Global Tax Revolution: Unraveling the Impact of Country-by-Country Reporting and OECD’s Pillar Two Rules

By Sophia Castro Jurado, Manager, Tax & Business Services

In a monumental global effort to increase tax transparency, over 100 jurisdictions have now implemented the country-by-country report (CbCR), a disclosure mechanism designed to shed light on multinational enterprises (MNEs) tax footprints. The CbCR is rapidly gaining significance as it transitions from a simple tax compliance exercise to an important component during the implementation of OECD’s Pillar Two Global Anti-Base Erosion (GloBE) rules, set to affect the international tax landscape profoundly. With expectations that CbCR data will soon become public information, the implications for transfer pricing and cross-border intercompany operations are undeniable. Let’s delve into the interconnection of CbCR and Pillar Two rules, and their potential impact on international taxation.

CbCR was massively adopted seven years ago and is no longer viewed merely as an annual tax compliance exercise — it is now gaining significant attention and importance. It will be part of the transitory measures for implementing OECD Pillar Two’s Global Anti-Base Erosion (GloBE) rules, which are expected to impact the international tax environment profoundly. CbCR data is also expected to become public information in the short term.

In this article, we will briefly explain CbCR and Pillar Two rules and how they impact transfer pricing and cross-border intercompany operations in general.

OECD BEPS Initial Package

The Base Erosion and Profit Shifting (BEPS) action plan, originally published in 2015, consisted of a series of 15 specific action items developed by the OECD to address issues related to MNE tax avoidance. The plan was developed in response to growing concerns about MNEs’ ability to shift profits to low-tax jurisdictions, eroding the tax base in the countries where the profits are earned.

The BEPS action plan was developed through a collaborative process involving representatives from governments, businesses, and civil society organizations from around the world. Since the action plan was created in 2016 as part of a broader effort to implement the anti-BEPS recommendations, over 137 countries (participant countries), have joined the OECD/G20 Inclusive Framework on BEPS.1

CbCR as Part of BEPS Action 13

Transfer pricing matters are critical to the OECD BEPS plan.2 Action 13, a minimum standard BEPS action, introduced a three-tiered approach for transfer pricing documentation, including preparing a CbCR, a master file, and a local file.

Until recently, adopting CbCR alongside other transfer pricing documentation measures was unprecedented. By 2016, 58 jurisdictions had implemented the CbCR; by 2022, that number was over 100. In 2016, the U.S. adopted the CbCR by requiring MNEs with a U.S. parent and global revenues of over $850 million to complete Form 8975. The U.S. does not require MNEs to prepare a master file or local file because existing transfer pricing documentation requires taxpayers to prepare equivalent information.

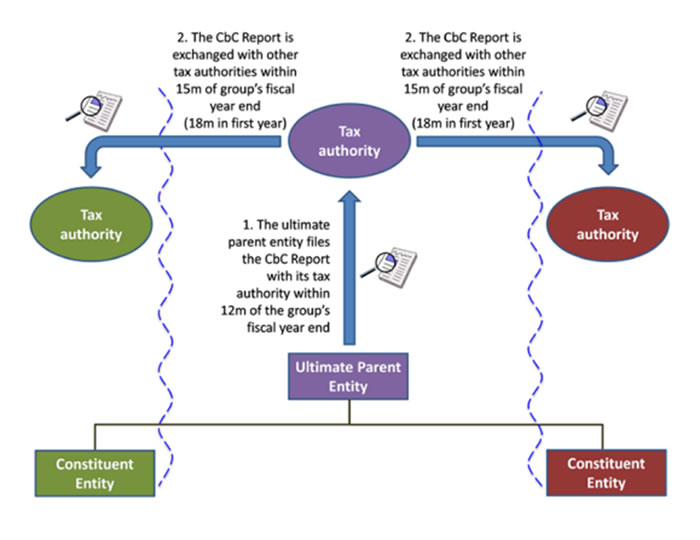

The CbCR obliges a MNE’s parent company to disclose aggregate data on the global allocation of income, profit, taxes paid, and economic activity in the tax jurisdictions where the MNE operates. This must be done in a standardized way and shared with tax administrations for use in high-level transfer pricing and BEPS risk assessments. The CbCR consists of three tables:

- Table one contains ten fields of numeric information on the MNEs, typically gathered from consolidated financial statements, entity statutory financial statements, regulatory statements, and even internal management accounts.3

- Table two contains, on a country-by-country basis, a description of each entity’s main business activity.

- Table three can be optionally used to provide additional information clarifying the report’s content.

The following diagram, prepared by the OECD, summarizes the CbCR exchange process between tax authorities.4

Implementing the CbCR required a significant effort not only from tax authorities but also from MNEs, which needed to prepare highly detailed financial information for the first time. To help, the OECD released further guidance on legislation implementation and technical aspects related to filling out the CbCR, plus how the guidance will be used as a risk assessment tool. For example, it identified 19 potential tax risk indicators that could be derived from the information contained in a CbCR.5 As a high-level risk assessment tool, a CbCR cannot be definitively used to propose changes to transfer prices or adjust MNE taxes — it should only initiate further investigation. However, tax authorities can use the data collected to plan tax audits.6

The fourth edition of the OECD Corporate Statistics, which contained aggregate and anonymized data from CbCRs for 2018, was released in November 2022.7 The United States registered the largest number of CbCR filers that year, with 1641, followed by Japan and China with 861 and 394, respectively. Other significant insights on BEPS around the world could be identified.

BEPS 2.0: Pillar One and Pillar Two Initiatives

While the BEPS project made progress in addressing some of the issues associated with international tax avoidance, it did not provide a solution to the challenges posed by the digital economy and MNEs’ ability to operate globally without a physical presence in a particular jurisdiction. To continue addressing these challenges, the OECD launched the two-pillar initiative in 2019, referred to as BEPS 2.0. Pillar One focuses on taxing rights between countries by allocating a portion of MNEs’ profits to countries with significant consumer-facing activities, even if they do not have a physical presence in those countries. Pillar Two, on the other hand, seeks to address BEPS by introducing a global minimum tax rate and an income inclusion rule, among other rules.

Similarly, as with the initial BEPS package, the two-pillar initiative was developed through consultation and engagement with stakeholders, including governments, businesses, civil society, and academia. Significant implementation progress has been made since the progress report was released in October 2021.8 Pillar Two has made significant progress towards its implementation whereas less consensus can be found around the adoption of Pillar One.

There was significant progress on Pillar Two recently, with over 130 countries agreeing to the key components of the initiative in October 2022.9 However, implementing Pillar Two will still require adopting domestic legislation in each participating country, which could take several years. The European Union (EU) seems to be ahead in this regard10, with countries recommending draft legislation almost every day. The United States has not yet taken an official position on adopting Pillar Two, though in the 2024 Greenbook Proposals issued in March 2023, the U.S. proposed repealing the Base Erosion and Anti-Abuse Tax (BEAT) and replacing it with Pillar Two’s Undertaxed Payment Rule (“UTPR”). On the other hand, recent foreign tax credit regulations indicated that the United States would not adopt Pillar One because, among other things, these new regulations would specifically deny foreign tax credits related to taxes paid by a country from income for which there was no presence in the country but was allocated to such country under the intended allocation rules of Pillar One.

CbCR and Pillar Two Rules

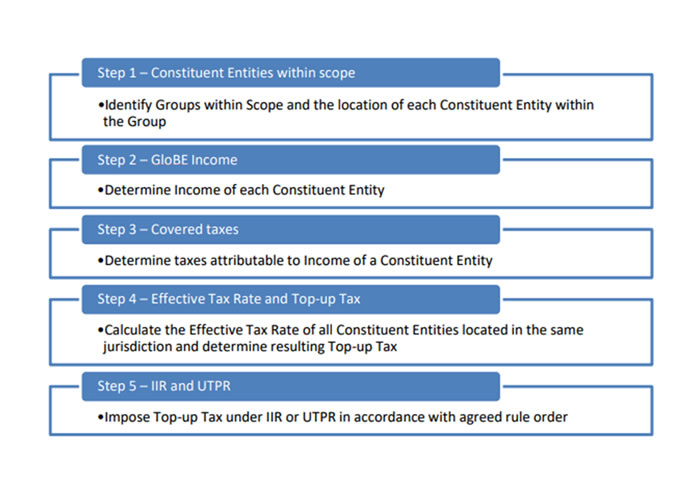

As of April 2023, the OECD/G20 Inclusive Framework on BEPS has agreed on the critical components of the Pillar Two initiative. The operative rules consider a monetary threshold of EUR 750 million of global turnover, and includes an agreed minimum tax rate of 15% and an Income Inclusion Rule (IIR). The IIR requires jurisdictions to tax the income of an MNE’s foreign branch or controlled entity if that income is subject to an effective tax rate below the agreed minimum tax rate. The rules also include an Undertaxed Payment Rule (UTPR), which allows jurisdictions to deny deductions or impose a withholding tax on payments made to a related party if the income associated with those payments is not subject to an effective tax rate above the agreed minimum tax rate.

According to the OECD, the following diagram illustrates the key steps MNEs might go through to determine liability under the Pillar Two Model Rules.

In December 2022, the OECD published an implementation package for Pillar Two which includes guidance on safe harbors and penalty relief, public consultation on GloBE information returns, and tax certainty for the GloBE rules.

As part of the GloBE rules, a transitional CbCR safe harbor was introduced to “ameliorate the immediate compliance difficulties that MNEs will face in building systems to collect the data needed for undertaking full GloBE calculations.” The safe harbor would allow a MNE to avoid undertaking detailed GloBE calculations with respect to a jurisdiction if it can demonstrate, based on its qualifying CbCR and financial accounting data, that in that jurisdiction, it has: revenue and income below the de minimis threshold (the de minimis test); an effective tax rate (ETR) that equals or exceeds an agreed rate (the ETR test); or, no excess profits after excluding routine profits (the routine profits test).11

The safe harbor applies to jurisdictions where the MNE’s constituent entities are located, provided the MNE qualifies under the three tests. However, the safe harbor only applies to fiscal years beginning on or before December 31, 2026, not including a fiscal year ending after June 30, 2028. MNEs cannot qualify for the safe harbor if they did not apply for it in a prior fiscal year.

To address concerns about the quality of data used, a Qualified CbCR is defined as one that is prepared and filed using Qualified Financial Statements prepared in accordance with acceptable financial accounting standards.

CbCR is expected to play a significant role in the first years of adoption of GloBE rules — not only as a key element of the transitory safe harbor explained above but also because CbCR data can be used to assess the accuracy and consistency of MNEs’ GloBE calculations. It’s more important than ever for MNEs to revisit their data-gathering process to prepare their CbCR.

CbCR Data Going Public

As part of broader tax transparency measures, countries are adopting legislation publicize CbCR.

In 2023, European countries will have to transpose into law the European Union (EU) Public CbCR Directive enacted in 2021. As a result, CbCR data for multinationals headquartered in the EU will start to be publicly disclosed. The first financial year of reporting will be the year starting on or after June 22, 2024; however, EU member states can opt to apply the rules earlier.

Australia released draft legislation in April 2023 that may not only make the CbCR data public but may also extend its scope.

Key Takeaways

- The CbCR, introduced as part of Action 13 to enhance visibility into MNEs’ tax affairs aiming at making tax collection more effective, is a crucial tool to monitor the MNEs’ transfer pricing by tax authorities.

- MNEs are starting to look at the CbCR obligation as more than a mere tax compliance disclosure since CbCR data may become public and can be used as part of the transitory safe harbor to simplify GloBE rules calculations during the first years of its implementation.

- Finally, the massive global adoption of the CbCR is an example of internationally coordinated efforts to increase tax transparency. This may prove that the further-reaching measures included in the Pillar Two GloBE rules could be implemented despite all the complexities involved.

Read Spanish version of article

Sources

- Action 8, addressing intangibles; Action 9, providing guidance on the allocation of risks and capital in transfer pricing arrangements; Action 10, proposing changes to the transfer pricing rules related to low-value intra-group services; and Action 13, recommending a new standard for transfer pricing documentation.

- According to the OECD, the Inclusive Framework provides a platform for countries to share their experiences and best practices, and to work together to address the tax challenges that arise from the digitalization of the economy. Through this forum, participating countries can collectively develop solutions to ensure that multinational companies pay their fair share of taxes in the countries where they operate.

- The fields included in Table 1 are: unrelated party revenues, related party revenues, total revenues, profit/loss before income tax paid, income tax accrued, stated capital, accumulated earnings, number of employees and tangible assets other than cash and cash equivalents.

- BEPS Action 13 Country by Country Reporting – Handbook on effective tax risk assessment published in 2017 and downloaded from https://www.oecd.org/tax/beps/country-by-country-reporting-handbook-on-effective-tax-risk-assessment.pdf

- The fields included in Table 1 are: unrelated party revenues, related party revenues, total revenues, profit/loss before income tax paid, income tax accrued, stated capital, accumulated earnings, number of employees and tangible assets other than cash and cash equivalent.

- BEPS Action 13 Country by Country Reporting – Guidance on the appropriate use of information contained in country-by-country reports, published in 2017 and downloaded from https://www.oecd.org/tax/beps/beps-action-13-on-country-by-country-reporting-appropriate-use-of-information-in-CbC-reports.pdf

- According to the OECD Corporate Tax Statistics: Fourth Edition, the anonymized and aggregated CbyCR statistics were provided to the OECD only by 47 jurisdictions, not by all the 76 jurisdictions that have received them during 2018 due to sufficiency data limitations.

- OECD/G20 Inclusive Framework on BEPS: Progress Report July 2020-September 2021. The report highlighted the progress made by participating countries in implementing the four minimum standards established by the BEPS project and included an annex containing the July 2021 Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalization of the Economy.

- OECD/G20 Inclusive Framework on BEPS: Progress Report September 2021-September 2022. provided an update on the implementation of the BEPS Action Plan. The report highlighted the progress made by participating countries in implementing the various BEPS minimum standards and noted that progress has been made towards the implementation of the Pillar One and Pillar Two initiatives.

- In December 2022, EU member states unanimously adopted the directive implementing GloBE rules. The final version of the directive is expected to be published by December 31, 2023, and will be applicable for fiscal years starting on or after December 31, 2024.

- OECD/G20 Base Erosion and Profit Shifting Project, Safe Harbors and Penalty Relief: Global Anti-Base Erosion Rules (Pillar Two) released in December 2022 and downloaded from https://www.oecd.org/tax/beps/safe-harbours-and-penalty-relief-global-anti-base-erosion-rules-pillar-two.pdf