Cryptocurrency: A Growing and Potentially Hidden Giant

By Nick Oldack, ASA, Senior Manager, Advisory Services

As the popularity and adoption of Bitcoin and other cryptocurrencies continue to rise, our jobs as forensic accountants in the matrimonial space have become increasingly difficult. Now, more than ever, financial experts need to be knowledgeable about:

- What cryptocurrency is.

- Where cryptocurrency and other related assets are held.

- How to track and identify crypto assets.

- How to value these assets.

- Income generated from these assets.

1. What is Cryptocurrency?

Let’s start with what cryptocurrency is. Per Investopedia:

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

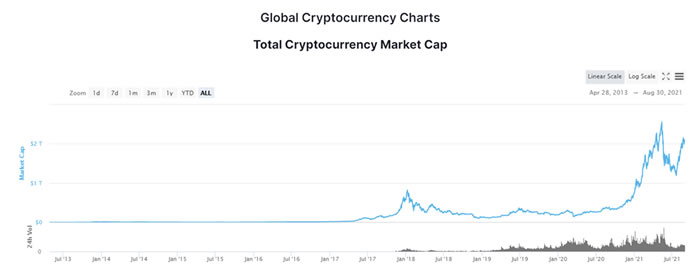

The crypto industry has grown exponentially in recent years. As demonstrated in the chart below, the market capitalization of all cryptocurrencies increased from approximately $15 billion at the beginning of 2017 to approximately $2.1 trillion as of August 30, 2021. Leading the way are Bitcoin (BTC) and Ethereum (ETH) represent total market share of 43.6% and 18.3%, respectively.

As the popularity of the industry continues to rise, you can expect crypto-related issues to become more and more prevalent with your clients/caseloads. Due to the significant growth in the industry, it is not abnormal for modest investments of even a few hundred dollars to turn into gains of hundreds of thousands of dollars over short time periods. That begs the question: Where are cryptocurrency and other related assets held?

2. Where is Cryptocurrency Held?

Due to their digital nature, crypto assets are most often held in online, app-based “wallets” that are used to protect an individual’s Bitcoin and other types of cryptocurrency. In addition, hardware wallets and software wallets can be used to store cryptocurrency. Each wallet has its own password and seed phrase, which is typically comprised of a 12 or more word security phrase. Unlike banking with a large financial institution, if you lose your credentials there is typically not a customer service number to call or a “forgot password” link to click. As many have found out the hard way, misplacing your security phrase can lock you out of your wallet forever, costing you hundreds, thousands, or millions of dollars in crypto assets.

Identifying which wallets someone uses is where things become difficult. It is not uncommon for someone to utilize four or more wallets. In fact, using multiple wallets is typically encouraged to spread out assets and mitigate the risk and magnitude of a security breach or a locked account. Due to the number of wallets available and the general lack of understanding about this industry, tracing and finding assets can become a difficult process.

3. How to Track and Identify These Assets

While there is no foolproof way to identify all potential assets, it is time for us in the litigation community to become more aware of how significant these assets could be, and that they may not be easy to find. Here are some potential ways to identify these assets:

- Make sure to include cryptocurrency-related items in all discovery requests at the outset of each engagement;

- Ask pointed questions during client/opposition interviews;

- Prepare pointed questions to ask at deposition or through interrogatories;

- Review personal income tax returns for any income reported relating to crypto assets;

- Review financial affidavits or statements of net worth to see if there is any mention of crypto assets; and

- Review bank, credit card, and brokerage account statements seeking deposits or withdrawals to or from any crypto exchange (i.e., Coinbase) that would signify cryptocurrency activity.

If any of the above steps reveal activity in the crypto industry, it is imperative to do a deep dive to attempt to identify potential cryptocurrency/digital assets.

4. How to Value These Assets

Once identified, the valuation of these assets may be very straightforward. Similar to the stock market, there are several reliable resources that report up-to-the-second prices for cryptocurrency assets. However, unlike shares of some large publicly traded companies, crypto assets are extremely volatile and can increase or decrease by 20% (or way more) in value within any given 24-hour period. It is important to constantly update these values throughout any litigated matter.

While most crypto assets can be easily valued based on their public exchanges, other crypto assets, such as the increasingly popular non-fungible tokens (NFTs) can be much more difficult to value.

5. Income Generated from Crypto Assets

It is also important to be aware of potential income that can be generated from these assets in the form of staking, yield farming, etc. There are several platforms that provide a yield for staking or providing liquidity with crypto assets.

Conclusion

While many think they are “too late” to cryptocurrency because they missed out on the minuscule prices that existed a decade prior, the reality is that the industry is still in the early stages of its adoption cycle. As the crypto industry continues to evolve, identifying and valuing these assets will play a huge role in many of the cases both lawyers and financial experts will come across on a day-to-day basis.