Bribery and Corruption: Is “The Cost of Doing Business” Worth It?

By Nitasha Giardina, Director, Advisory Services & Lia Tonietti, Senior, Advisory Services

The Foreign Corrupt Practices Act (FCPA) of 1977 addresses international corruption through its anti-bribery and accounting provisions and is enforced by the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC). In the present day it is impossible to imagine a time when the FCPA was not a part of the legal system of this country and the world — but such time existed less than 50 years ago.

World Before the FCPA

Until 1977, there was not a single country in the world that considered bribing foreign officials for business purposes to be illegal1 — in fact, it was considered the cost of doing business. In some European countries, a foreign bribe could even be deducted from corporate tax returns as an expense.2 With the FCPA, the United States became the first country to address the problem of international corruption.

Why was the FCPA enacted?

The FCPA was enacted to address international corruption by making it illegal to bribe or offer a foreign official anything of value to gain or retain business. This came in the wake of the Watergate scandal, which revealed an abuse of political power and created “an atmosphere of cynicism and distrust” in the American people.3 The severity of the corruption came to light when the SEC discovered U.S. companies paid hundreds of millions of dollars in bribes to foreign government officials to secure business overseas using a secret “slush fund” and falsified records to conceal the transactions.4 The FCPA paved the way for combating corruption and building back public trust and confidence.

FCPA: Enforcement and Violations

The FCPA addresses international corruption through its anti-bribery and accounting provisions and is enforced by the DOJ and the SEC. Specialized teams within the DOJ and the SEC work together with other agencies to enforce, investigate, and prosecute FCPA violations; reduce bribery demands through strong corporate governance programs; and promote a fair playing field for U.S. companies that conduct business abroad.5

The anti-bribery provisions apply to prohibited conduct anywhere in the world and extend to all U.S. publicly traded companies and their officers, directors, employees, stockholders, and agents. That includes, but is not limited to, third-party agents, consultants, distributors, joint-venture partners, and others.

The accounting provisions complement the anti-bribery provisions by requiring corporations to maintain accurate books and records and have an adequate system of internal controls.6

Violations of the FCPA could be significant and could lead to civil and criminal penalties, sanctions, and remedies, including fines, disgorgement/restitution, and/or imprisonment.7

While the DOJ and the SEC enforce the FCPA, other agencies and/or independent professionals are often involved as trusted advisors or investigators. They provide a variety of preventative or investigative services in response to an FCPA violation.

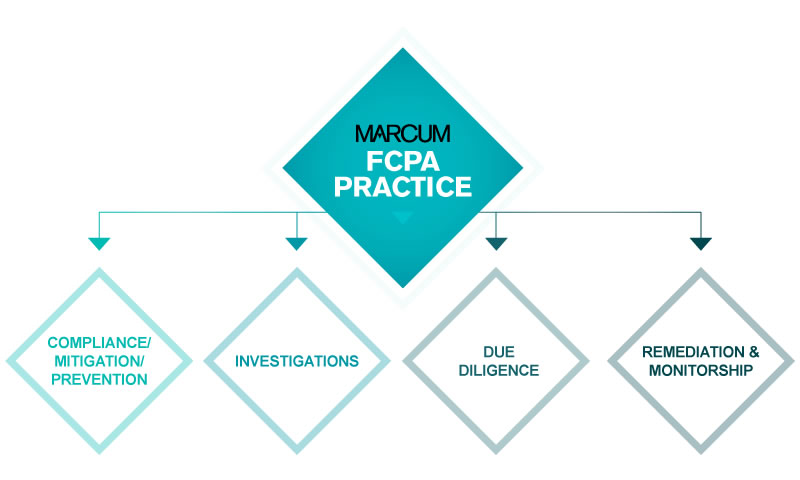

Marcum is one such independent professional organization that provides the following services related to FCPA:

Marcum and FCPA

Compliance/Mitigation/Prevention

Corporations globally, especially those that are publicly traded, understand the implications of violating the FCPA, which is why they often spend a significant amount of money developing and implementing corporate compliance/risk mitigation/prevention programs. The best defense is often a good offense, and as enforcement authorities globally ramp up efforts to investigate and prosecute corruption, compliance programs and risk mitigation efforts become more important than ever.

Investigations

When corruption issues arise, prompt investigations are critical to evaluate the incident, assess risks and exposure, preserve crucial evidence, calculate any monetary damages, and create appropriate remediation plans.

Monitorship

A company charged with an FCPA violation may be subject to remediation and/or monitorship services. After the company is investigated by regulators and/or law enforcement agencies, the monitor’s job is to track the compliance programs and implementation of action plans.

Due Diligence

In addition to the above, FCPA discussions have become a customary part of the merger and acquisition process. Recent years have seen a significant increase in mergers and acquisition activity across all industries. Entities have grown by leaps and bounds through both strategic acquisitions and vertical integrations. To ensure that clients are not inheriting significant FCPA-related risks, it’s necessary to conduct thorough due diligence on the entity being merged in or acquired.

FCPA Today

In 2020, global penalties collected in cases involving a coordinated FCPA resolution exceeded a record-breaking $9 billion. Goldman Sachs and Airbus comprised approximately 69% of total penalties collected globally.8

Goldman Sachs

Goldman Sachs entered into the largest FCPA settlement in history after conspiring to violate the FCPA by participating in a scheme to pay more than $1.6 billion in improper payments to officials in Malaysia and Abu Dhabi. The payments were intended to help Goldman Sachs obtain a lead role in underwriting approximately $6.5 billion in three bond deals for an entity named 1Malaysia Development Berhad. Goldman Sachs agreed to pay a combined $2.97 billion in global fines and penalties, making it the second-largest coordinated global anti-corruption resolution in history.9

Airbus

Airbus entered into the world’s largest anti-corruption resolution in history and agreed to pay a combined $3.68 billion globally to resolve bribery allegations in more than 20 countries after participating in various fraudulent activities over the span of 10 years. Airbus allegedly paid at least $150 million and offered at least $150 million more in bribes and improper payments to aviation executives and foreign government officials around the world to purchase airplanes and satellites. Airbus did so by disguising the true purpose of its business partners and consultants in a variety of ways. The company created false invoices for services never performed, false activity reports, oral agreements, non-reimbursable loans, and indirect payments to third-party intermediaries. It also offered improper gifts, travel, and entertainment to foreign government officials.10

Amazon

In 2020 a whistleblower within Amazon flagged alleged bribery issues in its Indian operations, prompting the company to investigate accusations that legal fees paid by the company have been used as bribes.11 Whistleblower laws strengthen the FCPA and significantly contribute to its success. The U.S. has collected more than $7.2 billion related to the FCPA mostly from cases initiated by whistleblowers.12

World After FCPA

Despite the record-breaking sanctions in 2020, there has been increased anti-corruption coordination and cooperation over the years. As a result, a number of countries have implemented foreign bribery laws similar to the FCPA. There are also various anti-corruption conventions, such as the Organization for Economic Co-operation and Development (OECD), the United Nations Convention Against Corruption (UNCAC), the Inter-American Convention Against Corruption (IACAC) in Venezuela, the Group of States Against Corruption (GRECO) established by the Council of Europe, and the African Union Convention. Individual countries have increased or amplified their anti-corruption laws and regulations — for example, Operation Car Wash in Brazil and the Sapin II law in France.

So, is “the cost of doing business” worth it?

A major takeaway that has proved true time and time again throughout history is that corruption is bad for business. Corruption is a global problem with a cost far greater than the sum of lost dollars. It creates market instability, lower-quality products, and an unfair playing field for honest businesses that do not pay bribes.

Corruption is also disastrous within a business: It weakens employee confidence in a company’s management and invites other kinds of corporate misconduct, such as employee theft, embezzlement, financial fraud, and anti-competitive behavior.13 Other consequences of corruption in a business include significant monetary fines for violating the FCPA, inherent reputational damage, and negative effects on customer, vendor, and employee relationships.

Additionally, corruption undermines a state’s ability to promote sustainable growth by draining public resources from investments that can improve economic performance and increase living standards, such as education, health care, and infrastructure.14

Despite the long-lasting negative effects, it could be argued that the Watergate scandal was actually one of the “best” worst moments in history because it changed the way business is conducted, both in the U.S. and in countries around the world. Ultimately, it paved the road to restoring public confidence and the integrity of the marketplace.

Sources

- http://www.pbs.org/frontlineworld/stories/bribe/2009/02/history-of-the-fcpa.html

- ibid.

- The Watergate scandal was a major political scandal in the United States involving the administration of U.S. President Richard Nixon from 1972 to 1974 that led to Nixon’s resignation. https://www.history.com/topics/1970s/watergate

- http://www.pbs.org/frontlineworld/stories/bribe/2009/02/history-of-the-fcpa.html

- “A Resource Guide to the U.S. Foreign Corrupt Practices Act. Second Edition.” Pages 3-4.

- https://www.sec.gov/spotlight/foreign-corrupt-practices-act.shtml

- “A Resource Guide to the U.S. Foreign Corrupt Practices Act. Second Edition.” Page 9.

- https://www.jonesday.com/en/insights/2021/01/fcpa-2020-year-in-review

- ibid.

- ibid.

- https://www.bloomberg.com/news/articles/2021-09-20/amazon-says-it-doesn-t-tolerate-graft-after-india-probe-report

- https://www.whistleblowers.org/why-whistleblowing-works/

- “A Resource Guide to the U.S. Foreign Corrupt Practices Act. Second Edition.” Page 2.

- https://www.imf.org/external/pubs/ft/fandd/2019/09/the-true-cost-of-global-corruption-mauro.htm