Relief Eligibility for 501(c)(6) Organizations

By Aaron Fox, Partner, Nonprofit Tax Services

The Payment Protection Program (“PPP”) enacted under the Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020 has been a boon for small businesses and nonprofits. However, not all organizations qualified for stimulus loans under the program, and for the nonprofit sector, only 501(c)(3) and 501(c)(19) organizations were eligible. Right away, lobbying groups for excluded nonprofits set to work, encouraging Congress to include them on the next update to the law.

For 501(c)(6) organizations, these efforts paid off. Under the Consolidated Appropriations Act of, 2021, section 501(c)(6) organizations are eligible for loans of up to $10 million as part of “PPP2.” This includes local chambers of commerce, labor and trade organizations, business boards, and other similar groups. Destination marketing organizations are also eligible.

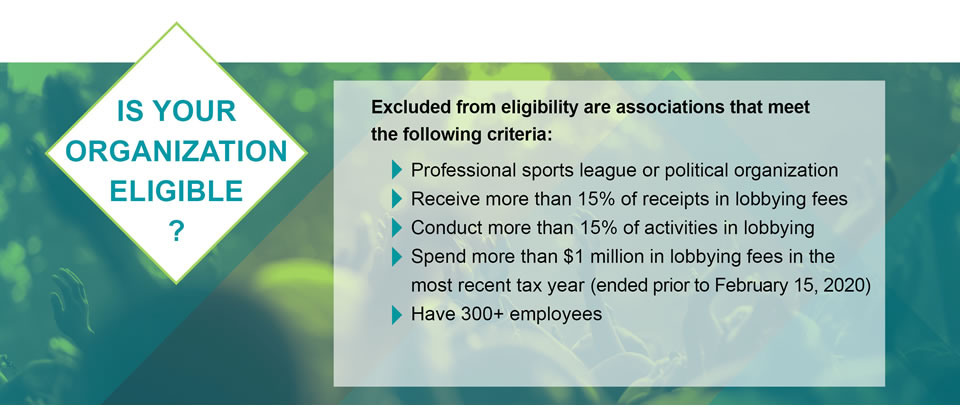

Eligibility

Unfortunately, not all associations are eligible.

Lobbying

So far, there hasn’t been specific guidance as to what determines “lobbying activities,” and we anticipate the SBA will provide future guidance. In the meantime, it is likely that the term will align with the IRS definition of lobbying with which 501(c)(6)s are accustomed, as specified on the Form 990, Schedule C. In fact, 501(c)(6)s are required to calculate lobbying as a percentage of expenses as part of their 6033 reporting requirements. Until future guidance is provided, 501(c)(6)s should continue to perform this calculation under current rules.

Best Practices with PPP

Most of the original terms of the PPP program are applicable to new 501(c)(6) borrowers. Funds can be used for payroll, rent, covered mortgage interest, and utilities. PPP2 also allows for forgivable expenses to include covered worker protection and facility modifications – including PPE – to comply with COVID-19 federal health and safety guidelines, payments to suppliers required for current operations, and covered operating costs such as software, cloud computing services and accounting.

Borrowers can qualify for a loan of up to 2.5 times their average monthly payroll costs in the year leading up to the loan or the calendar year 2019 or 2020. No separate bank account is needed to segregate the funds. However, to qualify for forgiveness, an association will need to carefully track the use of funds in its accounting system. Now that borrowers have up to 24 weeks to spend the funds, many applicants have found it simplest to spend them on just payroll costs and to provide payroll registers from third party payroll processing services to the lender at forgiveness reporting time.

ERC considerations

One curveball in the relief bill is the extension of the employee retention tax credit (ERC) to PPP borrowers. Previously, taxpayers had to choose one or the other. Now, they may take advantage of both programs as long as there is no “double dipping” (submitting the same costs to qualify for the credit and for PPP forgiveness).

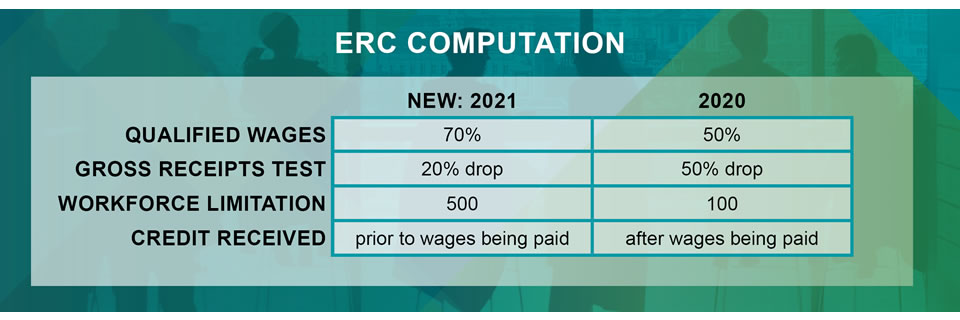

The computation of the ERC depends on the time period for which the association is claiming the credit.

The new ERC is much improved, and associations should carefully consider the advantages of applying for both the ERC and the PPP for 2021.

Conclusion

Marcum will continue to monitor SBA guidance closely. If your association needs assistance with applying for a PPP loan or has questions about forgiveness, please don’t hesitate to reach out to Aaron Fox. Our Nonprofit & Social Sector Group has assisted nonprofits apply for loans and forgiveness since the inception of the PPP – let us lighten the burden of participating in this program.