade in equipment when purchasing a similar piece and not recognize gain on the trade-in value. The tax law now limits that gain deferral only to real estate assets.

Note: Many states continue to disallow bonus and/or Section 179 depreciation.

Recommendation:

Businesses should carefully analyze their equipment needs to determine if additional property is a necessity, rather than spending funds to save taxes.

MORE CONTRACTORS CAN USE CASH OR COMPLETED CONTRACT METHOD TO REPORT INCOME

“The Give”: The Gross Receipts Limitation for use of cash method accounting has been increased to $25 Million

Contractors with average annual gross receipts of up to $25 million will be able to use the cash or completed contract method for tax purposes. Three prior years of revenue is averaged to determine the taxpayer’s average annual gross receipts for the purposes of this test. For some construction companies, this may be the most important change in the new law.

Since 1986 the tax code has used a revenue threshold of $10 million ($5 million for corporations and partnerships with corporate partners) as the definitive line between a “small” and “large” contractor. A large contractor is required to report gross profit from long-term projects under the percentage-of-completion method. As a result, the ability to defer recognition of income for tax purposes is diminished. Going forward, the $25 million limitation will be indexed for inflation on an annual basis.

Beginning in 2018, contractors that fall below the new revenue threshold will be exempt from reporting income on the percentage- of-completion basis. If the taxpayer previously exceeded the $10 million amount and filed returns utilizing a non-cash method, the business will be allowed to automatically change its method of accounting for long-term contracts to the cash or completed contract method for tax purposes. For the first three years beginning after December 31, 2017, the change will be automatic (by filing a Form 3115 and making the applicable 481(a) adjustment), even if an election was made in the prior five years. Contractors should review their business models to determine which method is most beneficial. Those operating under the $25 million limit should consider which method would be most advantageous going forward.

“The Take”: None, really. This change is very positive for contractors.

Recommendation:

Businesses should analyze their related parties to determine if, and how much, of the related party’s gross receipts need to be included when calculating average annual gross receipts. Also, businesses should analyze the effects of any accounting method change before making an election. Don’t assume the method currently used is worse.

ELIMINATION OF THE CORPORATE ALTERNATIVE MINIMUM TAX

“The Give”: No More Corporate AMT

The Alternative Minimum Tax (AMT) has been repealed for C- corporations but remains intact for individuals. Owners of companies were often subject to AMT as a result of accelerated depreciation of equipment, the treatment of long-term contracts, and a disallowance of state taxes.

Regarding C-corporations, small contractors using the completed contract method were previously required to recalculate alternative minimum taxable income (AMTI) using the percentage-of- completion method, resulting in large add-backs of the completed contract deferral. Going forward, with the elimination of the corporate AMT, this will no longer be the case. Large contractors that do residential construction will also benefit from the elimination of the AMT, as the 30% residential deferral will no longer need to be added back to calculate AMTI. C-corporations that previously paid AMT may also have outstanding AMT tax credits, which are now refundable.

Regarding individuals, exemption and phase-out amounts within the calculation have been raised, which should mean fewer taxpayers will pay the AMT. The adjustments for accelerated depreciation, the treatment of long-term contracts, and state taxes among other factors, will still need to be made.

“The Take”: Regular Tax More Closely Resembles AMT

On a corporate and individual level, the regular tax laws will more closely resemble those of the AMT, with lower rates, fewer allowable deductions, and limitations on loss utilization.

Recommendation:

Businesses should analyze prior returns to determine if there are any historical AMT tax credits. These credits do not expire and could have been improperly tracked through the years.

LOWER INDIVIDUAL TAX RATES AND DEDUCTION CHANGES

“The Give”: Lower Individual Tax Rates

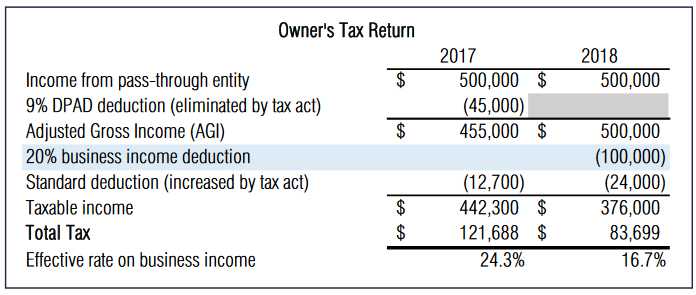

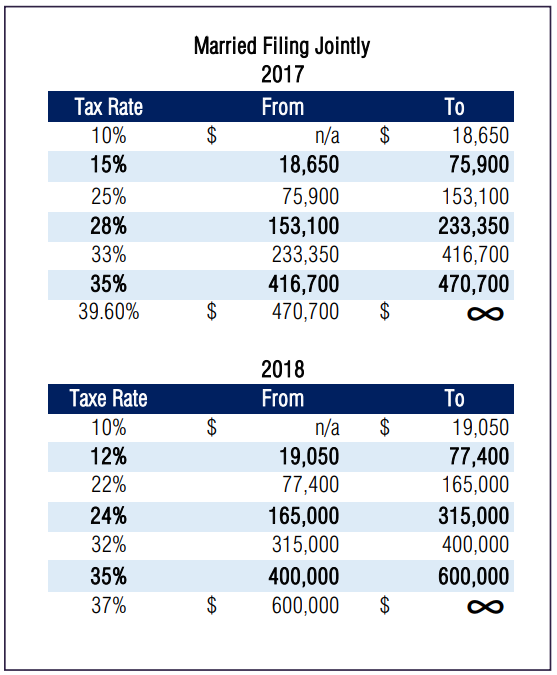

Most taxpayers should see a lower effective tax rate due to shifts in individual tax brackets. The largest reduction occurs within the highest tax bracket. In 2017, income over $470,700 is taxed at the top marginal rate of 39.6%, while in 2018 the highest bracket begins at $600,000 and is 37%. See chart below.

“The Take”: Deductions are More Limited

About 30% of taxpayers currently itemize deductions, and the Tax Act was designed to reduce that number (simplification!). Highlights of the changes effective in 2018 include:

- The standard deduction has been almost doubled to $12,000 for single taxpayers and $24,000 for Married filing joint, and personal exemptions have been eliminated.

- The deduction for state and local income, sales, and property taxes is capped at $10,000, adversely impacting taxpayers in states such as New York, New Jersey, Connecticut, and California.

- Motgrage interest will be deductible for debt balances of $750,000 and less, whereas the limitation was $1 million previously, and interest on home equity loans is no longer deductible unless the funds are directly connected to the underlying property.

- The phase-out of 3% itemized deductions for taxpayers with incomes in excess of $313,800 (Married filing joint in 2017) is eliminated by the new law in 2018 and beyond.

Aggregate business loss deductions are also limited to $500,000 for individuals. In the case of an individual who makes $1 million in wages and has $1 million in business losses, those losses are limited to $500,000 and the remaining $500,000 loss is carried forward. This is particularly important when planning owners’ compensation for loss companies.

Recommendation:

Individuals should determine if their state has developed a way to circumvent the limitation on state and local taxes.

LIMITATION ON INTEREST EXPENSE DEDUCTIONS

“The Give”: None

“The Take”: Deductibility of Business Interest Expense is Limited

Starting in 2018, deductible interest expense will be limited to 30% of the business’s adjusted taxable income (see below). Businesses with gross receipts under $25 million will be exempt from this rule. Real estate entities may opt-out of this rule, but will sacrifice accelerated depreciation deductions. A large contractor with high levels of debt should be cognizant of this limitation and may find it beneficial to reduce or renegotiate debt to avoid triggering the limitation. (Interest expense in excess of the 30% threshold may be carried over indefinitely).The following example reflects two companies with earnings before interest, taxes, depreciation, and amortization (EBITDA) of $2,000,000, which limits interest expense to a maximum of $600,000 (30%). $150,000 of Company B’s interest expense is therefore non-deductible in the current year (but can be carried forward indefinitely):

Note: This limitation is calculated at the entity level. Any limited interest is carried forward and must be tracked at the shareholder/member level.

Recommendation:

Businesses should consider restructuring their debt, if possible, to lower interest payments if it is anticipated that interest expense may be limited.

GIFT AND ESTATE TAX EXCLUSION DOUBLED

“The Give”: Huge Increases in Gift & Estate Tax Exclusions

Important to those performing succession and estate planning, the gift and estate tax exclusion amount has been doubled from $5.49 million to $11,180,000 per person, or $22,360,000 for married couples. This will allow a larger amount of assets, such as business interests, stock, and real estate, to be transferred to heirs tax-free. At the highest tax rate of nearly 40%, each additional million dollars of exclusion equates to up to $400,000 in tax savings.

“The Take”: None

Recommendation:

High net worth individuals should consider making gifts to take advantage of increased exclusions, in case future legislation reduces this benefit.

ENTERTAINMENT EXPENSE DEDUCTION ELIMINATED

“The Give”: None

“The Take”: More Conservative Rules Regarding the Deductibility of Meals & Entertainment

The two biggest impacts to the deductibility of meals and entertainment expense are the loss of the deduction for entertainment expense and the 50% limitation on meals provided to employees at the convenience of the employer. The deduction for business meals with clients remains at 50%, but any tickets for client entertainment can no longer be deducted. Meals provided to employees at the convenience of the employer were formerly 100% deductible and will now be limited to 50% deductibility. Expenses for events such as company parties, meals provided during training, and the like remain fully deductible.

Recommendation:

Businesses should be certain to record such expenses clearly and separately in their books to prevent the mingling of deductible and non-deductible costs.

PREVIOUSLY UNTAXED FOREIGN EARNINGS ARE NOW TAXABLE

“The Give”: Reduced Tax Rates

“The Take”: Mandatory Inclusion of Foreign Earnings

Under prior law, if a U.S. shareholder were an owner of a controlled foreign corporation (CFC), the earnings of the CFC were not taxable in the United States until the money was distributed to the U.S. shareholder. Under the new law, all foreign accumulated earnings and profit are deemed to have been distributed on November 2, 2017, or December 31, 2017, whichever point is greater. To ease the tax burden, these amounts are taxed at either 8% or 15.5%, depending on the underlying assets of the CFC.

Going forward, a 10% shareholder of a controlled foreign corporation must include their share of “tested income,” otherwise known as the Global Intangible Low-Taxed Income (GILTI). Benefits provided to C- corporations mitigate the effect of this inclusion and may potentially reduce any tax on this income inclusion to zero. In contrast, non- corporate shareholders are not entitled to these benefits, which may result in tax on this income of up to 37%.

Recommendation:

Businesses and individuals should review their foreign holdings to determine if they are subject to income inclusions. Non-corporate shareholders of controlled foreign corporations should consider setting up a U.S. corporate holding entity or converting the controlled foreign corporation to a foreign branch.

FINAL WORDS

The new tax law brings with it a host of new challenges for contractors. A “technical corrections” bill usually follows major tax legislation to resolve unintended consequences. This will not be a good year for “business as usual!”