Financial planning and analysis relies heavily on estimations and educated guess work to determine future returns and values. It has long been the case that historical returns were thought to be more accurate and a better indicator of future results. However, recently the tide has shifted towards using projected, go-forward returns. Building projected returns is a more nuanced, intuitive, and quantifiable way to look at future return and cash flow projections.

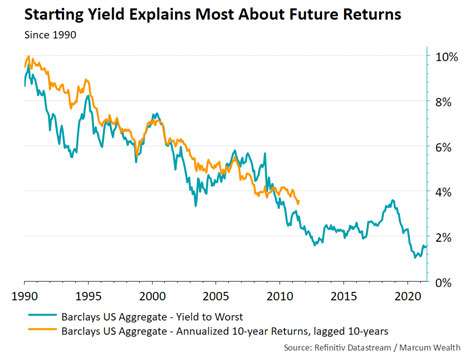

The basis for any go-forward return projection starts with the fixed income portion of the allocation. The reason to start here is straightforward. Financial analysis tools have specific metrics that let us easily quantify return expectations for this part of the portfolio. The yield to worst of a fixed income portfolio is a strong indicator of the future return of bonds over a target period of time (see chart below). This allows us to have a tangible, measurable value to build out our projected return assumption.

Of course, using today’s yield to worst is a forward-focused metric. If one were to use historical returns on fixed income, 6% or 7% as a baseline would not be out of the question. However, in order for current bond yields to rise, interest rates, in theory, would have to fall. If current yields are at 2%, and the interest rate is at 0%, getting to 6% fixed income returns is extremely hard! From current levels interest rates would have to go significantly negative. This is certainly possible, but low probability outcomes are not a useful tool for financial planning or divorce reasonable-rate-of-return calculations.

Once a baseline is established, most financial research has shown that equities or stocks provide a 5-6% return premium over fixed income over time. For a 3% return baseline in bonds, it is reasonable to assume an 8-9% return in the equity portion of the portfolio. The higher volatility of equities over fixed income is the price paid for the return premium. Even still, 6% is a historically low number; over the period 1991-2020, equities returned over 10% per year. However, it is also important to calculate an attainable and reasonable value when projecting equities. Importantly, this risk premium is fluid and must be revisited at least annually.

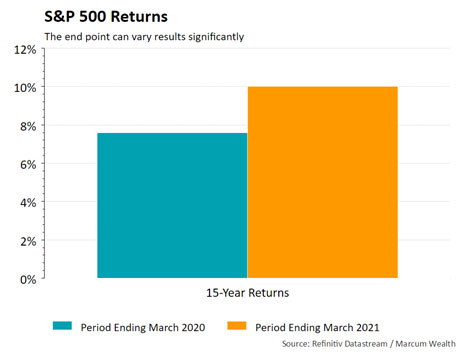

The following numbers help to illustrate how historical returns can be manipulated and misused. Using the S&P 500 as a proxy for U.S. equity returns, we can see large discrepancies from year to year.

One year of data can have an outsized effect on any calculation. Note that the only change in the prior data set is a shift from when the 15-year period starts, from March 2020 to March 2021. 15-year historical returns differ by 2.44% in the S&P 500 over the course of only one year! Which is the correct data set to use, and which is more honest? This choice can have major implications for client cash flows and asset valuations as it compounds over the course of a lifetime. When merely changing the date can have such a large effect, this only adds to the argument for utilizing projected returns.

During the financial planning process, forward-looking return projections are the standard. While we cannot 100% accurately make specific point estimates, using projected returns is the standard set with clients. Using historical returns takes away the ability to both dynamically shift expectations and present conditions, as well as review new and current research. Overestimating returns by looking at past fixed income windows, or expecting ballooning equity returns, can have catastrophic effects on financial success. In fact, if firms currently use historical return data to run their financial calculations, they are in the minority. Most peers use projected returns.

In summary, build projected returns from the ground up. Use a baseline fixed income projection, then build in an equity premium. We believe that using projected returns is in the best interest of the client, and as financial planners it is our moral and ethical duty to do what is right by the client. Firms still using historical returns may be late to the game.

Important Disclosure Information

Please Remember: Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Marcum Wealth-“Marcum”), or any non-investment related content or recommendations, will be profitable or prove correct. Although Marcum Wealth and Marcum LLP may collaborate on presentations when appropriate, Marcum Wealth and Marcum LLP are two separate entities. Reliance on Information Provided: Marcum has relied, and will rely, upon information provided by you, and has not, and will not, verify the accuracy of any such information that you have provided. Accordingly, in the event that any such information provided is inaccurate or incomplete, the corresponding results or recommendations will be inaccurate or incomplete. It remains your responsibility to notify Marcum of any changes in the information provided. Please Note: Projection/Assumption Limitations. To the extent that any portion of the content reflects assumptions and/or projections, no such content should be construed or relied upon as an absolute probability that such an assumption or projection will prove correct or projected result will occur. To the contrary, a different result (positive or negative) can, and most likely will, occur. Materially different results could occur at any specific point in time or over any specific time period. The purpose of the projections is to provide a guideline to help determine which scenario best meets current and/or anticipated financial situations and/or objectives, with the understanding that either is subject to change, in which event the client should immediately notify Marcum so that the above analysis can be repeated. Please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in the information provide d above, including any change in your personal/financial situation for the purpose of reviewing/revising previous recommendations and/or results, or if you would like to impose, add, or to modify any reasonable restrictions to Marcum’s investment advisory services.