The Application of the Multi-Attribute Utility Model in the Analysis of Personal Goodwill

By Steven Amoroso, CPA, ABV, CVA, Supervisor, Advisory Services

A key consideration in both the sale of closely held C Corporations and valuations for marital dissolution purposes involves the existence and value of personal goodwill. While business owners may claim sweat equity exists in every situation, valuation experts often find it necessary to quantify the amount of personal goodwill vs. enterprise goodwill. In the sale of a C Corporation in an asset deal, the sellers may want to argue that a portion of the purchase price is for personal goodwill so that the proceeds are not subject to double taxation. In the context of divorce, personal goodwill may not be a divisible asset, while enterprise goodwill is.

Personal goodwill is an intangible asset distinct from enterprise goodwill, which is the reputation and customer relationships that belong to the business. On the other hand, personal goodwill is tied to specific individuals within the company, often owners or key employees.

Determination of Personal Goodwill

Factors to consider in identifying whether goodwill is enterprise or personal:

- Earning power of the professional/business owner

- Reputation in the community for judgement, skill, and knowledge of the professional business owner

- Professional/business success of professional/business owner

- Age and health of professional/business owner

- Nature and direction of the professional practice/business

- Location of professional/business owner

- Size of professional practice/business

- Marketability of professional business owner

- Source of new clients/customers

- Compensation to professional/business owner

- Duration of professional practice/business

- Importance and closeness of contact of professional/business owner

- Types of clients/customers for professional practice/business

- Referrals diversity to professional/business owner

- Size of workforce

- Professional/business competition

- Work habits of the professional/business owner

- Name of professional/business owner

- Billing methodologies

- Demographics

Valuing a Business, 6th Edition, describes personal goodwill as “the intangible value attributed solely to the efforts of or reputation of an owner spouse of the subject business.”1 For marital dissolution purposes, personal goodwill may need to be excluded as it is not considered a marital asset in many states.2 Adjusting the company’s specific company risk, normalizing officers’ compensation, applying a with-or-without method, and utilizing the multi-attribute utility model (“MUM”) are a few ways an analyst may determine the amount of personal goodwill.

MUM Analysis

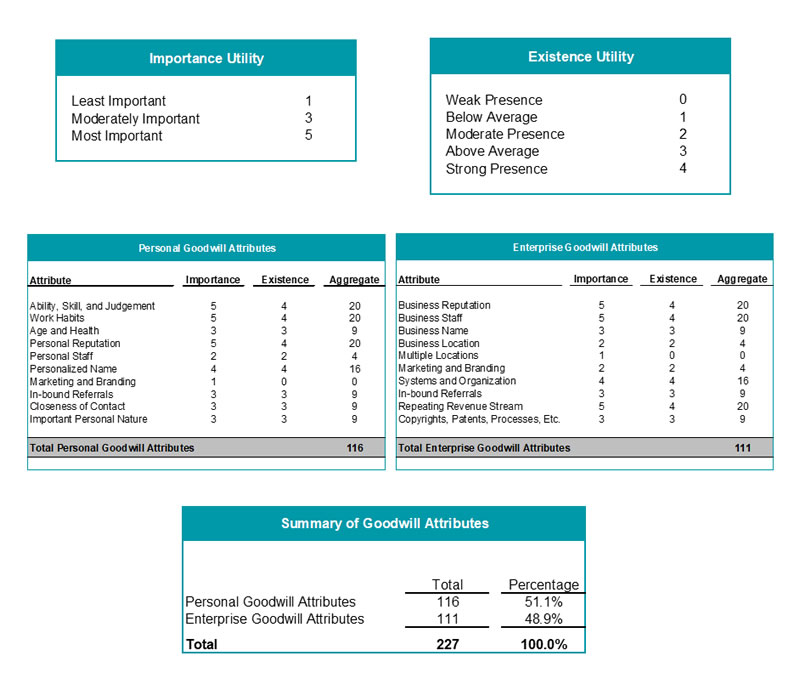

The MUM analysis is a commonly utilized model to determine the value of personal goodwill that assigns weight to different attributes that contribute to both personal and enterprise goodwill. The weight assigned to each attribute is based on its (1) importance and (2) existence in order to arrive at an overall value for each factor based on the specific facts and circumstances. The example below reflects the application of the weightings to each attribute using the MUM analysis.

After assigning the importance and existence weights for each attribute, the analyst determines the relative score attributable to personal goodwill vs. enterprise goodwill factors to determine the percentage of overall goodwill value allocable to each type of goodwill.

Takeaway

Personal goodwill represents the unique attributes and relationships associated with key individuals in a business. Valuing personal goodwill requires careful analysis and consideration, given that it is often subject to scrutiny from opposing parties, whether that be the IRS or opposing counsel in divorce litigation. Therefore, as with any valuation, it is crucial to seek the expertise of a qualified professional to ensure an accurate and supportable determination of personal goodwill.

Sources

- Valuing A Business – The Analysis and Appraisal of Closely Held Companies, Sixth Edition, Shannon Pratt, McGraw-Hill Publishing, 2022

- Treatment of personal goodwill can vary depending on state laws, court precedents, and other factors. Consult with a qualified attorney or valuation expert who is familiar with the laws and regulations in your specific state to understand the requirements and considerations related to personal goodwill in business valuations.