Alternative Investment Funds: A Guide to Your First Financial Statement Audit

By Salman Ali, CPA, Partner, West Coast Private Equity Leader

With Q3 rapidly drawing to a close, it’s prime time to cast an eye toward the 2023 year-end audits. If this marks your alternative investment fund’s audit debut, arming yourself with knowledge and organization is paramount. Far from being a mere compliance exercise, the financial statement audit can be a powerful tool to refine your financial reporting process and enhance account and entity-level controls.

Dive into these critical insights for a smooth auditing process:

Information Sharing with Auditors

GAAP Financial Statements

While your fund’s administrator will provide most of the required schedules and documentation, it falls on the investment firm if these tasks are executed in-house. Ensure your financial statement templates align with the US GAAP or IFRS as applicable. The primary guidance for alternative investment funds is the ASC Topic 946 Financial Services – Investment Companies. Lean on the annually updated AICPA’s Investment Companies – Audit and Accounting Guide and FSP Section 12,000 Checklist Supplement and Illustrative Financial Statements for Investment Companies. While this technical practice aid is not authoritative, the checklist is a helpful tool for reporting on investment funds and includes references to the applicable authoritative guidance.

Fair Valuation of Investments

Alternative investment funds are required to carry investments at fair value, based on the ASC 820 Fair Value Measurements of US GAAP. Fair value is the price received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). A fund utilizes market data or assumptions that market participants would use in pricing the investment, including assumptions about the risk inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated, or generally unobservable. A fund must use the best available data in estimating unobservable inputs when a fair value measurement cannot be developed solely based on observable inputs. Auditors will delve into the documentation supporting the fair value of investments and obtain an understanding of management’s assumptions behind the inputs.

Internal Controls

Auditors are required to understand the control environment relevant to preparing the financial statements. Having a well-documented system of internal controls will make this process efficient.

Allocations

Partners’ capital allocations, including management fees and incentive allocations, must be computed following the fund formation documents. Ensuring these schedules are set up correctly before the year-end will help avoid challenges in future periods.

Auditability

Consider the asset classes the Fund is invested in and ensure all investment transactions are supported and traceable (auditable). This is a key consideration for an alternative investment fund focused on digital assets that can be difficult to verify.

Fully Understand the Reporting and Regulatory Requirements of the Fund Structure

Different alternative investment fund structures have unique financial reporting requirements. Here are illustrations of two simplified fund structures:

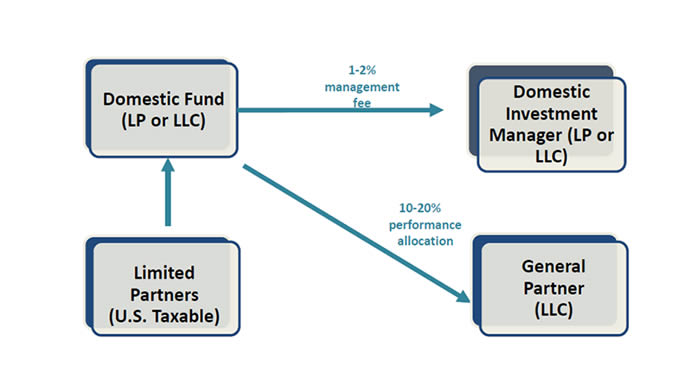

Standalone Domestic Fund Structure

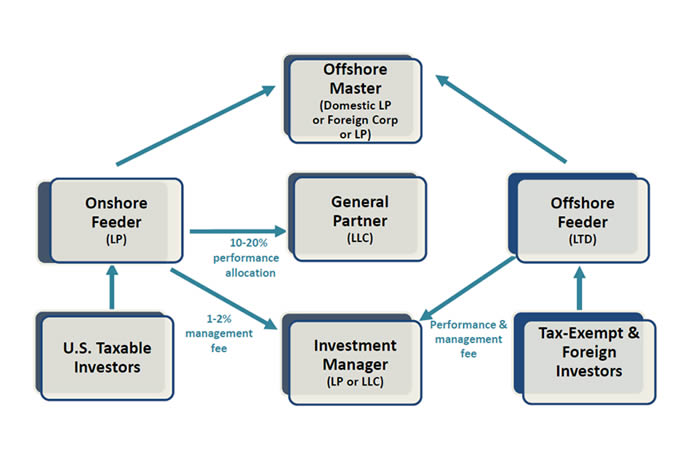

Master-Feeder Fund Structure

Master-Feeder

Contrary to standalone funds, a Master-Feeder structure mandates audits at both levels, with the feeder fund typically incorporating the master fund’s financial statements as an appendix. When the master and feeder have different year-ends, additional statements and disclosures for the master fund at the feeder’s reporting date will be necessary.

Offshore Entities

Be attentive to additional filings required by local regulators. For instance, the Cayman Islands Monetary Authority has specific Annual Return filing requirements for hedge funds and private equity funds which are due six months after the entity’s year-end.

Deadlines

Contractual or regulatory reporting deadlines generally range from 90 to 180 days after the year-end. Registered investment advisers should especially be vigilant about these. Managers registered as investment advisers with the SEC and most states will have a 120-day deadline to submit audited financial statements to their investors unless they are considered a fund of fund, which invests in other underlying funds. In that case, the deadline is extended to 180 days. Non-registered investment advisers should review their fund operating documents for any contractual reporting requirements.

Custody Rule

A new fund launch may trigger requirements to register with the SEC as a Registered Investment Advisor (RIA); hence compliance with the Custody Rule. This mandates RIAs to either undergo an annual surprise exam or obtain an annual audit.

Blockers

Consider the need for additional audits of blocker entities. It is possible certain entities within the fund structure would not require an audit depending on its ownership.

Taxes

While you are preparing for a financial statement audit, it is also advisable to coordinate the efforts with your tax preparers and be aware of the reporting requirements and deadlines to file the required tax returns and Schedule K-1s for all the entities within the fund structure.

Working with Specialists

The intricacies of the Alternative Investments sector mean a one-size-fits-all approach won’t suffice. Collaborating with industry experts can mitigate challenges and nip errors in the bud. Engage in thorough discussions with auditors, tax specialists, fund administrators, and compliance firms well before the year’s end.

Consistently presenting timely audited financial statements fortifies an asset manager’s credibility. This isn’t merely about compliance but a golden chance to amplify your fund operations and foster investor trust. Approach the audit process with preparation and proactivity to not only streamline it but also signal your unwavering dedication to stellar financial reporting and responsibility.

Marcum provides illustrative examples of financial statements for various types of alternative investment entities prepared in accordance with US GAAP. Please contact a Marcum Alternative Investment professional to address any questions.