Valuing "Harder-to-Value" Investments

By Daniel Roche, Director, Advisory Services, Marcum LLP

It has been nine years since FAS 157, Fair Value Measurements (now ASC 820), was introduced to the investment community, yet some private equity firms still grapple with the concept of “marking to market” and valuing their private investments at fair value for financial reporting. Now that most private equity firms are registered with the SEC and are issuing their private fund vehicles’ financial statements in accordance with generally accepted accounting principles (GAAP), it is more important than ever to understand the fair value measurement standard and ensure the firms’ valuation methods and models are compliant. Fair value is defined in ASC 820 as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The purpose of this article is to discuss traditional valuation methodologies when it comes to valuing private equity investments, which are consistent with the fair value definition and in accordance with GAAP, as well as suggested valuation guidance to follow when fundamental valuation methodologies are not easily applicable due to the early stage nature of underlying investments.

Traditional Valuation Approaches

The three traditional valuation approaches are the asset or cost approach, the market approach and the income approach. A brief description of each of these approaches is discussed below.

The asset approach typically serves as a floor to value; that is, an investment should not be worth less than what the proceeds would be if the assets of the company/investment are liquidated and the liabilities paid off. When private equity companies make arms-length investments, the cost approach may be the best indication of fair value if the date the investment is made is proximate to the valuation date. Put another way, if an arms-length investment is made in late November of a given year and the private equity company’s year-end is December 31, the price paid in November for that investment will most likely reflect the value of that investment unless there was a material change to that specific investment.

The market approach determines the value of an investment by comparing that investment to similar investments in the marketplace. There are three methodologies under the market approach that are utilized by valuation experts in order to value investments. These methodologies are the guideline company method, the guideline transaction method, and the consideration of transactions in the specific investment’s own stock or other securities. While the guideline company method and the guideline transaction method are helpful in determining the value of an underlying investment, transactions in the investment’s own stock or securities typically provide the best indication of value for the underlying investment, so long as the transactions are between unrelated third parties.

The income approach establishes the value of an investment by determining the present value of the future expected returns from that investment. The most common method under the income approach is the discounted cash flow methodology. This methodology requires the valuation analyst or the private equity firm to determine a projection of the future expected cash flows from the investment and to discount these cash flows back to the present date, utilizing a risk-adjusted rate of return.

Valuing Harder-to-Value Investments

These fundamental valuation approaches and methodologies are useful in almost all circumstances. However, consider the following scenario: an investment was made over two years ago, and there were no recent transactions in this company’s stock or other securities. Further, due to the early stage nature of this company, it has negative book value, negative earnings and management is unable to predict when this company will generate revenues or turn a profit. This presents a challenge for a valuation analyst, as the fundamental valuation methodologies discussed earlier become very difficult to apply.

The facts in this example place a huge strain on the valuation analyst. The discounted cash flow method becomes difficult, if not impossible to apply. Similarly, with no revenue history and no earnings projections, the application of market multiples is also extremely difficult. Finally, the “floor to value” approach – book value, results in negative value.

However, investors still perceive value to this type of investment. Why is this?

In order to estimate the fair value of this investment, we should take a step back and consider the reason why private equity makes investments, especially in investments as outlined above. The intention is to identify an investment that has potential for growth, to apply resources (staffing and other plans/expertise) to this company to generate growth, and eventually to exit this investment within a short time frame, typically five years. The exit from the investment is generally done by either selling the investment to another private equity firm or by taking the investment public.

To answer the question posed above, investors have an appetite for growth. That being said, these types of investments in early-stage companies are prevalent, and market transaction data exists in both the M&A space and in the IPO space. This data can give us, the valuation specialists, a good idea how similar unprofitable, pre-revenue companies have been priced in the private and public markets. We can use this knowledge to place a value on this harder-to-value investment.

In valuing this type investment, we rely heavily on information obtained from management and the marketplace and utilize this information to develop an indication of value for the investment. We work closely with private equity managers to understand the intention of the investment, the intended growth plans for this investment, and the potential exit marketplaces for this investment. We also consider the private equity manager’s history of exiting investments, both in terms of timing and the multiples or other metrics they have been able to achieve upon exit.

Research is then conducted into the specific industry in which this investment operates, especially related to trends within larger industries, as we find that most of these early-stage companies tend to operate in niche industries within a larger industry landscape. By understanding the market for the investment’s services, especially novel products or niche ideas, we can understand the growth trajectory that this investment may achieve. We compare this information to management’s intention for the investment. We also research M&A and IPO transactions of similar companies, but not necessarily with the same business plan.

Armed with this knowledge of the investment, the private equity firm’s intentions for the investment, the industry and transactions in the M&A and IPO space for similar companies, we can model out potential exit scenarios utilizing management’s input as to the probability of exiting at certain prices and at certain time points. After this, the results can be probability-weighted to arrive at a value for the investment that has a high probability of occurring based on the information available as of the valuation date.

While the results of this analysis are very assumption-based, it provides a private equity firm and its investors with a much better understanding of the potential value of the investment, as opposed to considering negative book value and no real projections for revenue growth or profitability.

Practical Example

Let’s take a look at an example to further illustrate this valuation methodology.

Consider this: A private equity firm made an investment in a pre-revenue bio-pharma company that has negative book value and no projections for future revenue, as this company’s drug will be going to clinical trials in the near future. The hope is that this drug will successfully complete clinical trials within five years and then be able to generate revenue and potential profit. In discussions with management, we understand that the primary preferred investors would like to exit this investment as soon as possible and will begin applying pressure to exit the investment when the drug compound completes Phase II clinical trials. This is expected to occur within three years.

We begin our analysis by examining the success rates for drug compounds. While we can’t predict the success or failure of this drug in clinical trials, we can look at the success rates of all clinical trials to determine the likelihood that this drug will successfully complete clinical trials.

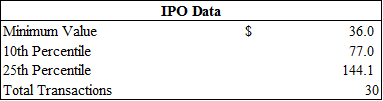

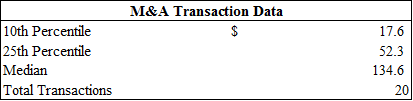

We would then conduct research into M&A transactions and IPO transactions of bio-pharma companies. We look for companies that have a similar drug portfolio, in this instance, one drug in Phase II clinical trials. The below tables reflect M&A transactions and IPO transactions that we have identified for similar companies. Finding comparable companies is very difficult, and therefore, we can utilize the information as to the number of drugs in a company’s portfolio, as well as what phase of clinical trials the drugs are in, to determine an approximate range for the value of the subject investment based on this criteria. We can either increase or decrease the applicable multiples accordingly.

We typically choose a range of possible values based on a range of possible multiples under both the M&A transactions and the IPO transactions. The following tables reflect the range of multiples we have selected:

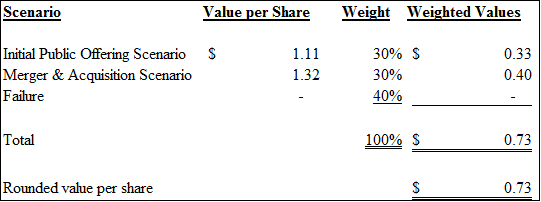

We then work with management to assign probabilities of achieving exits at each point within the selected range of multiples. Utilizing this information, we can get to a most likely result regarding an exit of this investment. These exits are then discounted back to present at a risk-adjusted rate of return that should consider the risk of achieving such exits (but not consider the potential failure of the company, as this is weighted into the final result as its own option). The resulting analysis considers the culmination of the present value of the investment at the various exit points and the probability of each occurring:

The result is a probability-weighted value based on all knowledge that could reasonably be obtained for the investment in the marketplace as of the valuation date.

While our example was conducted utilizing a bio-pharma company, it can be applied to any type of hard-to-value investment. Again, this analysis is very assumption–based, and the valuation analyst should work very closely with management to understand the growth potential and intentions for each investment, as well as the potential marketplace for an exit. Additionally, the analyst should conduct their own independent research regarding the market for the investment, as well as transactions in the public and private markets for similar investments. Assumptions should not be made blindly, as this may result in unreasonable values for the underlying investments.

Fair valuation of these harder-to-value investments can be difficult; however, knowledge of the investment and the application of fundamental valuation methodologies with guidance from valuation experts can lead a private equity firm to a supportable conclusion of value that follows the fair value definition and is in accordance with GAAP, given the most challenging facts and circumstances.