Fighting the Last War: Is Housing a Bubble?

By Michael McKeown, CFA, CPA, Chief Investment Officer, Marcum Wealth

When it comes to the housing market, it seems the general feeling is one of fear.

This is not a surprise; the biggest housing bubble ever occurred just last decade. It nearly wiped out the financial system and caused the most job losses ever.

We humans are good at pattern recognition. If we see a threat out in the wild – we react and avoid it.

Other times though, our snap judgments can lead us astray. As Economics Nobel Prize Winner Daniel Kahneman showed us in Thinking Fast and Slow, our System 1 brain reacts quickly and forms opinions based on the surface. Our System 2 brain will take time to contemplate and consider deeper information.

As investors, it may be good to take the well-known saying to heart, “Generals always fight the last war.” Meaning the previous pattern or strategy may not work out the same in the future as it has in the past.

Let’s dive into the housing market.

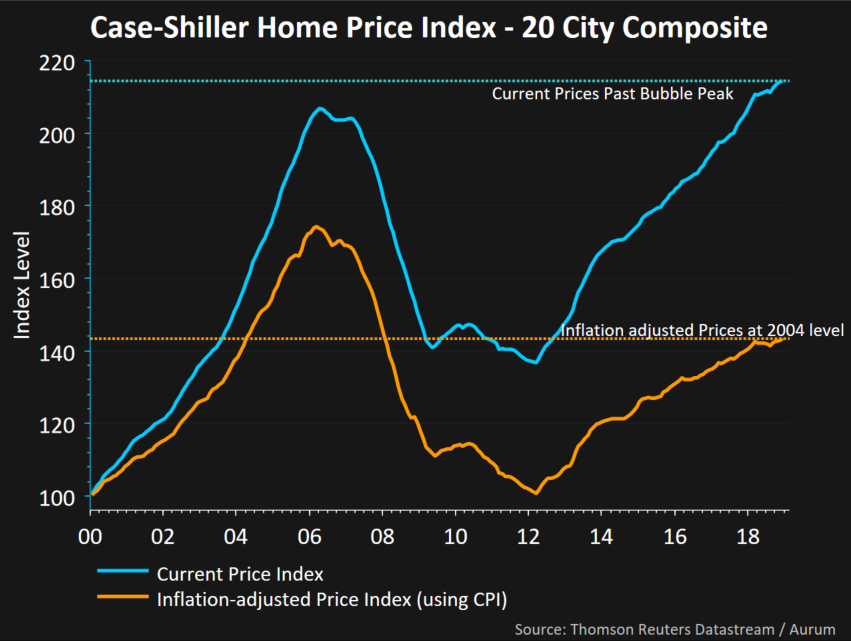

First up we have the Case-Shiller Home Price Index, which looks at trends across 20 major cities in the U.S. Cleveland is still included among the 20, but sadly, we are dead last in the recovery from the bottom. At least our sports teams are looking up!

The current prices went above the 2006 highs last year. But if we inflation adjust the price level (also known as real price), this is only at 2004 levels. With appreciation of 2% real since 2000, this would be 1% higher than the long-term average, but would not meet the general definition of a bubble.

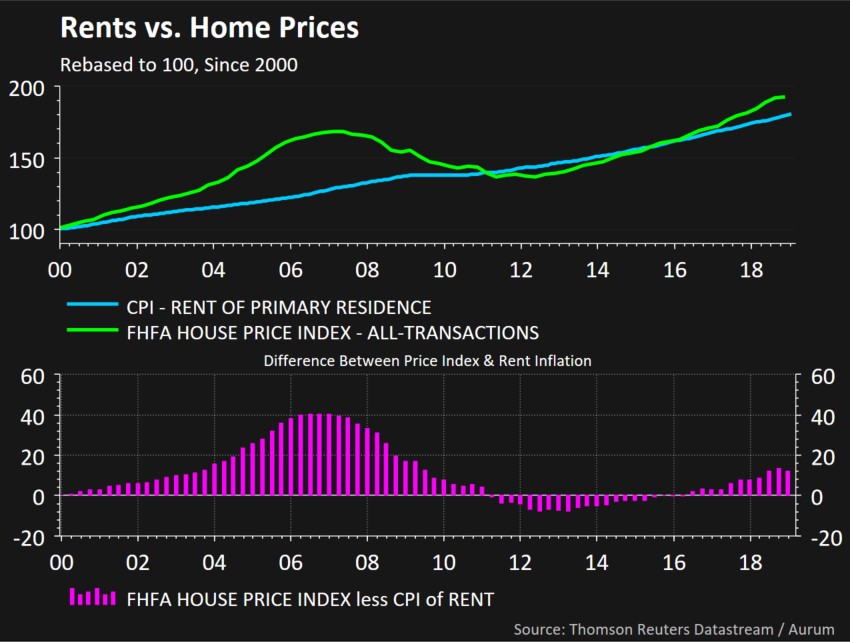

Here is another price metric, the FHFA (Federal Housing Finance Agency) index that includes all transactions in the U.S. Compare this to how the price of rents grew over time. The bottom half of the chart displays the difference between price growth and rent growth. Back in 2006, prices were 40% higher than rents. As of the last quarter, prices are only 12% higher.

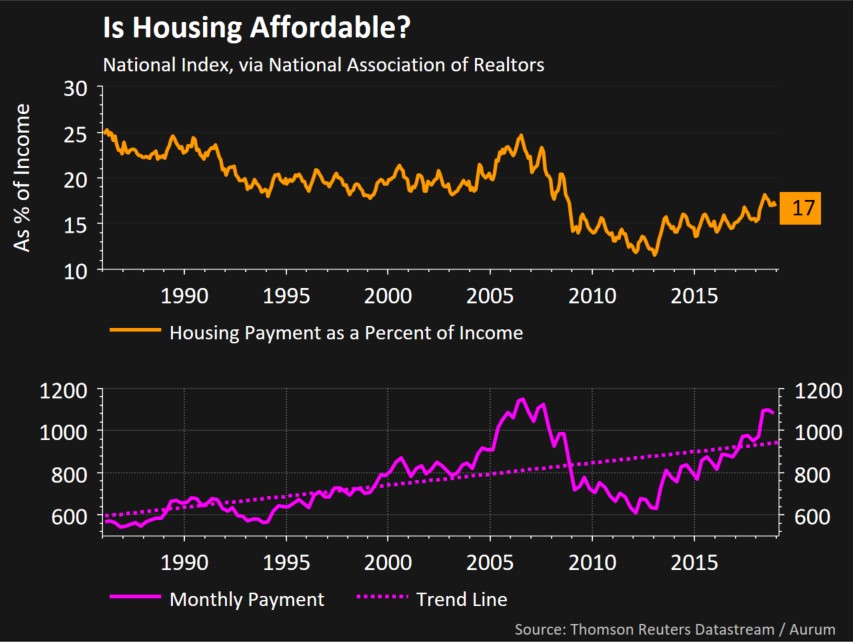

Housing payments as a percent of income are 17%, as seen in the top of the next graph. For the period from 1987 to 2007, this averaged 21%. Prices are still affordable relative to incomes.

In the bottom half of the graphic above, we see the monthly payment for housing (which includes principal and interest). On a non-inflation adjusted basis, payments are still at all-time highs. In 2006, the monthly payment was 40% above the trend line, today it is 15% above the trend line. Still, this is not inflation-adjusted, which would show that current payments are lower than any time during the 1996 to 2008 period.

The monthly payment is usually what people focus on when thinking about affordability. The monthly payment could fall for two reasons: if either prices were or interest rates fall.

The Millennials Are Coming.

Millennials do not exist just to annoy the Boomers and Generation X, though it seems that way at times. No, the Millennials are now the largest group responsible for new mortgages. According to Realtor.com by the end of 2018, Millennials represented 45% of all new mortgages, compared to 36% for Generation X, and 17% for Baby Boomers.

This huge demographic tailwind is set to take off during the 2020 to 2025 period. These will be the years when the most Millennials will enter peak first-time buying age.

So far we examined many areas that turn out to be a positive or neutral for housing.

One of the reasons the narrative has shifted to the negative side is that new home starts are down from the peak levels of January 2018. Starts usually top out at least two years prior to an economic downturn. This does not mean housing prices must come down. During the 1990 and 2001 recessions, housing prices moved sideways. But as we all know, real estate is local.

Another aspect weighing on prices are changes in the tax laws. The new limits on State and Local Tax (SALT) deductions are shifting many homeowners from itemizing deductions to the standard deduction. This makes housing in high-income tax states like California or certain neighborhoods marginally less attractive on an all-in basis.

Given all the information, would Danny Kahneman have us think fast or slow?

While prices are slightly above trend compared to rents, affordability is still there. The cyclical peak in housing starts could be a sign of weakness in the new home market but does not mean existing home prices must come down dramatically. The Federal Reserve has backed off interest rate hikes. Rates staying lower for longer along with the demographic tsunami should keep demand high for housing. Rather than being wildly positive or negative, the housing market seems to be more fairly balanced between buyers and sellers than it has in years.

Questions about this blog? Contact Michael McKeown, Chief Investment Officer, Marcum Wealth.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.