Decoding Economic Trends: Insights from Our Speaker’s Presentation

By Matt McCormack, Manager, Client Accounting & Advisory Services

At the September 21, 2023, New England Life Science & Biotech Summit, presented by Marcum LLP and the CBIA, Janney Montgomery Scott’s Mark Luschini, Chief Investment Strategist, and David Reed, Managing Director – Investment Banking, provided an economic overview and outlook of the fundraising environment for life science and biotech companies. The presenters provided an optimistic outlook for the future of the industry.

For now, the canary is quiet

In the near term, it appears recession risks have receded. Mark Luschini pointed to several factors that demonstrate the continued resiliency of the U.S. economy, including:

- High-frequency data from the Atlanta Fed’s GDPNow estimate had an Q3 estimate of 4.9% which was well above the “Blue Chip” consensus of 1.5% to 4%.

- The GDPNow estimate proved right as GDP increased at an annual rate of 4.9% in Q3.1

- Household net worth remains robust. The ratio of household debt to disposable income is in decline. While there has been some whittling down on the excess savings peak in 2020, consumer strength will continue to bolster many sectors.

- A cooling, but still growing labor market.

- The claim was validated in the Bureau of Labor Statistics January 2024 jobs report with an unemployment rate at the end of 2023 of 3.7%2, up marginally from 3.4% at the beginning of the year.

Mark’s expertise prepared attendees for the strong performance through the remainder of calendar year 2023. His insights proved prescient as interest rates began to stabilize, and the S&P rallied 11.7% in Q4.

The road ahead for life science and biotech organizations

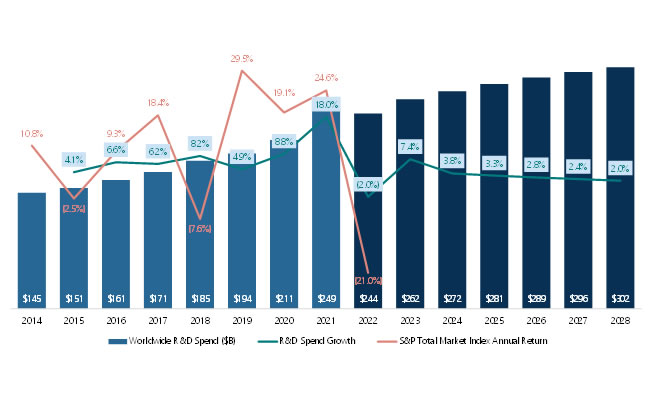

While the U.S. economy on the whole faces several potential stumbling blocks, David Reed expressed optimism specific to the life science and biotech industry. Reed specifically noted the forecasted growth in global research and development spending, which after a year-over-year decrease in 2022 is expected to increase by 7.4% during 2023 and remain positive through 2028:

Source: Janney Montgomery Scott presentation, New England Life Science & Biotech Summit, presented by Marcum and CBIA

Reed highlighted the upcoming “patent cliff” as a tailwind expected to bolster research and development spending. This term describes the potential decline in revenues upon patent expiration, which allows for greater competition and necessitates price concessions. Earlier this year, BioPharma Dive noted that at least $200 billion in current annual revenues are coming up against the “patent cliff” risk through 20303. Facing the risk of potential lost revenues and margin compression, the industry’s key players will be forced to spend, either by adding new products to their portfolio or seeking to reinforce existing positions through increased sales and marketing efforts.

Ready, set, don’t go?

With the U.S. economy proving more resilient than expected, many experts believe a new IPO window will reopen in 2024. With the market having, at least for now, staved off interest rate and inflation fears of “higher for longer,” it seems more of a question of “when” and not “if.”

The state of the IPO window can fluctuate significantly based on a variety of market conditions, and these shifts can happen rapidly, affecting the plans and valuations of companies looking to launch an IPO. When the next IPO window does open, the overall IPO process is unlikely to resemble the halcyon days of just two years ago. Companies should carefully contemplate their plan and timeline to go public, including considerations such as:

- Increased time to first trade – the unprecedented SPAC boom in 2020 and 2021 was quickly followed by underperformance of many of the high-profile SPAC names. Moving forward, bookrunners will seek to de-risk transactions, driving appetite away from SPACs and towards traditional IPO’s. This will likely necessitate increased time and investment in pre-launch “road show” activities as companies seek to drum up interest.

- Weakened deal economics – in a softer market, investors will require deals with friendlier terms. The result – smaller deal sizes and larger underwriting discounts. Accordingly, companies should temper expectations about the overall funds that can be raised through a public offering.

- A shift away from “growth at all costs” – in a zero-interest rate environment, companies were incentivized to over-hire to build revenues and justify lofty valuations. Investors will demand greater profitability, or at a minimum a path to profitability, as we continue moving towards a more risk-averse environment.

While no one can be certain when or for how long the next IPO window will be open, companies must begin the preparation process now. Waiting for clear signs will only leave companies waiting on the sidelines. Regardless of where you are on the project timeline, Marcum is the right choice to guide you through your IPO process. Without the right team, the path to becoming a publicly traded company can be arduous. We’ve helped many complete the journey successfully.

Sources

- https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and-gdp

- https://www.bls.gov/news.release/empsit.nr0.htm

- https://www.biopharmadive.com/news/pharma-patent-cliff-biologic-drugs-humira-keytruda/642660/