Investing in NFTs? Why You Need Guidance from Professionals and the IRS

By Brian Essman, Tax Manager, Alternative Investment Group

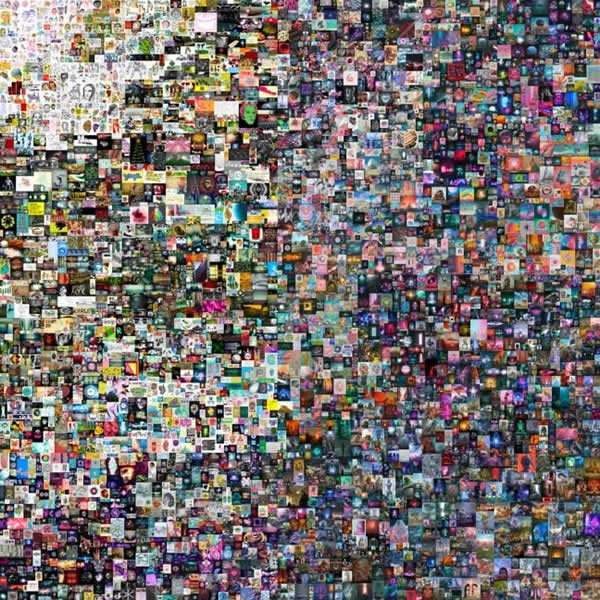

By now you have probably heard of the term “NFT.” A non-fungible token (NFT) is a digital certificate of authenticity that cannot be replicated, resulting in the uniqueness from which it derives its value. This digital certificate, or signature, is recorded and verified using blockchain technology. The most notable NFTs in the public consciousness relate to digital artwork, such as those of the Bored Ape Yacht Club. But NFTs can also encompass online information, including videos, memes, and Twitter founder Jack Dorsey’s first tweet. The largest NFT sale to date was Beeple’s EVERYDAYS: THE FIRST 5000 DAYS, (pictured below), which sold for the equivalent of $69.3 million.

It’s important to note that in many situations, the NFT purchase does not include full rights to the underlying intellectual property. The rights acquired are only to the blockchain-verified token. One way to wrap your head around that is to think of an NFT as the digital equivalent of an autographed basketball that has a certificate of authenticity from a third party. There are similar basketballs in existence, but only the specific basketball has the authenticated autograph.

Taxation of NFTs

As NFTs become more mainstream, it is only a matter of time before the Internal Revenue Service (IRS) or Treasury offer clear guidance on how NFT transactions should be taxed. The IRS has not yet issued authoritative guidance on NFTs. But based on existing principles and recent guidance related to cryptocurrencies (Notice 2014-21), certain tax treatments seem likely.

Any income an NFT individual creator receives from selling an NFT will most likely be considered trade or business income and taxed at ordinary income tax rates (up to 37%). NFTs are generally purchased using a cryptocurrency; therefore, the income reported by a creator would be the fair market value (FMV), in U.S. dollars, of the cryptocurrency received from the purchaser on the date of purchase. The creator would then hold cryptocurrency with a tax basis of the same amount. Based on guidance provided by the IRS, if the creator decided to sell the cryptocurrency, the sale would be treated as a short-term or long-term capital gain/loss based on the length of time the cryptocurrency was held before the sale.

NFT creators should also be mindful of the self-employment tax. Since the creator could be considered part of a trade or business of creating and selling NFTs, the IRS may subject the income from these sales to the additional self-employment tax of 15.3%.

Finally, keep in mind that the creator of the NFT maintains the rights to underlying property. Therefore, depending on the terms within the blockchain smart contract, the NFT creator may be entitled to royalty payments from the profits generated by a purchaser licensing the NFT.

With respect to investors in NFTs, even upon the purchase of an NFT a taxable event may occur. Because NFTs are generally purchased using a cryptocurrency, when a purchase is made, the purchaser needs to report a capital gain or loss on any change in the FMV of the cryptocurrency used to make the purchase. However, a purchaser may be able to buy the cryptocurrency necessary to acquire the NFT and then use it to make the purchase almost simultaneously, which could result in no capital gain or loss.

When a seller receives cryptocurrency in exchange for an NFT, they would report a gain if the cryptocurrency received (translated into USD) exceeds their tax basis in the NFT. It should be noted that since the IRS has not provided guidance, there are two competing schools of thought on whether a gain on the sale of an NFT results in a capital gain or a collectible gain. A collectible is defined in IRC Sec. 408(m) and includes, “Any work of art…or any other tangible personal property specified by Treasury.” As mentioned previously, a significant portion of NFTs are related to digital artwork. While a work of art is included in the definition of a collectible, “other tangible personal property” could suggest that all items included in the definition of collectible are tangible property. Since digital artwork is nontangible, the NFT would not meet the definition of a collectible and should be considered a capital asset.

In addition to the gain upon the sale of the NFT as described above, the seller now generally has cryptocurrency in their possession. Should the seller then sell the cryptocurrency, another capital gain or loss event would occur (depending on the change in value of the cryptocurrency from the date of sale of the NFT to the date of sale of the cryptocurrency).

The NFT community and their tax advisors will welcome further guidance from the IRS. Given the complexity of transactions involving NFTs, reach out to Marcum’s team of professionals to assist with the implications of these transactions.