There is a lot going on in the U.S. economy and financial markets. We boiled it down to four charts of interest to us today.

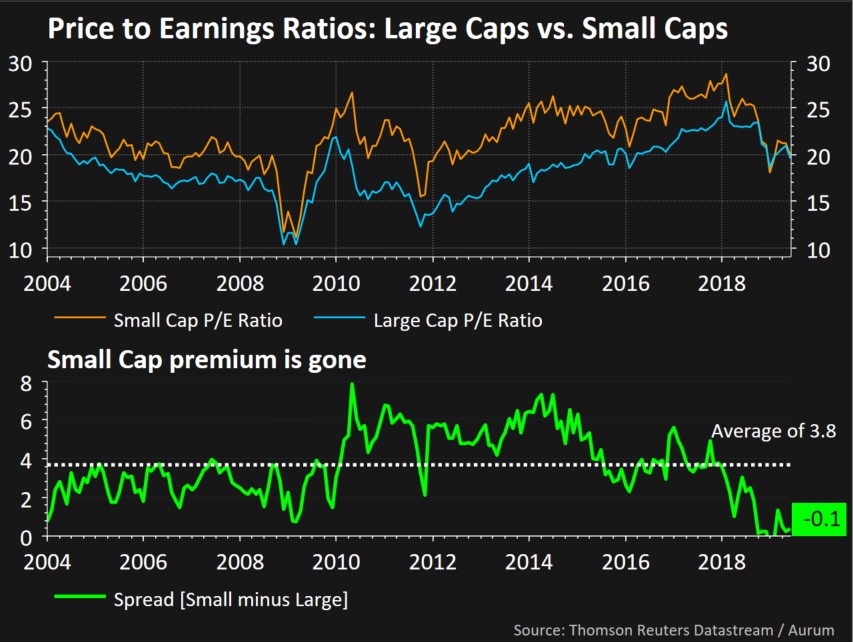

Over the last 15 years, small cap stocks traded at a premium to large caps. This has generally been the case throughout history, as smaller companies can grow earnings faster and thus deserve a premium price-to-earnings ratio. The exception was the tech bubble in the late 90s and early 2000s when the mania gave large caps a huge premium to small caps. The spread for the last 15 years has averaged about 4 points, but today its at zero. Investors do not have to pay a premium to own U.S. small caps for the first time in a long time. Small caps really traded richly from 2014 through most of 2018 and finally look more reasonably priced.

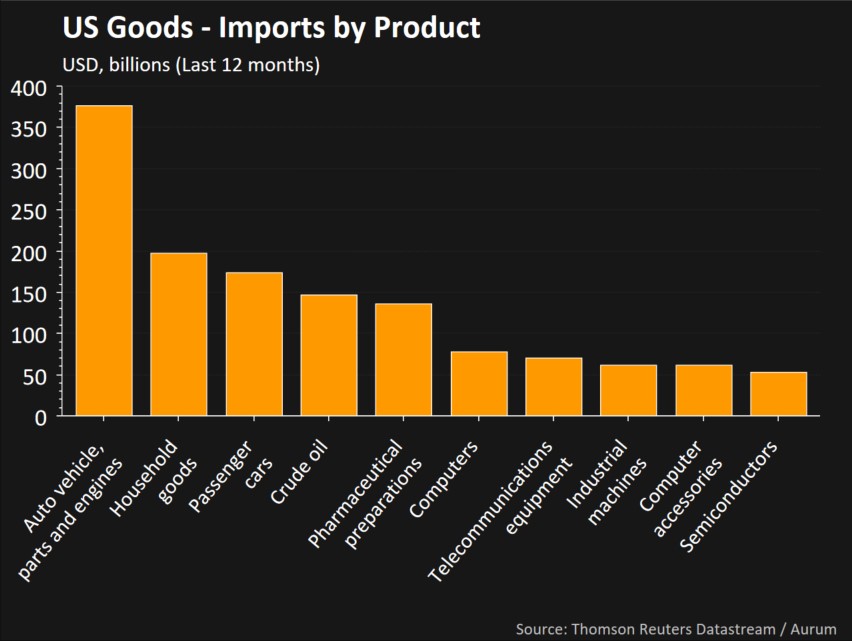

Here are the top ten import categories for goods into the U.S. Interestingly, automobile related categories make up two of the top ten and 40% of the total value of imports on this list at $550 billion. The list is relevant with the phrase ‘trade war’ sticking around for the last 16 months. It seems to be with us for a secular time frame as a core of this administration’s strategy.

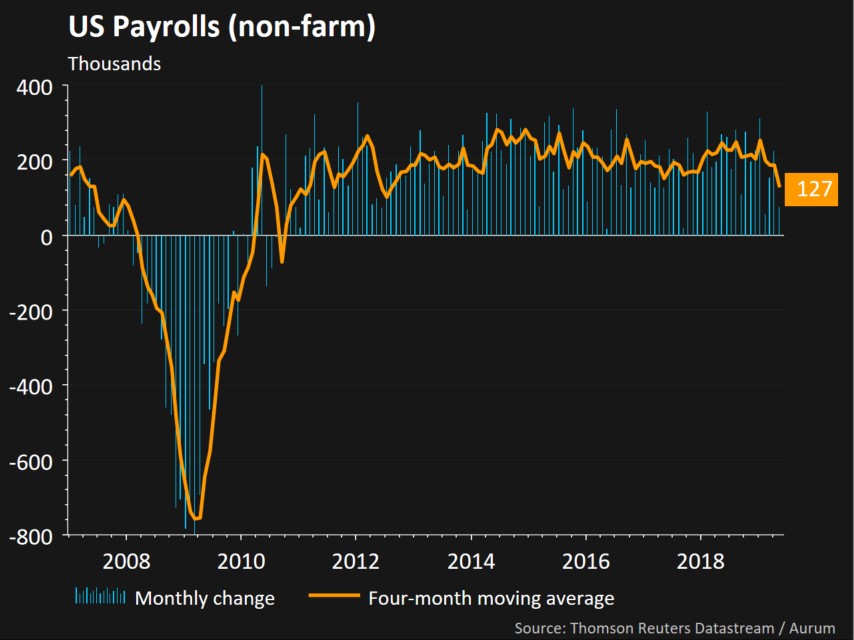

In two of the last four the four months, U.S. payrolls increased by less than 100,000. This is the lowest four-month moving average in job growth in seven years. The 100k to 150k level is a magic level because that’s what economists estimate the U.S. needs just to generate just to keep up with the growing demographic of job seekers. Is this a blip or a sign of a change in trend?

<

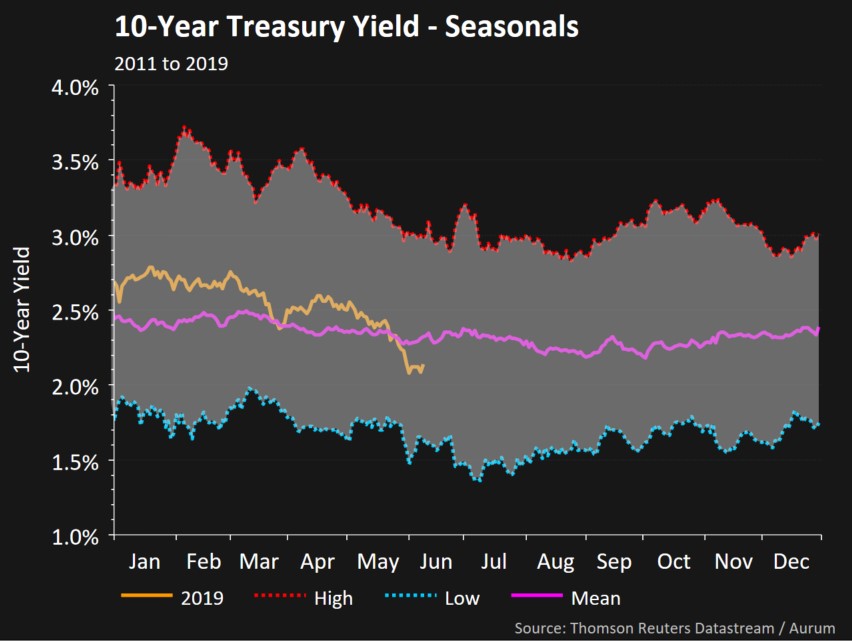

<Below we have a seasonal chart of the ten-year treasury yield. It takes the previous years since 2011 and shows the highest level reached on a given day, along with the lowest and average. So far, the fall of the 10-year Treasury yield in 2019 was 70 basis points. The yield went from 2.78% to 2.08%, which hardly anyone expected. The speed and magnitude of the change in yield could mean that we have seen the bulk of the move year-to-date.

The other amazing thing about the above chart is how interest rates over the past 9 years have been in a range of roughly 1.5% to 3.5%. Despite the calls about ‘printing money’ and runaway inflation, these forecasts were simply wrong.

Questions about this blog? Contact Michael McKeown at 440-449-6900 or email Michael.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth-“Marcum”), or any non-investment related content, made reference to directly or indirectly in this tweet will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this tweet serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. Please remember that if you are an Marcum client, it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Marcum is neither a law firm nor a certified public accounting firm and no portion of the tweet content should be construed as legal or accounting advice. A copy of Marcum’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please note that Marcum does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Marcum’s web site or tweet or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.