SEC’s Proposed “Dealer” Definition: How Does It Impact Investment Firms?

By Lawrence Montgomery, Partner, Assurance Services

In March 2022, the Securities and Exchange Commission (“SEC”) proposed a new rule to update the definition of “dealer” under Section 3(a) of the Securities Exchange Act of 1934 (“Exchange Act”). The proposed rule is in response to increased trading volume and market liquidity sourced by unregistered market participants. This has resulted in a significant increase in market activity by firms that are unregulated by the SEC. The SEC’s proposed rule is intended to enhance investor protection and provide market stability.

The increase in unregistered market activity is likely attributable to advancements in technology, including the use of algorithms, that are commonly used by proprietary trading firms. These firms focus on trading volume and speed in order to execute their strategies, noted in particular in the U.S. Treasury markets.

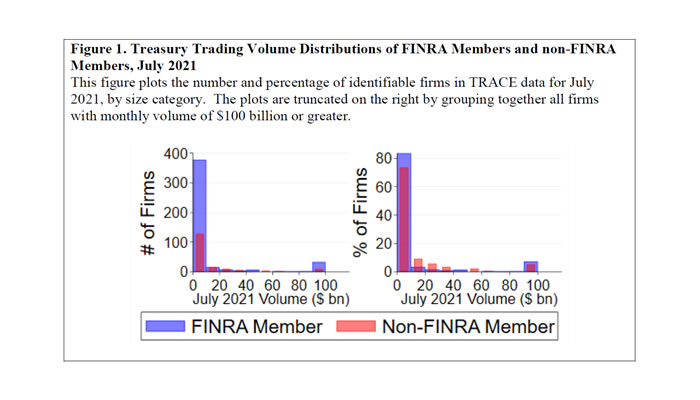

In the proposed ruling, the SEC provided the following graph to demonstrate this observed trend:

Source: TRACE data for July 2021 as presented in https://www.sec.gov/rules/proposed/2022/34-94524.pdf

As noted in the graph above, the SEC has observed how the trading volume by unregistered firms significantly exceeds the activity by regulated firms. The SEC believes this demonstrates the use of technology and accelerated speed at which these firms are executing trades. The current definition of “dealers,” requiring registration, pertains to those that buy and sell securities as their “regular business.” Unregistered market participants (non-dealers) have historically asserted that their activities are not a “regular business” in order to qualify for exemption from registration. By expanding the definition of “dealer,” the proposed rules are targeting market participants, such as investment managers and private funds, who have the effect of “providing liquidity” to markets. The draft rules add the following standards:Qualitative Standards:

- Routinely making roughly comparable purchases and sales of the same or substantially similar securities in a day;

- Routinely expressing trading interests that are at or near the best available prices on both sides of the market, which are communicated and represented in a way that makes them accessible to other market participants; and

- Earning revenue primarily from capturing bid-ask spreads, by buying at the bid and selling at the offer, or from capturing any incentive offered by trading venues to liquidity-supplying trading interests.

Quantitative Standard:

- A person, in each of four out of the last six calendar months, engaged in buying and selling more than $25 billing of trading volume in government securities.

- The quantitative standard focuses solely on government securities due to the SEC’s observed trend of significant trading volume in the U.S. Treasury market by non-FINRA member firms.

The qualitative standards do not provide any bright-line tests. Firms will be required to exercise a significant amount of judgment in applying terms such as “routinely” and “roughly comparable” used throughout these standards, as follows:

- Routinely – more frequent than occasional but not necessarily continuous.

- Roughly comparable –purchases and sales similar enough (i.e., dollar volume, share volume, risk profile) that they would yield a near market-neutral position.

The proposed rules are also aiming to update the definitions of “control” and “own account” in order to provide a more substance-over-form framework to be applied by parties who are the main beneficiaries of the market trading activity. The revised definitions would deter individuals and firms from reorganizing their legal entities to avoid being subject to the proposed rules.

Further, the SEC placed particular emphasis on how registered investment advisors view a “parallel account structure” in which there are multiple common-control legal entities investing in similar assets.

There are also practical concerns over how registered investment advisors will or will not aggregate their clients’ trading activity, which will require close analysis.

The compliance burden for firms to register as dealers as a result of the proposed rule will be significant. These requirements include, but not limited to, the following:

- Net capital requirements,

- Anti-fraud rules,

- Annual financial reporting (audited financial statements),

- Capital contribution lock-ups (12 months),

- New issue restrictions (IPO),

- Direct reporting of trading information, and

- Subject to examinations by the SEC and self-regulatory organizations (such as FINRA).

Market participants with controlled assets of less than $50 million would qualify for an exclusion from the proposed rule.

Comments were due to the SEC by May 27, 2022. Based on the comments posted on the SEC’s website (https://www.sec.gov/comments/s7-12-22/s71222.htm), the proposed rule has garnered a significant amount of negative reaction, including these representative comments:

- The expectation is that a large number of firms will require registration, particularly private funds.

- Rules are too vague.

- Rules provide jurisdiction exceeding the SEC’s statutory authority, including the original intent of the Exchange Act.

- Adverse market consequences, such as an immediate increase of selling positions as private funds sell off creating market pressure.

- Overall decrease in market trading volume.

- Reduced distinction between dealers and traders.

- Comment period too short.

- Limited discussion on considerations digital asset securities.

Conclusion

The SEC’s draft rule expands the definition of what constitutes a “dealer,” based on a market trend that could expose investors to risk, and proposes a solution providing increased regulation and oversight. The investment community’s response appears to be critical of the proposed rule due to the potential unintended consequences, such as high costs, resource constraints, negative market reaction, and difficulties in interpreting and implementing the rule in practice.

Source

- SEC Release No. 34-94524; File No. S7-12-22.