How Multiple Valuation Methods Are Reconciled to Reach the Concluded Value of a Company

By Sean R. Saari, Partner, Advisory Services

Investors in publicly-traded companies have the luxury of knowing the value of their investment at virtually any time. An internet connection and a few clicks of a mouse are all its takes to get an up-to-date stock quote. Of all U.S. companies, however, less than 1% are publicly-traded, meaning that the vast majority of companies are privately-held. Investors in privately-held companies do not have such a readily available value for their ownership interests. How are values of privately-held businesses determined, then? Each month, this eight blog series will answer that question by examining a key component of how ownership interests in privately-held companies are valued.

Reconciliation of Values

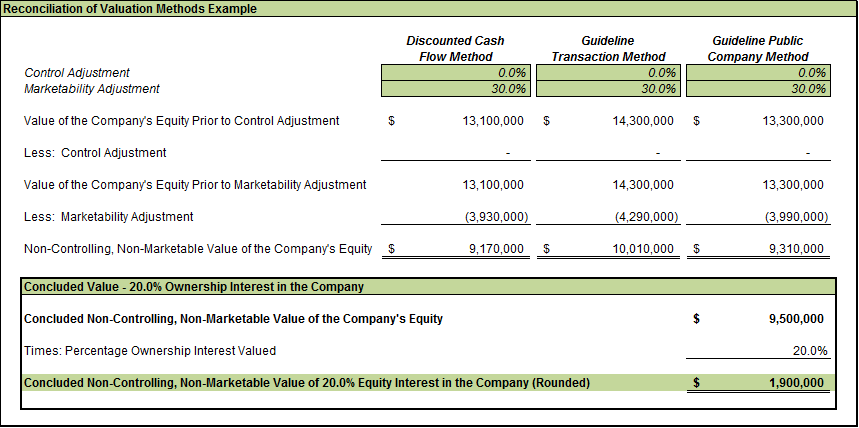

The final step in the valuation of a company is reconciling the values indicated by the various valuation approaches utilized. Generally, the values indicated by income and market-based approaches should be consistent and are usually given full weight when they are greater than a company’s adjusted net asset value (to which no weight would be assigned). When a company’s adjusted net asset value exceeds its income and market-approach values, however, consideration should be given to the higher asset-based value.

Some valuation analysts apply explicit weights to the values indicated by each methodology used while others use professional judgment and select a value within the range indicated by the methodologies applied. Regardless of the approach, the concluded value should be reconciled and supported by the valuation methods utilized.

An example of a reconciliation of various valuation methods is presented below:

Wrapping It All Up

Valuing a privately-held company is much more involved than simply typing a ticker symbol into Yahoo! Finance. It also is much more involved than just applying an estimated multiple to the company’s EBITDA. This blog series (and the related e-book) provides some basic examples of the valuation methods that are most frequently used in the valuation of privately-held companies (and even these basic examples can be quite involved). It should be kept in mind that there are additional nuances specific to each valuation that are not addressed in this e-book including income statement normalizing adjustments, financial statement analysis, economic and industry analysis, discount rate analysis, selection of control and marketability discounts, and many other items. At the end of the day, however, and regardless of the type of company or its industry, the valuation of privately-held companies comes down to the application of asset, income and market-based valuation approaches.