Apples to Apples: Comparable Companies and the Market Approach

By Ashley DeCress, CPA, CVA, Manager, Advisory Services

A while back, I was in an accident that unfortunately resulted in my car being totaled (but I’m OK!). In the aftermath, I learned that as part of the insurance claim process, the insurance company provides a valuation report for your car to determine the amount of money you will receive. The insurance company does this by comparing your car (year, make, model, etc.) to the value of similar cars.

I read over the report and found an obvious mistake – my car had an automatic transmission but the comparable cars used by the insurance company in its estimate had manual transmissions. I sent the valuation to my dad, who is a mechanic and more of an expert on the subject matter. Not only did he point out the apples-to-oranges comparison of my automatic car to manually operated cars, but also the differences in the car’s emergency system, the value of the sunroof, and even the tire size and tread length, among other differences.

We discussed all of this with the insurance adjuster, who was then able to identify better matching cars and give me an appropriate value for my car. Although exact comparables are rarely available, this situation illustrates the importance of determining appropriate search criteria and analyzing search results in detail so that it can be determined if the original search was reasonable or if the search requires some fine tuning.

Valuing a Business

The same concept applies to using the market approach in valuing a business, which relies on pricing multiples for similar companies recently bought/sold or that are publicly traded.

In order to find comparable companies, it is important to gain a thorough understanding of the subject business and the industry in which it operates. This can be done through discussions with the subject company’s management, review of company documents, review of the company’s website, and so forth.

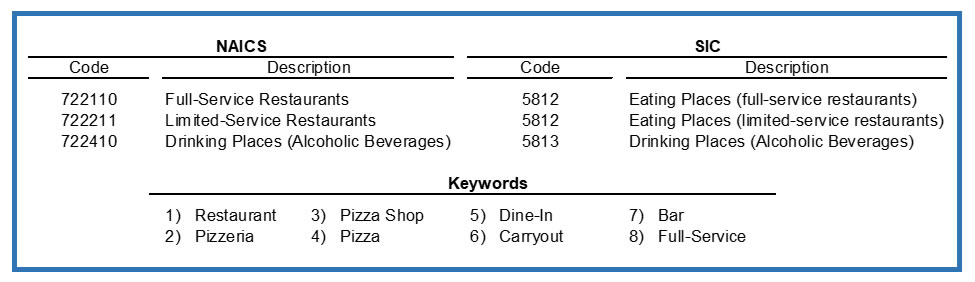

Once you are knowledgeable about the business, the next step is to identify the appropriate industry sector in which the subject company operates. The following tools are useful:

- Standard Industrial Classification (“SIC”) Codes – Four-digit code assigned based on common characteristics of companies in relation to products, services, production, delivery, etc.

- North American Industry Classification System (“NAICS”) Codes – Six-digit code classified based on industry information. Companies list their NAICS code on their tax return along with a business description.

- Keywords – Words that describe the business or the industry in which the company operates. Keywords can assist in determining the appropriate SIC and NAICS codes.

For example, the table below summarizes the NAICS and SIC codes along with certain keywords that might be used when valuing a restaurant or bar.

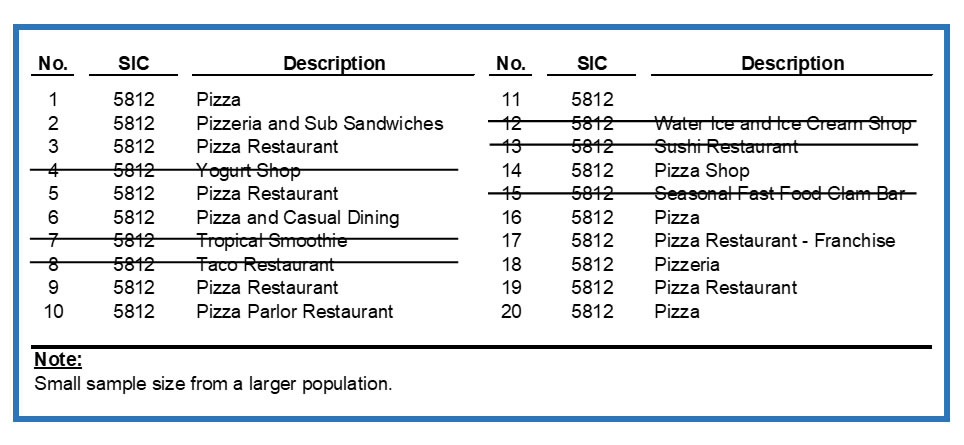

The industry information above assists the valuator in selecting an appropriate industry sector and developing a list of potential comparable companies from databases of publicly held companies or transactions of privately held companies. This information needs to be reviewed and carved down to eliminate 1) miscoded businesses – it is possible for a company/analyst to inappropriately select a SIC/ NAICS code and misrepresent the industry of the subject company; or 2) non-comparable companies – SIC/NAICS codes are broad and may include businesses that, in the valuator’s opinion, are not comparable to the subject company. It is not uncommon for the comparable population from the initial search to be pared down significantly before moving forward, as illustrated in the table below:

For example, the selected NAICS/SIC codes in the first table will likely result in a significant number of restaurants in a wide array of “sub-niches” within the restaurant industry. However, if the subject company is a pizzeria, it may not be appropriate to include a yogurt shop (same SIC code) in your analysis. It is also important to note that business valuations include elements of “art and science.” The selection of comparable companies certainly involves an element of professional judgment. If 10 valuators were given the same set of facts, those 10 valuators may arrive at 10 different datasets of comparables to the subject company. There is generally not a one-size fits all population for any subject company, as the selection of the best comparables is at the discretion of the valuator.

The comparable population can also be further analyzed to provide the valuator meaningful insight into key value drivers within the appropriate industry. Some of the factors that a valuator may use in evaluating the overall population of comparables include:

- Recent Transactions – Companies that have been sold in a period similar to the subject company’s valuation date may be considered a better reflection of the subject company’s value. Outdated sales transactions, which may include highly comparable companies from an operations, profitability or other perspective, may not be the best indication of the value today. Market values of companies change frequently, so due consideration must be given to the relationship between the subject company’s valuation date and that of the comparable company group.

- Revenues – Oftentimes, a valuator may stratify the comparable population based on revenue size. This provides the valuator the insight into the multiples that are paid for companies not only inside the same industry, but at similar revenue levels. A revenue-based stratification allows the valuator to consider factors such as operating leverage, borrowing capacity, and business risks that are specific to businesses of similar size to that of the subject company.

- EBITDA Margin – Similarly, the valuator may stratify the population based on overall profitability (e.g., EBITDA margin). Once again, the valuator is able to fine tune the analysis using a subset of the overall population that has a very specific value-driver (profitability) that is consistent with the subject company.

- Geographic Location – There may be differences in business operations based on where a company is located and therefore breaking down the information based on geography may help to further clarify industry multiples.

By analyzing the subject company through the prism of these categories, the valuator is in a better position to carefully consider the pricing multiples indicated by the peer group, and ultimately render a more reliable opinion of value.

There is one final key point to address, and it relates back to the importance of exercising professional judgment in the valuation process. In cases where limited criteria are submitted by a valuator through a public company or private company transaction database tool, the comparable population may be generated utilizing a generic industry code search without the appropriate vetting. Without reviewing the information and specifically selecting the comparable companies, the subject company could be inaccurately valued, and the valuation could be susceptible to criticism.

Summary

Similar to my father reviewing the valuation of my car, it is important to work with an expert who can determine an appropriate dataset population, analyze the results based on the company/industry, and appropriately slice the information into categories that will provide further clarification to the multiples that are ultimately utilized.

Do you have questions about comparable transactions/the market approach or other valuation-related matters? To discuss your company’s situation, please contact Ashley DeCress, CPA, CVA, at 216.242.0820 or [email protected].