Amendments to the Accelerated Filer and Large Accelerated Filer Definitions

By Alex Viader, Senior, Assurance Services

Background

On March 12, 2020, the Securities and Exchange Commission (the “SEC”) issued a final rulei adopting amendments to the accelerated filer and large accelerated filer definitions after considerations on its proposed ruleii. Following the adoption of the amendments, smaller reporting companies (SRCs) with less than $100 million in revenues (SRC revenue test) and less than $700 million of public floatiii, will no longer be required to obtain a separate attestation of internal control over financial reporting (ICFR) from an independent auditor, under Sarbanes-Oxley Act (SOX) Section 404(b). However, SRCs will continue to be required to establish and maintain effective ICFR under SOX Section 404(a), including those related to independent audit committees, CEO and CFO financial reporting certifications over their responsibility for establishing and maintaining ICFR, and the evaluation and disclosure on the effectiveness of the issuer’s ICFR. An independent auditor will also continue to be required to consider ICFR in the performance of the financial statement audit.

Key Amendments

- Under the previous definition, an issuer with public float of $75 million or greater qualified as an accelerated filer. There was no revenue test. Under the amended rule, other than during a transition period, an issuer with public float between $75 and $700 million and $100 million or more in annual revenue qualifies as an accelerated filer.

- Business development companies (BDCs) that have a public float of at least $75 million but less than $700 million and have investment income of less than $100 million are now excluded from the accelerated and large accelerated filer definitions. BDCs continue to be ineligible to be smaller reporting companies (SRCs).

- A check box now is required for the cover pages of annual reports on Forms 10-K, 20-F, and 40-F to indicate whether an ICFR auditor attestation is included in the filing.

- The amendments increase the transition thresholds for exiting accelerated filer status from $50 million to $60 million, and for exiting large accelerated filer status from $500 million to $560 million.

- For consistency with the amendments to the accelerated and large accelerated filer definitions, the amendments also add the revenue test and investment income test to the transition thresholds for exiting from both accelerated and large accelerated filer status.

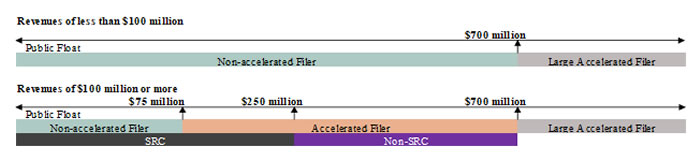

The accelerated filer and SRC definitions do not align under the amended rule. An issuer can be both an accelerated filer and an SRC (see table below). An SRC is defined as an issuer with less than $250 million of public float or less than $100 million in annual revenue. Qualifying as an SRC is not the trigger that determines the requirement for auditor attestation over ICFR. Issuers meeting the definition of an SRC qualify for certain scaled disclosure requirements.

The table below illustrates the intersection of revenues and public float requirements for an SRC and an accelerated filer under the amended requirements:

| Filing Status | Public Float | Revenues | SOX 404(b) | Filing Deadline for Periodic Reports |

|---|---|---|---|---|

| SRC and Non-accelerated | Less than $75 million | N/A | No | Annual – 90 days Quarterly – 45 days |

| SRC and Non-accelerated | $75 million to less than $700 million | Less than $100 million | No | Annual – 90 days Quarterly – 45 days |

| SRC and Accelerated | $75 million but less than $250 million | $100 million or more | Yes | Annual – 75 days Quarterly – 40 days |

| Accelerated but not SRC | $250 million to less than $700 million | $100 million or more | Yes | Annual – 75 days Quarterly – 40 days |

| Large accelerated Filer | $700 million or more | N/A | Yes | Annual – 60 days Quarterly – 40 days |

With the new amendment, the following have not changed:

- The accelerated filer definition still determines whether an issuer is required to have an auditor attestation over ICFR.

- The public float threshold for large accelerated filer has not changed ($700 million or more). For these filers, there is still no revenue requirement, and an ICFR auditor attestation is still required.

- These requirements do not apply to emerging growth companies (EGCs) until they exit EGC status.

Effective Date

This final rule is effective April 27, 2020, and may be applied to annual reports due on or after the effective date. Even if that annual report is for a fiscal year ending before the effective date, the issuer may apply the amendments to determine its status as a non-accelerated, accelerated, or large accelerated filer.

For example, an issuer that has a March 31, 2020, fiscal year-end and that is due to file its annual report on or after April 27, 2020, may apply the amendments to determine its filing status even though its fiscal year-end date precedes the effective date. An issuer that determines it is eligible to be a non-accelerated filer under the amendments is not subject to the ICFR auditor attestation requirement for its annual report due and submitted on or after April 27 and may comply with the filing deadlines that apply, and other accommodations available, to non-accelerated filers.

Final Insights

The amendments more appropriately define accelerated and large accelerated filers, thereby reducing unnecessary burdens and compliance costs for smaller issuers while maintaining investor protections. These smaller issuers will now be able to redirect the associated cost savings into growing their businesses.

Sources

i. SEC Final Rule Release No. 34-88365, Amendments to the Accelerated Filer and Large Accelerated Filer Definitions.

ii. SEC Proposed Rule Release No. 34-85814, Amendments to the Accelerated Filer and Large Accelerated Filer Definitions.

iii. Public float represents the aggregate market value of common shares outstanding held by non-affiliates and is calculated as of the last business day of the issuer second fiscal quarter by multiplying the number of the issuer common shares held by non-affiliates by the market price.