An Explanation of Income Approach to Valuation – Capitalization of Cash Flow Method

By Sean R. Saari, Partner, Advisory Services

Investors in publicly-traded companies have the luxury of knowing the value of their investment at virtually any time. An internet connection and a few clicks of a mouse are all its takes to get an up-to-date stock quote. Of all U.S. companies, however, less than 1% are publicly-traded, meaning that the vast majority of companies are privately-held. Investors in privately-held companies do not have such a readily available value for their ownership interests. How are values of privately-held businesses determined, then? Each month, this eight blog series will answer that question by examining a key component of how ownership interests in privately-held companies are valued.

Income Approach

There are two income-based approaches that are primarily used when valuing a business, the Capitalization of Cash Flow Method and the Discounted Cash Flow Method. These methods are used to value a company based on the amount of income the company is expected to generate in the future.

The Capitalization of Cash Flow Method is most often used when a company is expected to have a relatively stable level of margins and growth in the future – it effectively takes a single benefit stream and assumes that it grows at a steady rate into perpetuity. The Discounted Cash Flow method, on the other hand, is more flexible than the Capitalization of Cash Flow Method and allows for variation in margins, growth rates, debt repayments and other items in future years that may not remain static. As a result, the Capitalization of Cash Flow Method is typically applied more often when valuing mature companies with modest future growth expectations. The Discounted Cash Flow Method is used when future growth rates or margins are expected to vary or when modeling the impact of debt repayments in future years (although it can still be used in same sort of “steady growth” situations in which the Capitalization of Cash Flow Method can be applied).

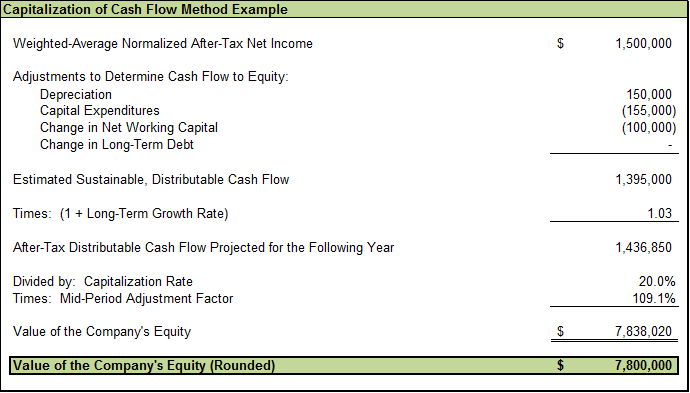

More information related to the Capitalization of Cash Flow Method is provided below along with an example:

Capitalization of Cash Flow Method – The Capitalization of Cash Flow method values a business based on an expected cash flow stream, capitalized by a risk-adjusted rate of return. This single-period capitalization approach is most appropriate when a company’s current or historical level of operations is believed to be representative of future operations and the company is expected to grow at a relatively stable and modest rate. The steps taken in applying the Capitalization of Cash Flow method include determining a sustainable earnings base (i.e. benefit stream), making the necessary adjustments to convert projected earnings into projected cash flow (adjusting for capital expenditures, depreciation, changes in net working capital and changes in interest-bearing debt), developing an appropriate capitalization rate, and applying the capitalization rate to the cash flow base to arrive at a conclusion of the fair market value the company.

To summarize, the Capitalization of Cash Flow Method is an income-based approach to valuation that is based on the company’s ability to generate cash flows in the future.

Questions? Contact Sean R. Saari, Partner, Advisory Services