Budding Headaches – What Challenges Await Massachusetts’s Cannabis Businesses in 2023?

By Rudaba Ahmed, Staff Accountant, Assurance Services

Six years ago, on November 8, 2016, Massachusetts voters approved taxing and regulating marijuana purchases similarly to alcohol. Since then, the cannabis industry has grown dramatically with the help of investors and public support. Since the beginning, the market has faced challenges due to high regulation and the costs that come with. The onset of COVID-19 surprisingly became its saving grace. As we continue to recover from the pandemic in the coming year, what challenges can we expect to be faced in this nascent industry?

The Cannabis industry has had its ups and downs over the past 3 years; Initially, in 2020, we saw the historic boom in cannabis sales and jobs, with people in lockdown with not much to do and the bonus of government stimulus money being possible motivators. However, as the pandemic began subsiding in the summer of 2021, we began to see a decline in legal cannabis sales, increased prices, cash shortages, staff layoffs, and increased debt to support operations. More recently in 2022, over-supply in the market led to falling prices nationally, coupled with inflationary pressures which increased costs to producers. Further, this may be regarded as more of a correction from the pandemic’s record-breaking sales, than a true decrease in demand for cannabis products.1 Regardless of its profitability, over the past years there continued to be efforts on both federal and state levels to push forward the industry. Progress on the SAFE, MORE, and CAOA acts, three additional states legalizing adult-use cannabis, and around a total of $1.42 billion2 in revenue from Massachusetts adult-use sales in 2022 (9% increase from 2021) were areas we saw growth despite the challenges.

These same challenges will likely continue into 2023, as many of the efforts in the past year are still pending. Here are some key takeaways from cannabis reform and what we can expect in the upcoming year:

1. CAOA Act

The Cannabis Administration and Opportunity Act, co-sponsored by Senate Majority Leader Chuck Schumer, was introduced to Senate in July 2022. Although not passed yet, the bill will decriminalize and de-schedule cannabis, expunge certain cannabis offenses, advance medical research, and allow cannabis companies access to financial services, including bank accounts and loans. As Senate has reviewed it twice and referred it to the Committee on Finance, we can expect it to be considered in 2023.

2. Banking Restrictions & the SAFE Act

If passed, the Secure and Fair Enforcement Banking Act would prohibit federal regulators from penalizing financial institutions for providing services to state-legal cannabis-related businesses. It has passed the House seven times, most recently in June 2022, but has yet to make it through Senate. This would be instrumental for businesses as Congress has yet to lift federal banking restrictions on cannabis companies, limiting their access to capital. Further, as investors continue to tighten their investments fearing a recession, access to capital is more crucial now than ever.

3. MORE Act

Passed in April of 2022, this bill removed Cannabis from the Controlled Substances Act and decriminalized its possession, manufacturing, and distribution. Further, it called for the demographic data on cannabis business owners and employees to be published regularly by the Bureau of Labor Statistics. It further introduced and encouraged Small Business Administration loans and services, as well as many other changes to encourage cannabis research, education, and safety.3

4. Cannabis Research Bill

In December 2022, President Biden officially signed the Marijuana Research Bill4, which was the first piece of federal pro-cannabis legislation in U.S. history. The law will now allow the production, distribution, and possession of Cannabis for medical research purposes, prohibit the Department of Health and Human Services from investigating routine marijuana research, and allow physicians to discuss the drug with their patients. As we are still early into the year of 2023, we can expect this law to bring forth a lot more clarity on the drug, which if positive, will push many pending legislations to the forefront. In 2022, the administration also pardoned federal offenses of simple marijuana possession and reviewed cannabis’s classification under federal law around the same time. Congress further enacted the Medical Marijuana and Cannabidiol Research Expansion Act. Given this, we expect 2023 to be a year of research, which could be a decisive factor in getting cannabis de-scheduled and loosening government restrictions.

5. An Act Relative to Equity in the Cannabis Industry

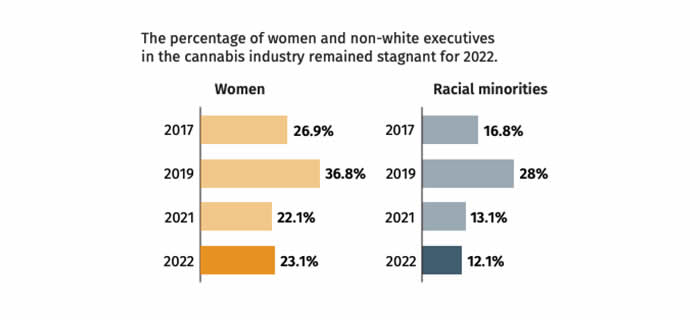

Former Governor Charlie Baker signed a package of various reforms in August 2022. Chapter 180 of the Act5 brought forth significant changes in Massachusetts cannabis law allowing “social consumption” venues, also known as Cannabis Cafes’, which would be bar-like spaces for marijuana use. The same law also promises to dedicate 15% of adult-use excise tax proceeds to entrepreneurs from diverse and disenfranchised communities. In January of 2023, the city of Cambridge took steps following this law to promote equity in the industry and passed a municipal code requiring companies hire 51% of minority, women and/or veterans as employees and on their board if they wish to obtain a Cannabis Business Permit.6 There has also been a push for equity and minority representation in the industry from a national front. However, not much progress has been made there as noted in the figure below, with minority representation remaining stagnant in 2022.

Source: MJBizDaily

6. Marijuana 1-to-3 Act

In 2023, we have started to see support from both republican and democratic political parties to reschedule cannabis. Rep. Greg Steube (R-FL) has refiled a bill to move marijuana from Schedule 1 to the less restrictive Schedule 3 drug under federal law.7 Previously in 2019, he expressed his support for extending research:

As marijuana is legalized for medical and recreational use across the United States, we must study the effects of the substance and the potential impacts it can have on various populations. By rescheduling marijuana from a schedule 1 controlled substance to a schedule 3 controlled substance, the opportunities for research and study are drastically expanded.

There seems to be validity in Rep. Steube’s positive outlook as we can expect growing research in cannabis-related life science and biotech sectors to create more investment opportunities, identify innovative solutions, increase job opportunities, and eventually lead to majority acceptance of the industry.

7. M&A

After a successful year in 2021, cannabis investments began to slow down in 2022, with total mergers and acquisitions decreasing by 62% nationally, compared to 2021. According to Viridian Capital Advisors, there was also a 39% decrease in transactions from 2021.8 This low period of investments was most likely due to rising interest rates and low cannabis stock prices, making deals more expensive. However, in 2023 we can expect to see more investment activity, especially within small and mid-size companies as estimated by legal and financial experts alike.9 Viridian, a cannabis advisory firm for example, is anticipating a capital market slowdown which they believe will give management service organizations (MSO’s) an incentive to acquire struggling companies as a more cost-efficient means of growing their business and entering a new market.

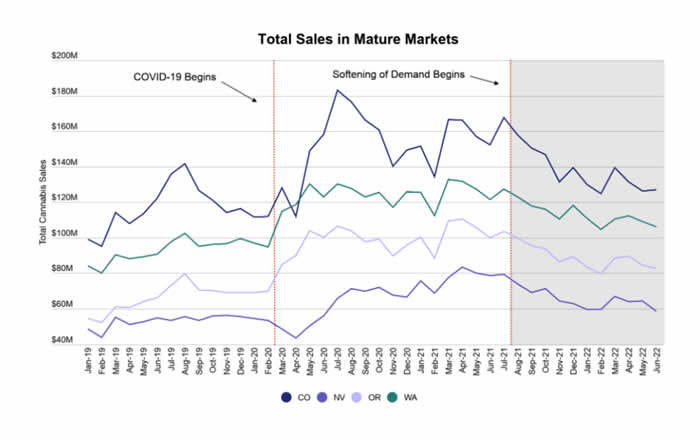

8. Inflation

As inflation steadily rises, we would expect it to lead to higher production and product costs, causing rising prices. However, the opposite seems to have occurred thus far, with retail prices nationally decreasing 20% from Q3 2021 compared to Q3 2022, as illustrated in the figure below.10 This decrease has been reflected especially in mature markets, with a decreased demand compared to pandemic times and increased competition leading to lower prices, and profit margins. In an economy where everything is getting more expensive, cannabis prices will be one less worry for its consumers. As such, we can expect demand to stay consistent, and can attribute any decreases to a correction of the pandemic’s high cannabis performance. On the other hand, although prices are decreasing, costs are not, leaving businesses in a cash crunch. Moreover, as interest rates continue to rise, lenders are becoming more cautious about their investments, adding on to the difficulty for cannabis businesses to secure funding for operations and expansion in 2023. Karson Humiston, Founder & CEO of Vangst, a cannabis job-searching platform, noted this challenge as one the industry is already ready for, “Due to federal regulations, access to capital has always been tough for cannabis businesses. Since most companies have never had the luxury of unlimited capital, cannabis has always been a scrappy industry — one that has been primed to be more prepared than any other industry should we enter a recession.” 11 Following her note, we can expect larger companies to have an upper hand in this situation as they tend to have better funding, strategy and resources to perform better in the case of a crisis.

Source: Headset

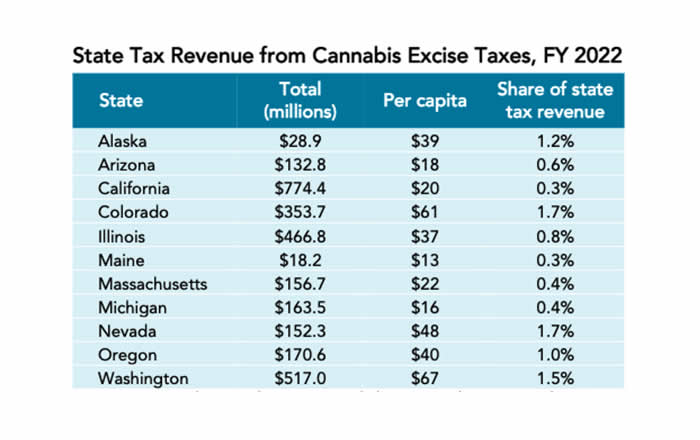

9. Taxation

The cannabis reform bill signed by former governor Charlie Baker (discussed above) also decoupled Massachusetts from the internal revenue code section 280E, which was a relief for many operators. The federal regulation prevented businesses engaged in the trafficking of Schedule 1 and 2 controlled substances from deducting business expenses on their state income tax returns (see eligible deductions in this article). Moreover, sales revenue has increased from the year before, with a total levy of around $156.7 million tallied for the year 2022 as noted in the figure below12 (not including local excise tax or general sales tax revenue). Most of that tax income funds public organizations such as the state Bureau of Substance Addiction Services, Cannabis Control Commission’s oversight of the industry, and a fraction to the Department of Agricultural Resources. As Springfield City Council President Jesse Lederman noted on the benefit of taxing Cannabis:

It’s exciting to think about the amount of money that can really be poured back into the community that was once negatively impacted by the same plant, and now leverage it in a positive way, that’s what funds the majority of the city’s core services, so the DPW, the parks department, infrastructure and emergency services.

Since we decoupled from 280E only in August of 2022, and the MA tax benefits are undeniable, we can expect taxes for this industry to stay stagnant in 2023 with no plans of reduction.

Source: Urban Institute

10. Driver’s Ed

As of January 2023, the Registry of Motor Vehicles (RMV), in collaboration with the Cannabis Control Commission (CCC) announced a new cannabis component to the driver’s education classes. The American Automobile Association (AAA) curriculum will focus on educating teens and drivers on the risks of cannabis-impaired driving, which has been a longstanding concern amongst parents. Implementing this risk-mitigating course can increase the overall acceptance of cannabis and help manage concerns surrounding its increased use. Its inclusion into regular driving courses, alongside other regularly used substances, is definitely an indication of its normalization.

11. Curbside Pick-ups

Curbside pick-ups for medical cannabis were first introduced due to COVID-19. It sought to alleviate issues with accessibility during the pandemic. Earlier this year, the CCC decided to extend the policy until February 2023, which now has been extended to the end of 2023.13 According to CCC’s Commission Executive Director Shawn Collins, an average of 80% of all initial Healthcare visits for medical marijuana first-time patients were conducted via telehealth.14 The continued extension of curbside pick-ups as well as virtual medical visits for new patients will benefit new entrants in the market who are hesitant to visit a retail location. It will also allow current consumers the flexibility and ease to purchase products.

12. Oversaturation of Market & Other challenges

With the market’s oversaturation of supply, sales and prices are decreasing while inventory is building up, like a traditional commodity market. Further, cannabis businesses have other regulations to worry about, for example, having to grow the plant in the same state and spending ample funding on child-safe packaging to ensure it meets federal guidelines. These are all challenges cannabis business operators, and owners have continued to face and are unlikely to change in 2023. As such, in the short-term, businesses will have to restructure or exit, while in the long-term, when the economy stabilizes, with more spendable dollars the quality of products will improve, and the industry will benefit from the experience of navigating through a myriad of regulations and tumultuous financial times.

13. Leadership

Cannabis reform, like all change, is heavily dependent on the public and those who are in positions to legally represent them. Our newly elected governor, Maura Healey, was previously opposed to the legalization of adult-use marijuana and is a former attorney general. She also signs the budget of the CCC and appoints 3/5 of its officers. As such, it’s reasonable to expect her outlook of the industry to be a little more conservative and cautious than her counterparts. On the other hand, State Sen. Elizabeth Warren has previously supported legalization and campaigned for a “Just and Equitable Cannabis Industry” in 2020 as a presidential candidate. While the industry may have her support in advancing, she may not have the time to prioritize cannabis reform in the current atmosphere. Lastly, the chair of the CCC, Shannon O’Brien, has a longstanding history in politics and experience tackling the cannabis industry (formerly Co-owner of Greenfield Greenery). Hence, we can expect her to carry quite a bit of insight and raise awareness of the hurdles operators face. With all state level key players considered; we can assume regulations to remain consistent at the very least in 2023.

Final Thoughts

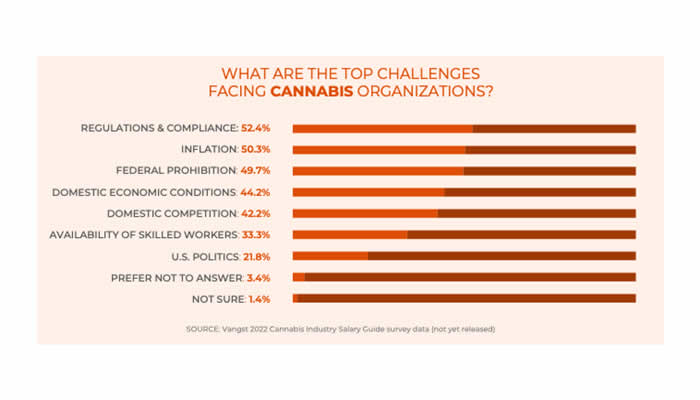

Based on the passed and pending legislation, we can expect to revisit very similar challenges from the prior year in 2023; same regulations and restrictions, increasing debt, expensive cost of capital, rising costs and falling prices. Further, Vangst’s report on the state of the cannabis economy from the perspective of cannabis business owners has arrived at the same conclusions, with regulation and compliance being their top challenge, followed by inflation, and federal prohibition. While we can expect this to take a bigger toll on smaller businesses, larger franchisers will have to strategize how to overcome increasing expenses and decreasing investments to preserve cash. On a brighter note, all the fruitful efforts from past years will begin to realize in the current year, allowing us to see the impact of new research, cannabis education, and marketing on the growth of a still-young industry.

Source: Vangst

Sources

- https://www.headset.io/industry-reports/an-analysis-of-declining-growth-in-recent-us-cannabis-sales

- https://masscannabiscontrol.com/open-data/sales-and-product-distribution/

- https://www.congress.gov/bill/117th-congress/house-bill/3617

- https://www.congress.gov/bill/117th-congress/house-bill/8454

- https://malegislature.gov/Laws/SessionLaws/Acts/2022/Chapter180

- https://plus.lexis.com/api/permalink/0a462b7d-326c-4ea8-ac03-0745fe632981/?context=1530671

- https://www.congress.gov/bill/118thcongress/housebill/610/text?s=1&r=15&q=%7B%22search%22%3A%5B%22steube%22%5D%7D

- https://www.viridianca.com/

- https://www.greenmarketreport.com/perfect-storm-for-cannabis-ma-in-2023/

- https://www.cannabisproductsinsider.com/articles/127700-bdsa-retail-cannabis-prices-drop-from-2021#:~:text=Across%20BDSA%2Dtracked%20adult%2Duse,across%20that%20same%20time%20period

- https://assets.vangst.com/reports/2022-q4-white-paper-economic-outlook.pdf

- https://www.taxpolicycenter.org/publications/pros-and-cons-cannabis-taxes/full

- https://masscannabiscontrol.com/2023/02/administrative-order-allowing-curbside-operations-for-medical-marijuana-treatment-centers-february-2023/

- https://masscannabiscontrol.com/2023/02/cannabis-control-commission-votes-to-extend-several-covid-19-orders/