Insights

Seize the Opportunity: NYC’s Biotechnology Tax Credit Back in Action

Read More

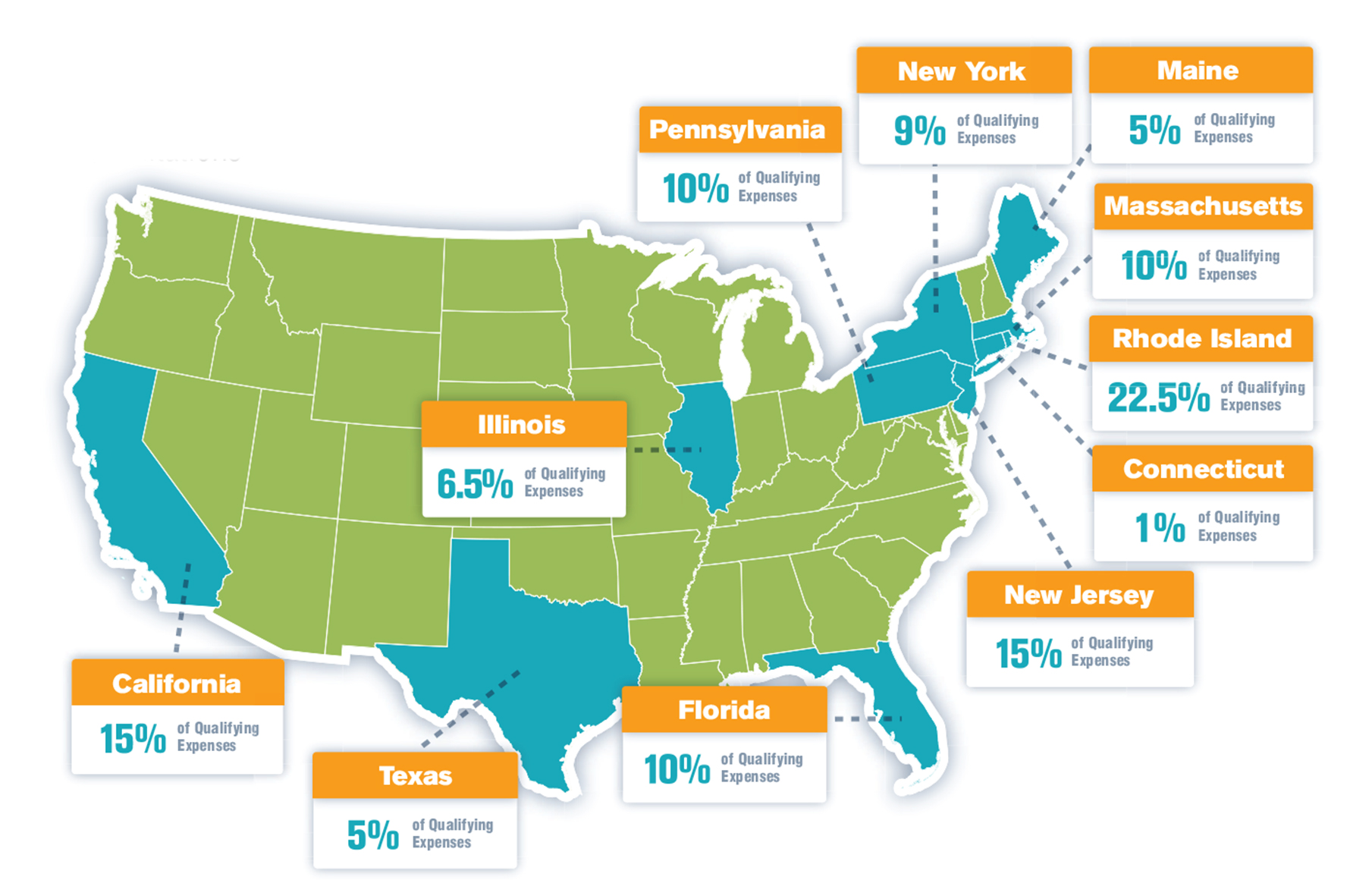

The Research and Development Tax Credit is often overlooked, but it can provide enormous benefits to companies that recognize its potential. Typically, organizations claim less tax benefit than they’re entitled to or, even worse, believe they don’t qualify because research and development isn’t their main business. In addition to the federal tax credits, many states have enacted generous credit programs, and some are refundable even if you haven’t paid taxes.

Marcum has helped our clients save more than $200 million using the Research & Development Tax Credit.

*States have unique qualifying limitations.

Select the region to view contacts.