Recommendations to Maximize the Value of Your Privately Held Company (Part 3 of 3)

“By failing to prepare, you are preparing to fail.” This famous quote by Benjamin Franklin reinforces the idea that if you do not properly prepare for a desired outcome, you are not likely to achieve it. If your goal is to maximize the value of your company, this quote can serve as an important reminder to help keep you prepared and on track to do so.

Owners are often laser-focused on the day-to-day operation of their businesses, and unintentionally pay less attention to big picture items that can help trigger material increases in the value of the company. If your long-term objective is to enhance the value of your business, it may be helpful to consult a valuation analyst to shed light on what it takes to accomplish that goal.

Part 1 of this blog series on maximizing the value of your privately held company focused on financial considerations that impact value while Part 2 focused on non-financial factors. Part 3 will highlight a few high-level strategic considerations that business owners can use as tools to increase value.

1. Understand That Maximizing Value Doesn’t Happen Overnight

Consistency is key. If you try to sell your company immediately after generating a record profit, a savvy buyer will quickly question your company’s ability to achieve that level of profitability on a recurring basis going forward. By demonstrating consistent historical revenue growth and positive cash flow, a potential buyer will likely assess a lower level of risk associated with your company’s ability to continue to grow both revenues and profitability. Consistent positive cash flow will almost always command a higher price, since a buyer can reasonably expect to be paid back on his or her investment faster in comparison to a company with erratic historical cash flows.

2. Understand Your Company on a Normalized Basis

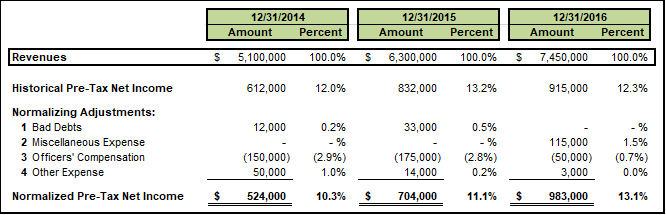

An experienced buyer will adjust a company’s earnings for discretionary expenses and/or items that are not expected to recur in the future (or items that were not incurred in the past but are expected in the future). This analysis is often referred to as “normalizing,” and a valuation analyst can help assist in this process. A simplified example of this process is shown below:

In this simplified illustration, the valuation analyst made the following adjustments:

- Bad Debts, Miscellaneous Expenses, Other Expenses – Normalizing adjustments are typically made for non-recurring expenses. In this example, the company had a variety of one-time expenses which were normalized to develop a sustainable income stream that reflects expected results going forward.

- Officers’ Compensation – An owner of a privately held company may underpay or overpay himself for various reasons (tax planning, cash flow availability, etc.). A valuation analyst will consider whether or not the historical officer compensation levels are representative of fair market value based on the services rendered to the company and adjust earnings accordingly.

These are just a few of the normalizing adjustments a valuation analyst may record to adjust the historical earnings. The key takeaway here is that oftentimes a company’s reported income levels do not necessarily provide a reliable indication of the underlying economics of the business.

3. Understand the Approaches Used to Value a Privately Held Company

By understanding the general approaches used to value a company, business owners will be far better prepared when the time comes to negotiate a sale. This basic knowledge of valuation can help business owners understand how offers were formulated and determine how to appropriately counter. The three approaches used in valuing companies are as follows:

Adjusted Net Asset Approach

- Under this approach, a company is valued based on adjusting its assets and liabilities from their historical book values to their fair market values.

- Total adjusted assets are then reduced by recorded and unrecorded liabilities.

- The excess or residual value leftover after netting the fair market value of the company’s assets against that of its liabilities is considered the adjusted net asset value of the business.

Income Approach

- This approach values a company based on its future cash flow potential. Within the Income Approach resides two approaches that can help you arrive at the indicated value of the company:

Capitalized Cash Flow Approach – This approach is used when future revenue and income levels are expected to be consistent with historical results. The normalized benefit stream is then capitalized based on a capitalization rate that considers the risk and expected growth of the company.

Discounted Cash Flow Approach – This approach is used when future revenue and income levels are not expected to be consistent with historical normalized results (e.g., significant revenue and earnings growth expected going forward). The projected benefit streams are discounted to present value based on the risk of the company and the likelihood of achieving the projected results.

Market Approach

This approach values a company based on pricing multiples (e.g., revenue and EBITDA) observed for comparable public companies, or in transactions in the company’s industry. Similarly, within the Market Approach resides two approaches that can help you arrive at the indicated value of the company:

Guideline Transaction Approach – This approach is used to value a company based on pricing multiples derived from the sale of companies in industries similar to that of the business being valued.

Guideline Public Company Approach – This approach values a company based on pricing multiples derived from publicly traded companies in industries similar to that of the business being valued.

Creating value does not happen overnight. It is important that owners develop and execute a strategic plan that enhances the factors that will favorably impact value. By starting early and working with an experienced valuation analyst, an owner will be better prepared to tackle any hurdles that arise during the exit planning and sale process.

Do you have questions about valuing privately held companies, or other valuation issues? Please contact us at (855) MARCUM1.