Part 3: Understanding Your Business Valuation – Approaches and Discounts

By Ashley DeCress, CPA, ABV, CVA, Manager, Advisory Services

The final steps in understanding your business valuation relate to the approaches applied to determine the value of your company and the discounts made to reach the final value of the interest. While the application of valuation approaches and discounts have a dramatic impact on the overall conclusion of value, the concept of “garbage in, garbage out” can also play a key role. If the company’s historical or projected financial information is not reliable or the normalizations do not reasonably reflect the future benefit stream of the company, these final steps may still result in an inaccurate value even if applied correctly.1

There are three approaches to valuing a company: the asset approach, income approach, and market approach. Within each approach, there are several commonly accepted methods that the valuator may choose to employ in valuing the business.

Asset Approach

The asset-based approach is also referred to as the cost approach, asset approach and replacement cost approach. The theory behind the asset approach is as follows: current value of all assets (tangible and intangible) – current value of all liabilities = current value of the company’s equity. The following are the most common asset approaches used in a valuation:

Adjusted Net Asset Method

The adjusted net asset method is the principal method used in the asset approach. This method is used to value a business on the basis of the difference between the fair market value of a company’s assets and its liabilities. Under this method, the assets are adjusted from their book (or historical) values to fair market values, and the total adjusted assets are then reduced by recorded and unrecorded liabilities. This method sets a “floor value” of the business based on the amount that would be realized upon a sale of a company’s assets and satisfaction of its liabilities.

This methodology is most appropriate in the case of a holding company or a capital-intensive company, when losses are continually generated, or when valuation methodologies based on a company’s net income or cash flow levels indicate a value lower than its net asset value (floor value).

Capitalization of Excess Earnings Method

This is a hybrid method (which incorporates the asset- and income-based approaches), in which the tangible and intangible assets (excess earnings) of a company are valued independently. Conceptually, this method discounts the earnings based on two capitalization rates: (1) a rate of return on tangible assets and (2) a rate attributable to the company’s intangible assets. According to Revenue Ruling 68-609, the capitalization of excess earnings method is only to be used when no better method exists. Therefore, this method is rarely used in practice.

Income Approach

The income approach is often used as the primary approach in the valuation of operating companies. The two most frequently utilized methods of the income approach are as follows:

Capitalization of Cash Flow (CCF) Method

The CCF method is a single period valuation model that converts a company’s benefit stream into value by dividing it by a rate of return that is adjusted for growth (capitalization rate). This method is used when the company expects long-term, stable cash flows into perpetuity. When this method is used, the valuator uses the recent historical results of the company as a proxy for future operations.

Discounted Cash Flow (DCF) Method

The DCF method is a multiple period valuation model that converts a future series of benefit streams into value by discounting them to present value at a rate of return that reflects the risk inherent in the benefit stream. This method is based on the theory that the value of a company is equal to the present value of its projected future benefits over a specific period of time, plus the present value of a residual value. In order to execute this method, the valuator uses forecasts or projections for the company (which are typically provided by management). If you believe your historical results do not capture the anticipated growth of your business, this method would be useful to determine the company’s value.

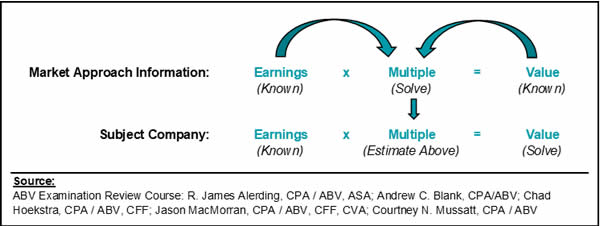

Market Approach

The market approach is appealing because it allows for a comparison of similar companies. If you want to sell your house, you will likely look on Zillow to determine a price for similar homes or homes in the same neighborhood – which is essentially what the market approach is for businesses. The market approaches rely on transaction multiples derived from the earnings and value information provided to various databases. The valuator then takes the estimated market multiple and multiplies it by the subject company’s earnings to arrive at the subject company’s value.

The main methods under the market approach are as follows:

Guideline Transaction Method

The guideline transaction method values a company based on pricing multiples derived from the sale of companies (normally private companies) that are similar to the subject company. The valuator reviews transactions involving the purchase of comparable companies and selects those that best reflect the company’s operations, industry and economic conditions. Depending on the sources of information used by the valuator and the industry in which the company participates, there may be a significant number of transactions available (particularly in comparison to the guideline public company discussed below). On the other hand, the subject company may provide a very niche product, making it difficult to identify comparable companies. As such, the ability to execute this method is largely at the mercy of the data available to the practitioner. In order to fine tune his or her analysis, a valuator can slice the data by year (to review more recent transactions in the market), by size (similar revenue or EBITDA levels as the subject company) or even by geographical location based on the data available.

Guideline Public Company Method

The guideline public company method values a business based on the multiples derived from publicly traded companies (that trade on major exchanges, e.g., NYSE and NASDAQ) that are comparable to the subject company. Similar to the guideline transaction method, companies that operate in the same industry as the subject company and have similar operational models and financial risks are selected. Due to the difference in size and risk factors of public companies as compared to private companies, the selected guideline public company’s multiples may be adjusted based on the subject company’s estimated rate of return. This adjustment normalizes the earnings to better reflect the multiples of the subject company being valued.

Prior Transactions Method

The prior transactions method utilizes information from the company’s previous acquisitions or transactions as an indicator of value. It is important to assess the circumstances surrounding the prior transactions of the subject company to ensure the transaction is at arm’s length (both parties are acting in their own best interest) and it is representative of current market expectations. Prior transactions could be with related parties and, therefore, the value may not be at fair market value rates.

A proper valuation requires the valuator to consider all of the available approaches when determining a value. However, each method has certain limitations, and although each of the approaches should be considered, it is acceptable to dismiss an approach if there is valid reasoning behind doing so. Additionally, based on the purpose of the valuation, modifications can be made to the types of approaches applied, which may allow you to reduce the amount of work needed as well as the engagement fee. Review all of your options with a valuation professional to determine the needs for your valuation and the most applicable methods.

Ownership Interest

The last step in formulating a company’s value is evaluating the nature of the underlying ownership interest and applying any necessary control or marketability adjustments to reflect characteristics specific to the nature of the ownership interest being valued.2

Control

The interest being valued may either be a controlling ownership interest (greater than 50%), a 50%/50% ownership interest, or a minority interest (non-controlling, less than 50%). A non-controlling (minority) interest cannot control company policy or make decisions for or on behalf of that entity. A minority owner is unable to:

- Elect directors or appoint management.

- Set levels of management compensation and perquisites.

- Determine cash dividends/distributions.

- Set company policies or business course.

- Decide on what investments and what projects are undertaken and how they are financed.

- Purchase or sell assets.

- Determine when to liquidate the company.

- Force the liquidation of an investor’s interest in the company.

The control aspects of a 50% ownership interest are unique, particularly when there is only one other (50%) owner. In that case, neither owner can unilaterally control the subject company, but both owners have more power than a true minority owner. Therefore, in this case and in the case of a pure non-controlling owner, a discount for lack of control (reduction to value) is necessary to determine the applicable values indicated by the valuation methods discussed above.

Marketability

Marketability refers to type of marketplace (public or closely held) and the amount of liquidity (ability to convert to cash quickly) of an ownership interest. There are certain marketability differences between an ownership interest in a private company and an interest in the stock of publicly traded companies. An owner of publicly traded securities can know at all times the market value of a holding. The holding can be sold on virtually a moment’s notice, for cash, net of brokerage fees, received within several working days. Selling an ownership interest in a private company would be a more costly, uncertain and time-consuming process.

Due to the above reasons, the ownership interest in a privately held company is considered to be non-marketable and, therefore, a discount for lack of marketability (reduction to the company’s value) may be necessary to determine the applicable values indicated by the valuation methods discussed above.

In summary, there are a number of steps that take place in a business valuation. You can be best prepared by:

- Understanding the purpose of your valuation, standard of value, level of value and the ownership interest being valued.

- Discussing the necessary approaches with a valuation professional to determine what best suits your needs.

- Considering the impact of the company’s history, industry and economic outlook as well as the nature of normalizing adjustments made.

- Understanding the application of the applicable approaches and methodologies as well as the necessary discounts to value, based on the underlying ownership interest.

Additional Resources

Part 1: First Steps in Understanding Your Business Valuation

Part 2: Understanding Your Business Valuation – The Price is Right. Right?

Sources

- For more detail about the first steps of a valuation, company information and normalizations as well as industry/economic impacts see the ‘Understanding Your Business Valuation – First Steps’ and ‘Understanding Your Business Valuation – The Price is Right. Right?’ articles.

- The control and marketability discounts are directly related to the ownership interest being valued. Refer to the ‘Understanding Your Business Valuation – First Steps’ article for additional detail on this matter.