Blockchain Primer – Preparing for the Next Phase of Digital Growth

The internet has revolutionized business, and that has pushed companies of every size and scope to adapt and find new ways to operate. Companies like Amazon, a bevy of social media sites, have transformed entire industries. Now, the next phase of evolution is here, and it’s called blockchain.

On the surface, blockchain is not the simplest technology to understand. Yet, it will increasingly underlie many facets of business and commerce. Already, its impact is being felt in major industries that touch us all. The time to learn about blockchain is now. With knowledge in hand, you and your company will be better equipped to plan for its potential integration into your operations.

This e-book is intended to provide a basic overview of blockchain – what it is; how it’s used; which industries currently use it; which could benefit from it; advantages; and challenges. It is organized in five sections:

- What is Blockchain, and How Does it Work?

- Blockchain In-Depth: Security Considerations, Advantages and Challenges

- How Various Industries Currently Use Blockchain

- Blockchain and the Accounting Industry

- Conclusion

We hope you find the information in this e-book useful as you think about blockchain as a potential driver of business growth, efficiency and profitability. We welcome the opportunity to answer questions, be of service, or discuss your issues and concerns. Please refer to the Conclusion for Marcum contact information and additional resources.

What is Blockchain, and How Does it Work?

A blockchain is a continuously growing list of records – commonly called blocks. Blockchain technology was devised in conjunction with the implementation of the virtual currency bitcoin. The core of blockchain is a record of transactions, like a traditional ledger. However, the blockchain ledger is anything but traditional. The blockchain ledger is a continually updated, transparent, fixed and distributed record of transactions on a peer-to-peer network. The distributed ledger is designed to be held by the users of the network and be accessible by all members of the chain. Blockchain stores the information of the transaction in a way that makes it virtually impossible to add, remove or change data without being detected by other users. The community verifies a transaction by consensus, bypassing any need for a central authority.

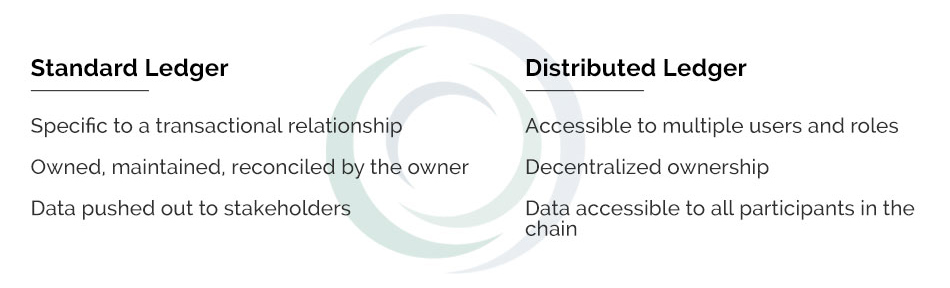

Today’s ledgers are owned and maintained by each entity that enters into a transaction. Because it is a decentralized ledger, no one member of the blockchain has control of the chain or the ability to manipulate it.

Below is a comparison of how standard ledger compares to a blockchain distributed ledger.

How Blockchain Works

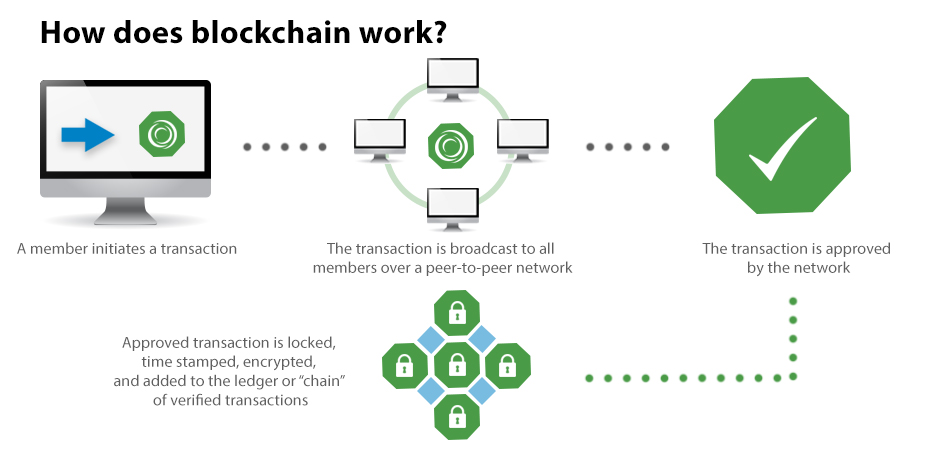

A blockchain is tasked with gathering and ordering data into blocks, and then securely chaining them together using cryptography.

For example, let’s follow the sale of a boat from Dan to Jon. Rather than Dan and Jon maintaining their own records, a blockchain is mutual, with Dan and Jon each sharing the same ledger of transactions. The transaction information is recorded and shared with other computers in the blockchain network. The other members of the blockchain receive the information and agree that the terms are correct. Once approved, the record of the transaction is combined with other transactions into a block and time stamped. Once a block is complete, it is time stamped as a whole. The time stamp allows for the information to be recorded in a sequential order, which helps avoid duplicate entries. The completed block is sent out across the network, where it’s appended to the chain. As multiple blocks on the network are sent out at the same time, the time stamp ensures the data is added in the correct order, and all participants on the network have access the latest version.

Blockchain has the ability to be implemented as a public chain or a semi-private chain. On a public blockchain, all transactions on the chain are visible by all members of the chain. This includes every detail of a transaction, including sale price, contract terms and payment. In a semi-private blockchain, the details of specific transactions can be limited to only certain members of the chain. Using our example on a semi-private blockchain, Dan may want to sell the boat to Jon for a price lower than what he is offering to other members. This information can be limited so that it can only be seen by the buyer and seller of the boat.

In our next chapter, we’ll go in-depth with blockchain, examining security considerations, highlighting advantages to using it, and detailing associated challenges.

Blockchain In-Depth: Security Considerations, Advantages and Challenges

Security Considerations with Blockchain

Blockchain networks are only as safe as the infrastructures on which they exist. Blockchain is built on the premise to set rules, define and assign roles, manage user accounts and permission rights, and enforce network compliance. A blockchain network must have an auditable operating environment with comprehensive log data that can be easily audited and tested for compliance. It provides a security benefit through verified transactions, locked contracts onto the distributed ledger and a single set of records which can be viewed by all members.

Advantages of Using Blockchain

Blockchain is designed to improve the accuracy, security and efficiency of maintaining records. It has the potential to eliminate reconciliations, duplicate ledgers being maintained and disputes over contract terms. Efficiencies are gained by all members since the information on the chain is continuously updated, intermediaries are removed from the transaction process and funds are transferred in real time. The blockchain also will allow members or companies to certify the accuracy and legitimacy of documents. Since files uploaded to the chain are time stamped and cannot be altered when people are searching for historic documents, they can have complete confidence that the document has remained unchanged.

Blockchain technology is real and ready to change industries, but first it must face the challenges of implementation.

Challenges to Implementing Blockchain

Any new technology requires significant time, development and capital to implement. Blockchain is no different, and in that regard, the following challenges must be addressed.

- Setup. There are hurdles that exist to setting up a blockchain. All members of a network must join simultaneously, which can be burdensome to certain industries. For example, syncing everyone to a bank’s blockchain would cut everyone off from their funds for a specified period of time. This could likely cause varying levels of angst and hardship.

- Computing. A blockchain requires a great deal of computing power to verify transactions, which is quite power-intensive. There must also be enough bandwidth available in order for a blockchain to work effectively. Too little bandwidth could result in a bottleneck of blocks of information being recoded to the chain.

- Public Understanding. People generally are wary of the unknown. Combined with a current general lack of knowledge about blockchain, these factors present a major challenge for blockchain implementation. Given that the technology is so new, many people are unaware of it or know little about it. A strong parallel can be drawn to the dawn of the internet. Today, many people associate blockchain with various cryptocurrencies; it will take time for a larger segment of the business and financial community to realize that there is so much more to it.

- Regulation. With this new technology, there currently is a low level of regulation. As more and more professionals adopt blockchain technology, expect to see an increase in regulations designed to monitor blockchain compliance.

Next, we’ll take a closer look at how various industries currently are leveraging blockchain.

How Various Industries Currently Use Blockchain

So far, we’ve explained what blockchain is, how it’s used, how security surrounding it is structured, and advantages and challenges associated with it. Now, let’s examine how companies currently are using it and look at its impact on various industries.

Food Suppliers: Major food suppliers are implementing blockchain technology into the global food supply chain. Blockchain technology can quickly track a product’s progress from farm to store. Among other benefits, this can help in identifying contaminated food, since the blockchain tracks and records the movement of individual products or groups of products. Such information, and the speed at which that information is obtained, could potentially prevent major outbreaks of foodborne illness. Notable food supply companies now utilizing blockchains include Dole, Tyson and Nestle.

Banks: Banks have begun to implement blockchain for a variety of reasons—particularly the reduction of fraud.

Banks have seen an increase in fraud and cyberattacks in recent years. The majority of banking systems are built on a centralized database, which makes them more susceptible to cyberattacks since all information is stored locally in one place. By spreading out information over the blockchain database, information is verified on various terminals, making it more difficult to commit fraudulent activity since it would be made immediately obvious to all terminals on the network.

Another benefit of using the blockchain in banking is the ability of banks to transfer money faster and cheaper, both domestically and internationally. Currently, it can take five business days to make an electronic funds transfer in the U.S. The blockchain would enable that transaction to happen more quickly, and at a lower cost.

Lastly, using blockchain allows banks to easily obtain compliance information on their customers. Regulators want better access to customers and transaction histories, while banks try to remain compliant with those regulators. Blockchain enables banks to build compliance platforms and processes to reduce operational costs and gain efficiencies when dealing with regulators. Notable banks now utilizing blockchains include J.P. Morgan Chase, Citigroup and HSBC.

Real Estate: Some countries and local governments have turned to blockchain to help ease the burden of property sales and title transfers. Anyone who has bought a house knows the countless hand cramps you get from signing your signature over and over again on the associated piles of paper. Migrating transactions to the blockchain help all that paper go away and makes it more difficult to forge records.

Automotive: The automotive industry has greatest potential to gain from blockchain technology. Supply chain management can become more streamlined with help from the blockchain; the blockchain reduces human error, waste and additional manpower throughout every point within the supply chain. Audit trials and real-time negotiations are also benefits for auto manufacturers to implement blockchain technology. Notable automotive companies now utilizing blockchains include DMW, Toyota and Ford.

Health Care: The health care industry benefits from blockchain technology in many different ways. Blockchain enables data exchange systems that are cryptographically secured and irrevocable in regard to patient data. This, in turn, enables easy access to current and historic records while eliminating the burden and cost of data reconciliation.

Another advantage to the health care industry is that blockchain can also eliminate fraud related to excess billing or billing for non-performed services. It is estimated that three to 10 percent of annual health care expenditures are lost due to fraud, which equates to over $50 billion. Microsoft, IBM and Factom have all developed blockchains for the health care industry.

In our next chapter, we describe ways that blockchain technology can significantly impact the accounting industry.

Blockchain and the Accounting Profession

Blockchain has potential to transform the accounting function—for CPA firms and all businesses that utilize accounting. Efficiencies gained from blockchain could help professionals better manage entity risk and further streamline internal processes. As discussed earlier, companies can reduce operating costs through the potential reduction of reconciliations, which is usually labor intensive.

That said, one of the main hurdles for the accounting profession and its use of blockchain technology is the adoption of the technology itself, and the learning curve associated with understanding it. Since this technology is relatively new, firms and businesses will need to invest initially in blockchain technology, with the expectation that it will reduce costs on the back end.

One of the greatest opportunities for the accounting profession as it relates to blockchain is in the compliance piece. Auditors can potentially be granted access to a company’s blockchain to perform a substantial amount of audit procedures. Gaining access to this information, which is recorded in real time and can’t be altered, can be audited on a daily basis, potentially reducing fees for companies and eliminating the burden of the time-intensive audit process that usually occurs after year end.

There are still questions surrounding the auditing function and an auditor’s use of a company’s blockchain, including:

- Would an auditor be a user or a node and be added to the blockchain itself?

- Would the blockchain itself (i.e., the controls surrounding the blockchain) need to be audited?

- Could a blockchain that is operating effectively serve as audit evidence and thus be used to reduce risk assessment and testing procedures?

Other potential advantages to using blockchain in the accounting profession include:

- Reducing the potential for errors when reconciling complex and disparate information from multiple sources

- Freeing up an auditor’s time to focus on more value-added services

- Decreasing the amount of time it takes to complete an audit, which in turn, eases the associated burden on clients

- Cash savings to clients from the reduction in audit testing

- Reducing fraudulent activities

- Increasing security against cyberattacks and hacking

Conclusion

Many people see parallels in the arrival of blockchain to the emergence of the internet. As we all know, the internet disrupted industry after industry. Blockchain aims to do the same. While companies now race to adopt blockchain technologies, it’s still in its relative infancy. Consider: If you decide to implement a blockchain today, you would need to hire developers with a strong understanding and background in blockchain technology. Per Forbes Magazine, only about 5,000 developers worldwide have thus far built an application on blockchain platforms. Compare that to Java, the main programming language of the web, which has more than 10 million developers currently utilizing it. Today, it still may be an expensive and time-consuming task to implement blockchain. That said, it is expected to get easier and cheaper to do so over time, as it did for the web and apps in the next few years. The time to educate yourself is now. And it’s never too early to start planning.

We advise you to follow blockchain news and identify use cases of blockchain that could apply to your business. Marcum will continue to be a resource for you in this new and emerging space, and we will keep you apprised of significant trends and developments as they occur.

We hope you found the information in this e-book useful as you think about ways to potentially leverage blockchain for your business. If you have questions, we encourage you to contact your Marcum representative at (855) MARCUM1.