Business Owners Share Their Biggest Value Acceleration Challenges

By Michael Trabert, Partner, Advisory Services

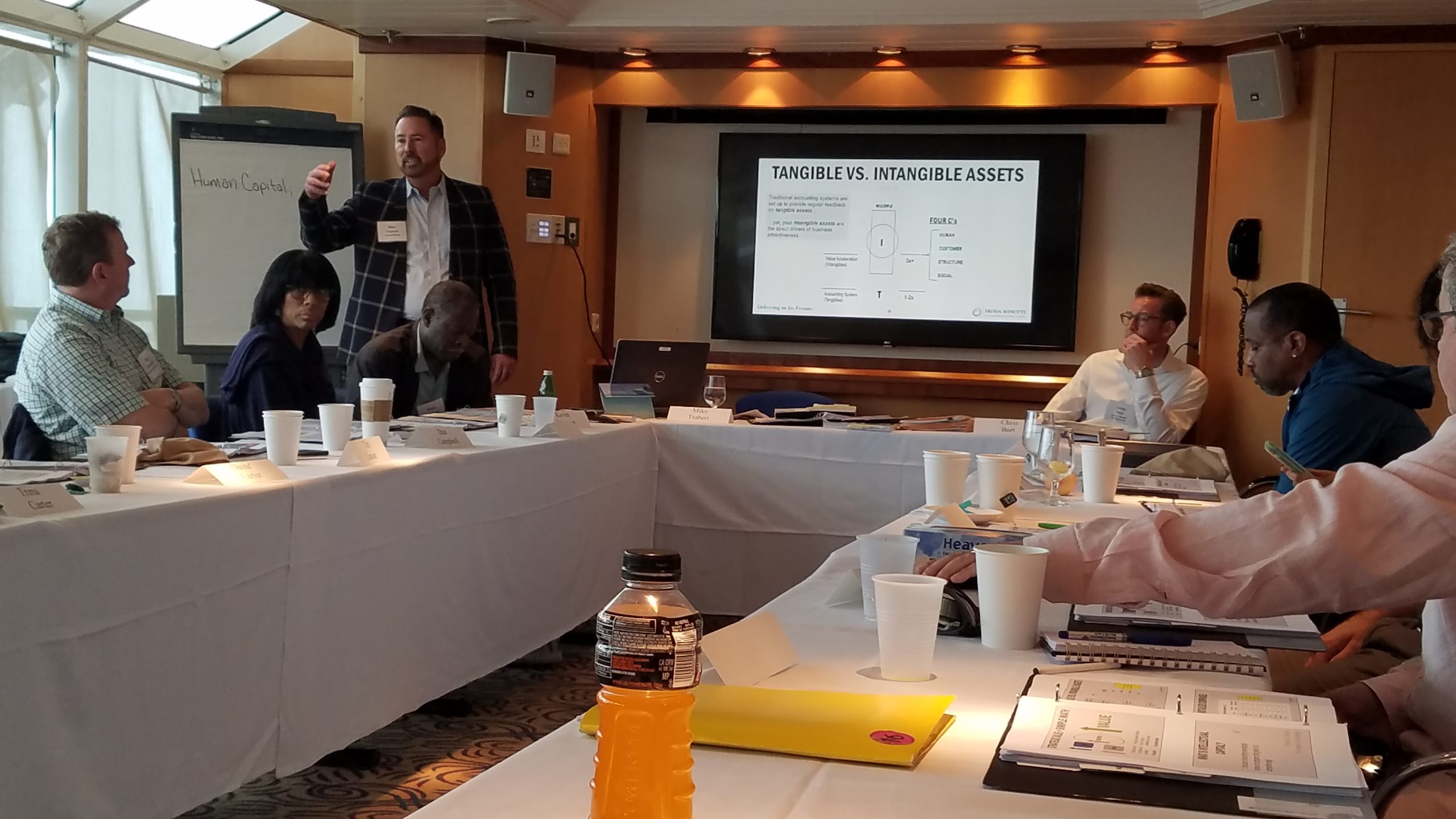

Having just returned from our inaugural Owners’ Roundtable at sea (and 15th overall Owners’ Roundtable), I’m filled with indelible memories—of the extraordinary ship we cruised on, the unforgettable places we visited (Havana, Cuba; Nassau, Bahamas), the fabulous food, the camaraderie that developed among the two dozen participants, and so much more.

Yet, as I reflect on this amazing experience, what really hits home are the common challenges that business owners face in preparing their businesses for transition. No two businesses are exactly alike; but many of the challenges they face as they endeavor to build maximum value – and exit on their terms – are similar. Consider some of the challenges cited most frequently by participants in this latest session:

What’s my business’ actual value?

At Marcum, we help clients identify value as the first of five Value Maturity steps so that business owners have a baseline measurement from which to track value over time. In other words, as they work to build (and hopefully maximize) value, they can refer back to this baseline to revalue the business based on their relative success.

Identifying a business’ actual value is useful in this regard—and so many other aspects as well. It’s essential for estate planning purposes, as well as planning for a post-exit lifestyle. For example, the business you thought was worth $5 million may, in reality, only be worth $2 million. Knowing this well in advance of a transition allows a business owner to make informed decisions. Which also relates to the next question that so many participants of this recent Owners’ Roundtable had on their mind…

What’s my number?

When business owners seek to exit their business and transition ownership and operation, identifying the true value of that business is only part of the equation. It’s just as critical to understand, up front, the approximate dollar amount needed to live the post-exit lifestyle you desire.

Why? Well, if that hypothetical $2 million business sells, and the business owner has their eye on a bucolic $4 million Tuscan villa, he/she would need at least $2 million of existing net worth just to entertain the idea. That’s an overly simplistic example, but it demonstrates the need to plan well in advance for transition by taking stock of your future obligations, goals and desires.

There are many variables that go into determining your number. In Stage Five of our five-stage Value Maturity process, we explain how value is managed by focusing on key estate planning and financial planning tasks. These include:

- Reviewing estate documents (e.g., will, revocable trust, financial power of attorney, health care power of attorney, living will), insurance policies and retirement account/pension beneficiary designations

- Retitling assets to avoid probate and maximize the use of estate exemptions

- Developing a detailed budget

- Preparing a personal net worth statement that reflects all assets and liabilities

- Undertaking a global investment asset allocation review with your financial advisor

Additionally, identifying your number means understanding what you want out of life after transition. Do you see yourself starting a new business, or acquiring an existing one? Do you want to travel, pursue philanthropy, buy a vacation property, join a private club or fund higher education for your loved ones? These and other goals cost money—not to mention bills and other expenses of daily living. Identifying your post-transition goals, your current net worth and your expenses and obligations will go a long way toward knowing your number—and understanding where you are on the road to achieving your post-exit dreams.

How can I truly de-risk my business?

In past Owners’ Roundtable sessions, we’ve spent considerable time discussing de-risking a business to protect its current value. This latest session was no exception. In fact, the sheer number of business risks cited by participants this time was astounding. Just some of their concerns included: lawsuits; regulations; technology; politics; debt; customer concentration; human and intellectual capital; business model disruption; natural disasters; safety/compliance; embezzlement; death/disability; and cybersecurity.

Face it: The more risk that your business bears, the less someone will be willing to pay for it. For Owners’ Roundtable participants – and all business owners – protecting business value therefore entails addressing risk in three areas: business, financial and personal. The challenge entails first mitigating risk (i.e., heading off potential issues before they occur), then addressing and minimizing current risk-related issues.

How can I build value – systematically and strategically?

Building value is a necessary step in the Value Maturity process for every business owner, regardless of circumstances. Why? Three reasons:

- If you as a business owner have identified a gap between your company’s actual value and your target value, you’ll need to build value to close or eliminate that gap.

- If you’re lucky enough that your business’ actual value is also your target value, you’ll still need to build value so that you and your team can facilitate a transition under the time frame and conditions you desire.

- Buyers like to invest in growing companies. While the current value of your business may be of interest to a potential buyer, they might be wary of pursuing a deal if recent growth has been flat or modest.

In our recent Owners’ Roundtable at sea, we talked through strategies for building tangible value—e.g., plant and building improvements, systems upgrades, marketing and more. Yet, much of our discussion around building value centered on intangible value—specifically, what we term the Four Cs: human capital, customer capital, structural capital and social capital. When it comes to valuing a business, intangible value is often more highly rated than tangible value. Certainly, a business owner may decide it’s strategically wise to build tangible value; but generally, most businesses can develop and improve value if their focus is on increasing intangible value.

Which transition option best suits my unique circumstances?

Which transition option best suits my unique circumstances?

As I said earlier, every business is different, so no single transition option fits the needs of every business owner. From family/intergenerational transfers, to management buyouts, sales to existing partners, third-party sales and even liquidations, there are lots of roads to consider. At Marcum, our Value Acceleration/Exit Planning Services Group educates clients on the options available to them; helps them identify and consider the pros and cons of each; and assists with weighing each option against their business, financial and personal goals.

Overall, this latest Owners’ Roundtable provided participants with a wealth of information to use as they endeavor to optimize value for their businesses, as well as 90-day action items that are executed relentlessly to keep the momentum going. For me, this session was a strong reminder of the numerous challenges business owners face on so many fronts, and the role that Value Acceleration plays in meeting those challenges and transforming them into golden opportunities. I look forward to future Owners’ Roundtable sessions – on land and on sea – and I encourage business owners who are interested in attending to contact me to learn more.

Do you have questions about maximizing the value of your business, or other value acceleration/exit planning issues? Please contact Michael Trabert, Partner, Advisory Services