All in the Family: Direct-to-Equity and Debt-Free Valuation Methods

Imagine two brothers, both have similar physical characteristics (e.g., tall and freckles), but one likes to write music and the other likes to play sports. Or, imagine two sisters, both having curly hair and blue eyes, but one likes to spend the afternoon shopping with friends and the other likes to spend time reading alone in a park. One may ask, how can two siblings who look so similar still be so unique? Just like these siblings, there are two similar yet unique benefit streams that can be used in valuing business ownership interests when applying an income approach:

- Net Cash Flow to Equity (Direct-to-Equity Method)

- Net Cash Flow to Invested Capital (Debt-Free Method)

Direct-to-Equity Valuation

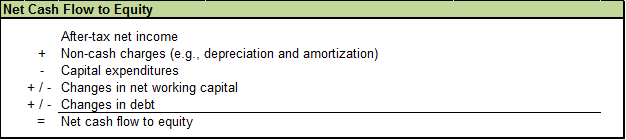

Applying the income approach using net cash flow to equity (Direct-to-Equity Method) produces a value of the subject company’s equity. To calculate a company’s net cash flow to equity benefit stream, the following components must be considered:

The net cash flow to equity represents the amount of cash flow available to the equity owners of the business. It should be noted that net cash flow to equity takes into consideration the company’s debt service requirements (interest and principal) as well as other changes in the company’s debt balances. After this benefit stream is calculated, the appropriate discount/capitalization rate to apply to determine the company’s equity value is its calculated cost of equity.

Debt-Free Valuation

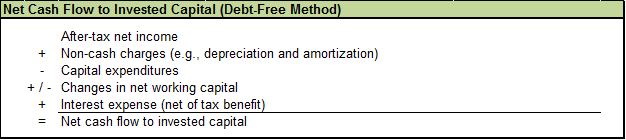

The income approach can also be applied using the net cash flow to invested capital (Debt-Free Method), which produces a value of the subject company’s invested capital (total equity and debt value). This method differs from the Direct-to-Equity approach mentioned above since it determines the value of a company’s total invested capital (equity and debt), not just its equity value. To calculate a company’s net cash flow to invested capital, the following components must be considered:

The net cash flow to invested capital represents the amount of cash flow generated by the company prior to consideration of how it may be financed. As shown in the example above, it excludes the impact of changes in debt and is pre-interest expense. Therefore, net cash flow to invested capital represents the cash flow that is available to both the debt and equity investors in the company. The company’s weighted-average cost of capital (WACC) is used to discount/capitalize these cash flows in determining the company’s invested capital value.

Importance of Appropriate Discount Rate

It is crucial that the appropriate discount rate is used when valuing a company using the direct-to-equity and debt-free methods. The cost of equity is applied when the benefit stream being used is net cash flow to equity. A WACC is applied when the benefit stream being used is net cash flow to invested capital. If the right discount rate is not matched with the appropriate benefit stream, it may produce an unreliable and skewed value.

Relationship between Equity Value and Invested Capital Value

A company’s equity and invested capital values are related and one can be used to calculate the other. To calculate an equity value when using the Debt-Free approach, one must simply subtract the interest-bearing debt from the total invested capital value determined. To calculate an invested capital value when using a Direct-to-Equity approach, add the interest-bearing debt balance to the company’s equity value. Therefore, at the end of the day, the Direct-to-Equity and Debt-Free methods should produce consistent values of the company’s equity and invested capital values.

Conclusion

Just like the siblings, the Direct-to-Equity and Debt-Free valuation methods are similar, yet unique, approaches to use when valuing a business interest. It is important to know their differences so that they are applied appropriately to reach a reliable valuation conclusion.

If you have any questions about direct-to-equity and debt-free valuation methods contact your Marcum representative at (855) MARCUM1.