Dental Management Services

Dental practices face complex organizational, business and financial decisions every day.

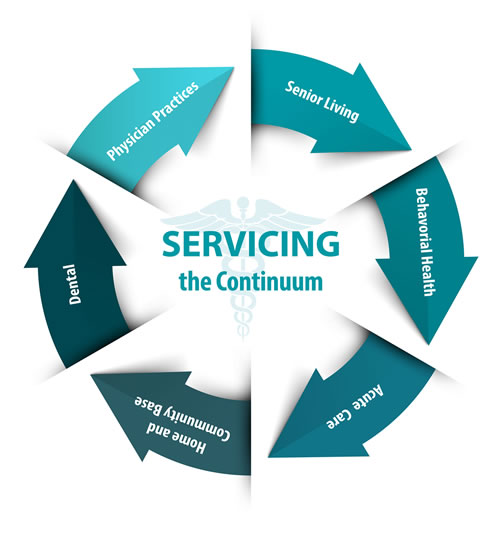

Marcum’s experience in the healthcare industry covers the full continuum of care, with a special focus on the post-acute care geriatric services, hospitals, and physician practices.

We go beyond providing traditional audit and tax services and truly understand the clinical, regulatory, reimbursement, and operational challenges facing today’s healthcare industry.

To best serve our clients, we have assembled a team of professionals dedicated to meeting the specialized needs of healthcare companies and nonprofit organizations, and providing resources to help them succeed in their businesses.

The 2024 Marcum Three-Year Nursing Home Statistical Review includes a deep dive into the distinct stages of the pandemic – the pre-COVID environment, the heart of COVID, and then what some might call the beginning of COVID recovery.

Nonprofit Trade Association Seeks More Reliable Financial Reporting and Greater Efficiencies

Expediting Medicare/Medicaid Enrollment during Change of Ownership at Nursing Homes

Nursing Home Responds to Claims of Negligence

Federal, state and third party reimbursement represents the overwhelming majority of payments received by the provider community. Marcum has made it our business to maintain a detailed understanding of the changing reimbursement landscape, both on a national and regional level. Through the Firm, we continue to assist the provider community in such area as:

The keys to success in today’s ever-changing marketplace are based upon a clear understanding of how the evolving landscape impacts a provider’s operations. Our team of professionals assists the provider community by offering specialized services such as:

Documentation is the key to payment for healthcare providers. Insufficient or non-existent documentation can result in loss of cash flow. Marcum’s clinical staff, which currently includes 3 RNs and an AHIMA-approved ICD-10 trainer, can review medical documentation on-site or remotely to ensure that there is supportive documentation for Medicare and Medicaid reimbursement, that staff is in compliance with federal and state guidelines, and that staff members understand their role in state on-site surveys. In addition, we can assist you with:

Our healthcare services extend to two specialty areas – avoiding anti-kickback and fraud and abuse issues by determining appropriate fair market value in transactions that include referrals, and in providing forensic accounting and litigation support in civil and criminal matters relating to various healthcare issues. These often include accusations of fraud and abuse, false claims and disputes between healthcare entities regarding value or properly handling various billing and collection-related services.

Understanding the unique intricacies of healthcare requires a highly specialized team of professionals beyond a traditional accounting. Marcum’s dedicated Healthcare Assurance team truly understands the details of today’s provider community and, on a regular basis, provides the following services:

The provider community is made up of both for profit/nonprofit operators with often time complex tax structures. Marcum’s Healthcare tax team not only understands the uniqueness of the industry and regularly assists providers, owners, board and managers through challenging situations including: