Insights

Enhanced Disclosures and Protections: SEC’s Latest Move on SPAC IPOs and Transactions

Read More

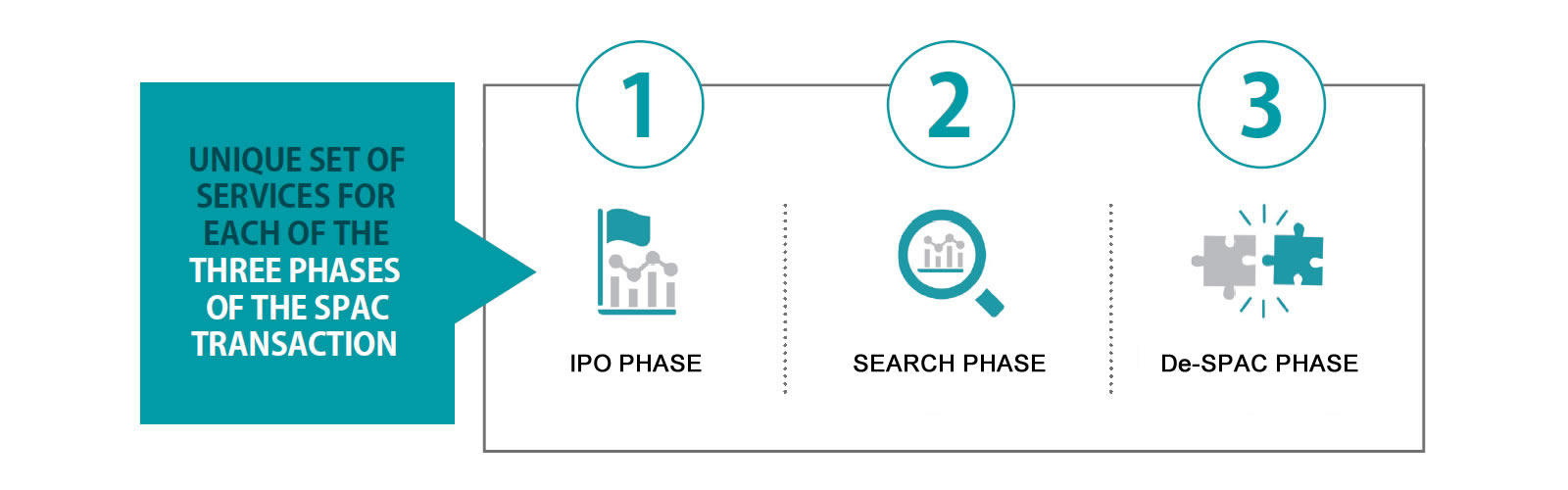

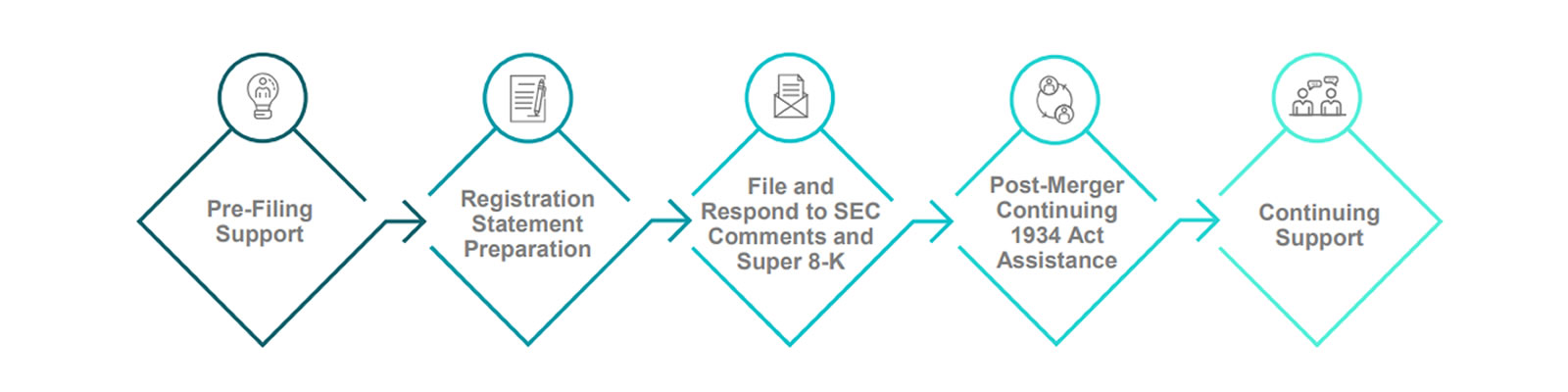

Marcum has represented issuers and worked with underwriters and targets of special purpose acquisition companies (SPACs). We have wide-ranging experience in both initial public offerings (IPOs) and subsequent business combinations entered into by such companies. This experience gives us a thorough understanding of the intricacies of the SPAC process.

Marcum LLP has extensive SEC knowledge and experience to assist you in navigating SEC rules and regulations which give rise to complex issues and questions.

| Issuer | Led Underwriter | Offering Size | IPO Date |

|---|---|---|---|

| Distoken Acquisition Corporation | I-Bankers Securities | $69,000,000 | 2023 |

| Pono Capital Three, Inc. | EF Hutton, B. Riley FBR, Westpark Securities | $115,000,000 | 2023 |

| TenX Keane Acquisition | Maxim | $66,000,000 | 2022 |

| Hudson Acquisition I Corp. | Chardan, B. Riley FBR | $68,000,000 | 2022 |

| EF Hutton Acquistion Corp. I | EF Hutton, Joseph Gunnar | $92,000,000 | 2022 |

| Hainan Mansalu Acquisition Corp. | Ladenbury Thalmann | $69,000,000 | 2022 |

| Pono Capital Two, Inc. | EF Hutton, Tiger Brokers, US Tiger Securities, Joseph Gunnar | $115,000,000 | 2022 |

| Monterey Capital Acquisition Corp. | EF Hutton, US Tiger Securities, Tiger Brokers, Joseph Gunnar | $92,000,000 | 2022 |

| Stock Symbol | Company Name | SPAC Entity |

|---|---|---|

| SMX | Security Matters | Lionheart III Corp |

| AMBI | Ambipar | HPX |

| OCS | Oculis | European Biotech Acq |

| HUBC | HUB Cyber Security Limited | Mount Rainier |

| VGAS | Verde Clean Fuels | CENAQ Energy Corp. |

| LUNR | Intuitive Machines | Inflection Point Acq Corp. |

| LNZA | LanzaTech | AMCI Acq II |

| CRGO | Freightos | Gesher I |

| MMV | MultiMetaVerse | Model Performance Acq Corp. |

| ALTI | Tiedemann Group and Alvarium Investments | Cartesian Growth Corp |

| MLEC | Moolec Science | LightJump Acquisition |

| MLGO | VIYI Algorithm | Venus Acq |

| ZVSA | ZyVersa Therapeutics | Larkspur Health |

| GETR | Getaround | InterPrivate II Acq |

| AGBA | OnePlatform Holdings Limited, TAG Asia Capital Holdings Limited | AGBA Acquisition |

| OABI | OmniAb | Avista II |

| PKBO | Peak Bio | Ignyte Acq |

| COEP | Coeptis Therapeutics | Bull Horn |

| PERF | Perfect | Provident Acquisition |

| SATX | SatixFy Communications Ltd. | Endurance Acq |

| SLNA | Selina | BOA Acq |

| SHFS | SHF Holdings | Northern Lights |

| AMPX | Amprius Technologies | Kensington Capital IV |

| NOGN | Nogin | Software Acq III |

| WEST | Westrock Coffee | Riverview Acq Corp. |

| AKLI | Akili Interactive | Social Capital Suvretta I |

| PET | Wag Labs | CHW Acq Corporation |

| QBTS | D-Wave | DPCM Capital |

| APGN | Apexigen, Inc. | Brookline Capital Acq |

| NOTE | FiscalNote | Duddell Street |

| WALD | Waldencast | Waldencast Acq Corp |

| OPAL | OPAL Fuels | ArcLight Clean Transition II |

| FAZE | FaZe Clan | B. Riley 150 |

| MOND | Mondee | ITHAX Acquisition Corp. |

| PROK | ProKidney | Social Capital Suvretta III |

Select the region to view contacts.