Why Do We Love Round Numbers?

By Michael McKeown, CFA, CPA, Chief Investment Officer, Marcum Wealth

As the stock market pushes to new highs, the Dow Jones Industrial Average Index is nearing a level it never breached before – 20,000. Financial news anchors are downright giddy (so we hear, watching too much CNBC can rot your eyes).

There is something satisfying about round numbers. Per a News Works article, SAT takers are more likely to retake the test if they fall just short of a round number. Major League baseball players are four times as likely to end the season with a .300 batting average than .299.

It is how we talk about age, being in our 30s, 40s or 50s. It is how we think about numbers all the time. So why this obsession with round numbers and the base of 10 number system?

According to Eugenia Cheng, a scientist at the School of the Art Institute of Chicago, “It’s very intimately linked to the fact we have 10 fingers.” Experts agree that the evolutionary accident of humans having ten fingers for counting drives our obsession with a base-10 number system. Why do we have ten fingers (and ten toes)? One theory is the Limb Law, which states that based on the length of the limbs (arm), animals develop an optimal number of further limbs (in this case, fingers). Based on the size and length of human arms, five fingers on each hand turns out to be optimal.

We fixate on round numbers due to our own selves. And this is partly why we care about Dow 20,000.

The Dow Jones Industrial Average is a price-based index. The price of all the stocks are added together to come up with the Dow’s price. The actual size of the company does not matter, the dollar value of the stock price is what is important. This makes it an imperfect measure of stock market performance.

As an investor, most important is the percentage move of an index, not the dollar-based price move.

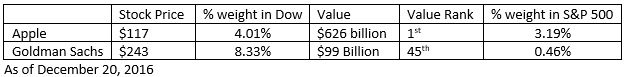

Let’s show why this matters. Goldman Sachs’ stock price is $243. It is the highest price stock of the 30 companies in the Dow Jones Industrial Average. Thus, it is the largest percentage weight of the index at 8.33%. Yet, it is not the largest company by market value (at $99 billion) in the U.S. That honor goes to Apple whose value is $626 billion. Goldman Sachs is the 45th largest company by market value. The S&P 500 is an index based on market value. Within the S&P 500, Goldman Sachs has a weight of 0.46%, or less than half a percent. It is 18 times larger in the Dow Jones Industrial Average and its daily changes affect it that much more. This is significant because the S&P 500 is the most popular index and most tracked by mutual funds and exchange-traded funds (ETFs).

There are other ways to consider the significance of reaching milestones or all-time highs in the stock market. One could inflation adjust the index by dividing by the consumer price index to get a ‘real’ value of the stock market. Alternatively, most quoted price indices exclude dividends, which is not really a true representation of the experience of a ‘buy and hold’ investor. Looking at a ‘total return’ would be more accurate.

Setting new highs means equity portfolio values are also setting new high-water marks. The nostalgia of passing the round numbers also holds some significance. People remember the ill-timed book Dow 40,000, published in 1999 during the midst of the tech bubble. Finally, 17 years later and flirting with Dow 20,000, we are half way there!

This material is based on public information as of the specified date, and may be stale thereafter. Marcum Wealth has no obligation to provide updated information on the securities or information mentioned herein. Actual events may differ from those assumed and changes to any assumptions may have a material impact on any projections or estimates.

Sources: http://www.newsworks.org/index.php/local/the-pulse/80394-10-50-100-why-do-we-find-comfort-in-round-numbers

http://www.science20.com/mark_changizi/why_do_we_have_ten_fingers