America COMPETES Act Aims to Heighten Competition Overseas

An old aphorism coined by Sir Alec Issigonis, designer of the original Mini, goes that “a camel is a horse designed by committee.” Sir Alec liked to work alone and the Mini shows he needed neither help nor consensus. Moreover, the saying underestimates the camel’s great efficiency and suitability for its task but you get the point.

On February 14, 2022, the House passed the America COMPETES Act. The Senate passed its version on March 28, 2022 by substituting the language of the previously passed U.S. Innovation and Competition Act (USICA) of 2021 for the original language of the House bill. This is not an unusual legislative procedure and normally the amendment is pre-arranged with the House so that it can be passed quickly.

Not in this case. The House rejected the amendment and so the House and Senate are proceeding to meet in conference committee. The process, designed to iron out the differences between the two bills seems very straightforward. The House gives a little, so does the Senate, each body votes on the compromise, done.

You’d expect a committee of this sort to be relatively small to facilitate discussion and move the agenda swiftly. Seeking to surpass The Brian Setzer Orchestra and the P-Funk All Stars, the conference committee has 107 members. Given that every politician needs to speak and then the group will break out into committees, they expect to be done by the end of the summer.

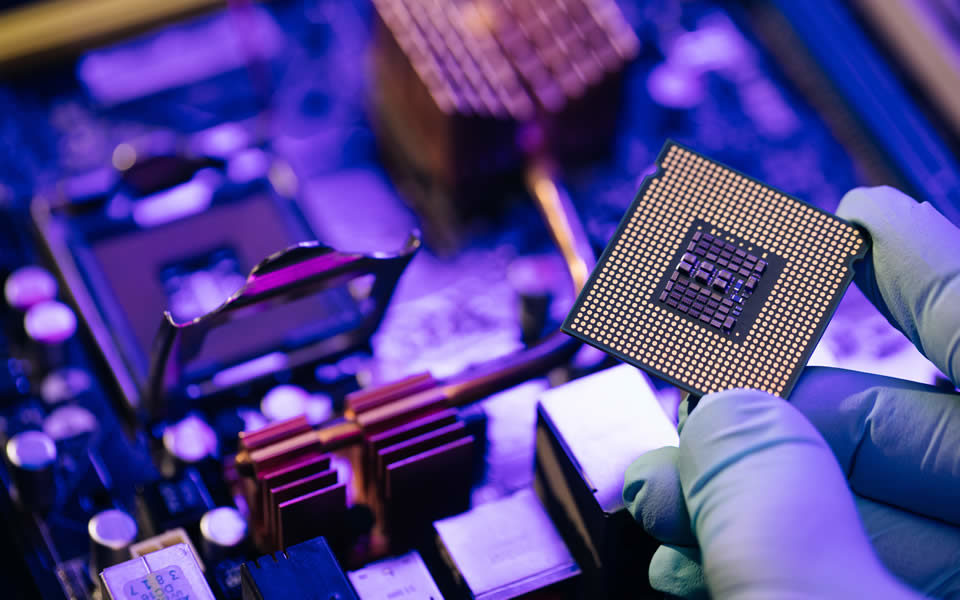

Chips

The main focus of the bill, at least with respect to tax provisions, is semiconductors. Both bills include roughly $50 billion in grant money to support US competition against China in chip manufacturing. Several chip related bills have been introduced in each body providing tax breaks, mostly credits, for research and development and investments in semiconductors and printed circuit boards at all levels of the supply chain.

LIFO Relief

Supply chain issues are resulting in phantom income recognition for auto dealers who use the LIFO inventory method. A shortage of chips is a major cause of this supply disruption. Rep. Dan Kildee is looking to get his “Supply Chain Disruptions Relief Act” included in the conference bill.

R&E Expensing

In prior years they were fully deductible. Now, thanks to the 2017 Tax Cuts and Jobs Act (“TCJA”), they must be capitalized and amortized over 5 years. There is broad bipartisan support to repeal this provision, notwithstanding the fact that it was a significant pay for in President Trump’s signature tax bill. But that was then and this is now. Expect to see repeal language in the conference bill.

Marijuana Banking Legislation

As if the stakes weren’t high enough, a bipartisan group of 24 Senators want to include the Secure and Fair Enforcement (“SAFE”) Banking Act in the conference bill. They say it will “help cannabis-related businesses, support innovation, create jobs, and strengthen public safety in our communities.” This isn’t technically a tax provision and it isn’t clear if it will be considered. We just thought you should know.

You can count on your Marcum advisor to keep you updated as this bill moves forward – particularly with regard to the research and experimentation and inventory issues given their immediate and potentially retroactive impact. Stay tuned.