Valuing & Dividing Stock Options in Divorce

By Alynne Zielinski, MBA, CFP, CDFA, Marcum Wealth

Valuing and dividing deferred compensation, specifically stock options, is complicated. Multiple factors determine stock option value. Grant date, grant price, vesting, expiration, and volatility all factor into the value of an option. Other features, including the reward intent (past performance vs future performance), forfeiture, and taxes impact the division of the options in a divorce settlement.

As tough as it is to value and divide stock options, often times it is even more difficult to discover them. Stock options are not listed on tax returns, W2s or other statements unless an exercise occurred. Spouses are inclined to forget they own stock options and will omit the information on the financial affidavit. To understand the full scope of compensation for the employee spouse, either subpoena the company or have the employee spouse provide plan documents with a summary plan description. This should include award letters and information on the grants including: grant dates, number of shares, grant/exercise price, expiration, and vesting schedule.

Two common types of employee stock incentives are non-qualified stock options (NQSOs) and restricted stock.

- NQSOs are a form of equity compensation with vesting schedules of 1-5 years.

- NQSOs provide the employee the opportunity to purchase company stock for a set period of time (usually 10 years) at a specified Grant (exercise) Price ($GP) usually at a favorable rate to the employee.

After non-qualified shares vest, the employee can exercise the vested shares at the current market price ($MP). The exercise results in taxable ordinary income in the amount of ($MP – $GP) x number of shares.

For example, a grant of 100 shares at $20 is exercised at a market price of $25. Exercising this stock results in a taxable amount of ($25 – $20) x 100 = $500. This $500 is taxed at the employee spouse’s tax rate and is subject to payroll taxes including social security and Medicare. |

|---|

- Restricted stock awards typically depend on the employee spouse meeting a benchmark.

- Restricted stock awards are subject to forfeiture upon termination of employment and typically have vesting schedules of 1-5 years.

After shares vest, the entire amount of the restricted stock award is included as ordinary income and taxed at the employee spouse’s tax rate.

It is important to reiterate that both stock incentives are taxed at the employee spouse’s tax rate. Therefore, these cannot be taken at face value in calculating division, distribution, child support and maintenance.

Four ways to value stock incentives are:

| Spousal Agreement | Intrinsic Value | Black-Scholes | Binomial | |

|---|---|---|---|---|

| WHAT IT IS | A valuation based on agreement between spouses | Uses a simple formula to value an option. Value = ($MP of stock on an agreed upon date – $GP) x number of shares |

A differential equation requiring 5 inputs to solve the value of options

|

An iterative procedure that assumes there are only two possible outcomes for the price of a stock; it either goes up or it goes down. |

| ASSUMPTIONS | None | None |

|

Uses points in time to build out a tree of possible stock prices with the top half assuming the stock goes up at a certain rate and the bottom half assuming the stock goes down. |

| CHALLENGES | Getting the spouses to agree |

|

|

|

While the intrinsic valuation method is the simplest and the binomial calculation factors in early exercise, the Black-Scholes method is the most widely used valuation method. Many web based calculators are available to assist in calculation, though consulting with a financial professional may also be prudent.

Most states deem options granted and vested during marriage as marital property. Unvested options and options granted before marriage are divided by a time rule known as the coverture fraction. In its basic form, the denominator of the coverture fraction is the total earning period and the numerator is the married years while earning the options.

Table 2 provides a coverture calculation example for an employee spouse with the following assumptions:

- July 1, 2001 – Married

- July 1, 2002 – Hired

- July 1, 2011 – 15,000 options granted for past performance and future incentive with 5 year vesting period

- July 1, 2013 – first batch of 3,000 options vests (a.k.a. 3,000 options “in flight”)

- January 1, 2014 – separated and filed for divorce

- Option grant primarily for future service

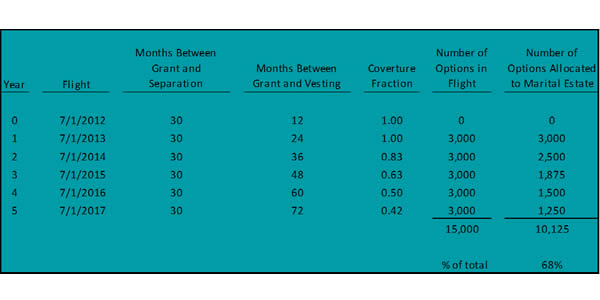

Table 2: Coverture calculation for options granted primarily for future service

When stock options are granted primarily for future service, the coverture formula divides the length of time the employee spouse was simultaneously married while contributing to earning the stock options by the length of time between grant and vest. In this example, the grant date for each flight is the same so the coverture numerator is constant at 30. A coverture result of 1.00 indicates all shares vest before the date of separation and may be considered marital property. A coverture result less than 1.00 indicates some shares are not vested before the date of separation and only a portion of the shares in flight may be allocated as marital property. The longer the time between grant and vest, the smaller the portion allocated as marital property.

In this example 10,125 (68%) of the options are marital property. The other 32% may be considered separate property and depending on the laws in your state both vested and unvested stock options could be subject to distribution.

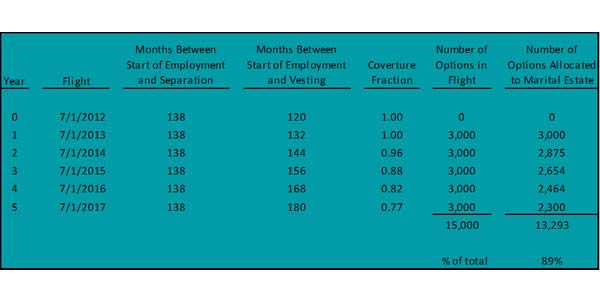

Table 3 below uses the same assumptions as Table 2 but assumes the options are granted mostly for past service. When stock options are granted primarily for past service, the coverture formula divides the length of time the employee spouse was simultaneously married while contributing to earning the stock options by the total length of employment until the options vest.

Table 3: Coverture calculation for options granted primarily for past service

Stock options are non-transferrable unless the plan allows it. Since allowance is rare the employee spouse either has to exercise the options on behalf of the non-employee spouse (in-kind division) or buy out the non-employee spouse. To divide NQSOs in kind, the unvested NQSOs remain in the employee spouse’s account until vested. Once vested, the NQSOs are split and the non-employee spouse receives their allotted shares. This will be taxable to the employee spouse. In a buyout of NQSOs, the employee spouse keeps all of the vested and unvested options. The options are valued based on an agreed upon date and the employee spouse buys out the non-employee spouse based on the current value with tax considerations.

Restricted stock is divided similarly. An in-kind division requires the employee spouse to hold the unvested stock until it is released. Once released, the stock will be split between the spouses and tax will be paid by either the employee or the employee spouse. The buyout strategy is the same as above except restricted stock is subject to forfeiture so that must be factored in.

The transaction needs to be specifically detailed in the divorce agreement or the court order. Most commonly, options are divided using coverture and valued using Black-Scholes. Each case is different, the calculations are complex and care must be taken when considering any model or formula to divide assets. This piece aims to provide insight into the difficulties discovering stock options and the ways to value and divide them if discovered. It may not be appropriate for all situations.

DISCLOSURE

Please Remember: Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Aurum Wealth Management Group LLC doing business as Marcum Wealth-“Marcum”), or any non-investment related content or recommendations, will be profitable or prove correct. Although Marcum Wealth and Marcum LLP may collaborate on presentations when appropriate, Marcum Wealth and Marcum LLP are two separate entities. Reliance on Information Provided: Marcum has relied, and will rely, upon information provided by you, and has not, and will not, verify the accuracy of any such information that you have provided. Accordingly, in the event that any such information provided is inaccurate or incomplete, the corresponding results or recommendations will be inaccurate or incomplete. It remains your responsibility to notify Marcum of any changes in the information provided. Please Note: Projection/Assumption Limitations. To the extent that any portion of the content reflects assumptions and/or projections, no such content should be construed or relied upon as an absolute probability that such an assumption or projection will prove correct or projected result will occur. To the contrary, a different result (positive or negative) can, and most likely will, occur. Materially different results could occur at any specific point in time or over any specific time period. The purpose of the projections is to provide a guideline to help determine which scenario best meets current and/or anticipated financial situations and/or objectives, with the understanding that either is subject to change, in which event the client should immediately notify Marcum so that the above analysis can be repeated. Please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in the information provide d above, including any change in your personal/financial situation for the purpose of reviewing/revising previous recommendations and/or results, or if you would like to impose, add, or to modify any reasonable restrictions to Marcum’s investment advisory services.