How the Changes to the Government’s Credit Rating Impacts Discount Rates When Valuing Private Companies

In corporate finance and valuation, both academics and practitioners have long used government security (U.S. Treasury Bills and Bonds) rates as proxies for risk-free rates of return. Underlying this practice was a general belief that the U.S., with its coveted AAA sovereign debt rating, could not default on its obligations. So, how have credit downgrades affected the risk-free rate within the context of valuation?

The risk-free rate is the cornerstone in finance for estimating both the cost of equity and debt capital. The cost of equity is computed by adding an equity risk premium to the risk-free rate, (usually measured as the Standard & Poor’s 500 Index). The cost of debt is estimated by adding a default spread to the risk free rate, with the magnitude of the spread depending upon the credit risk in the borrower. Thus, using a higher risk-free rate, holding all else constant, will increase cost of capital, which will reduce present value in a discounted cash flow valuation (i.e. debt and equity values will tend to decline).

If we categorize companies, based upon assets in place and growth assets, then when the risk-free rate changes then in theory growth companies, holding all else constant, should be affected much more adversely then mature companies.

The consequences of changes in the risk-free rate

Changes in the risk-free rate also have consequences for other valuation inputs. The risk premiums that investors use for both equity (equity risk premium) and debt (default spreads) may change as risk-free rates change. In particular, an increase in the risk-free rate will generally result in higher risk premiums, thus increasing the effect on discount rates. Investors, who settle for a 4% risk premium, when the risk-free rate is 3%, may demand a much larger risk premium, if risk-free rates rise. Finally, the most common factors that cause the shift in risk-free rates – expected inflation and real economic growth – can also affect the expected cash flows for a firm.

Or so finance theory suggests. The reality is not as clear cut as the theory.

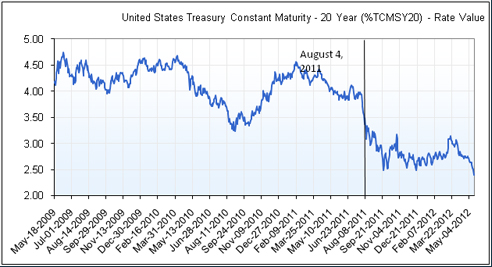

On September 17, 2007, the day before the Federal Reserve began cutting the Fed Funds rate to stimulate the U.S. economy, the effective Fed Funds rate was 5.33% and the 20-year Treasury rate was 4.76%. On August 4, 2011, the day before the ratings cut, the effective Fed Funds rate had declined to 0.09% and the 20-year Treasury rate was 3.37%. By month-end, the rates were 0.08% and 3.19%, respectively.

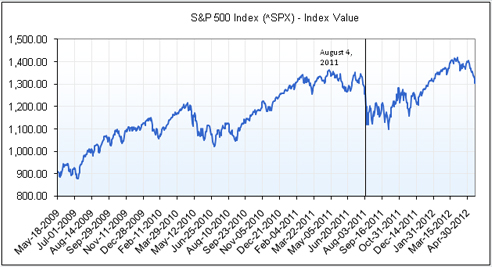

Since last year’s US ratings downgrade by Standard & Poor’s, the markets have been wracked by volatility and a flight to quality. According to the media, the flight to quality is due to a variety of reasons: the political infighting in the United States, the European sovereign debt crisis, the internal unrest in Syria, and changes to the expectations of the United States’ economy. The volatility is underscored when one looks at the charts of the S&P 500 Index and the long-term Treasury Bonds.

Does the change in the U.S. Treasury rates mean that the value of privately-held business has significantly changed as a result of the market forces? The short answer is not likely. Ray Miles, of the Institute of Business Appraisers, did a study on the IBA Market Database and concluded that there were no long-term changes over time in the multiples of the industries represented in that database over 20 years.1 Of course, some industries’ multiples will exhibit more volatility in the short-run than others due to their sensitivity to general economic conditions (retail), government regulation (restaurants), and natural disasters (bottled water).

Rodger Grabowski, in a 2009 white paper on the cost of capital observed, that the traditional methods typically employed in estimating the [Cost of Equity Capital] are subject to significant estimation and data input problems. Likely temporary aberrations in several of the inputs to traditional models during this period of economic crisis require analysts to apply more rigor and scrutiny in developing the cost of capital estimate.2

Conclusion

In short, recent ratings downgrades do not mean that the risk-free rate has changed markedly. Instead, it means that valuation professionals need to continue to utilize reason and apply rigorous analysis when developing their cost of cost of capital estimate.

1. Shannon P. Pratt, The Market Approach to Valuing Businesses, Second Edition, 2005, pages 40-41.

2. Roger J. Grabowski, Cost of Capital Estimation in the Current Distressed Environment, Journal of Applied Research in Accounting and Finance (JARAF), Vol. 4, No. 1, pp. 31-40, 2009.