Socially Responsible Investing: Good for Your Conscience and Your Portfolio

By Lara Coviello, MA CFA, Managing Partner, Auctus Wealth Management

As our once far-flung global society becomes an ever-shrinking, interdependent global village, more people are paying attention to how their actions and their investments may affect a community or a country half a world away.

Investors, concerned about a range of issues from climate change to clean energy, want to feel good about their investments. They want accountability and responsibility from the companies they do business with, and they want palatable choices about how and where they invest their money. To that end, many investors are increasingly aligning their portfolios to reflect their values. Welcome to the booming movement of socially responsible investing (SRI).

What Is SRI?

Also known as ethical, sustainable or green investing, SRI is a strategy in which investment decisions are motivated not only by the possibility of a robust ROI, but also by the individual investor’s personal beliefs. A socially responsible investor may, for example, exclude certain types of companies – those with sweatshops, those that don’t pay a living wage, those whose business carries environmental risks – from his or her portfolio because the business practices simply don’t measure up to his or her personal beliefs.

In recent years, as shareholder activism and environmental awareness have grabbed headlines, SRI has expanded to Environmental, Social and Governance (ESG) screening factors. Once considered outside the mainstream, ESG factors are now beginning to be used to evaluate a company’s operations and performance as well as its impact on the community, the market, and the environment. Many investment experts believe that “impact investing” and the use of ESG screening is the new normal – and the logical evolution – of sustainable investing.

Criteria for the environmental piece of ESG include reviewing a company’s waste, energy use and pollution, as well as risk management strategies and how any given risk could affect the company’s bottom line. Social criteria include looking at working conditions, labor standards, how involved a company is in the larger community and more. Governance refers largely to transparency and how a company does business: Does it engage in “pay to play?” Does it employ good and transparent accounting practices? Does it take care to avoid any conflicts of interest on its board?

Whether investors are using an SRI or ESG strategy, they don’t just want their investments to benefit the greater good; they also want it to grow. For today’s investor, making money and following one’s conscience are two sides of the same coin.

An Old Idea Reinvented

There’s nothing really new about impact investing or SRI. In fact, the practice goes back to the 18th century in the U.S., when John Wesley, founder of Methodism, and his followers were vocal opponents of slavery, smuggling and gambling, among other so-called sin industries. The Quakers, known as the Religious Society of Friends, followed suit by forbidding any investment in war industries and slavery. To this day, Friends Fiduciary, founded in 1898, continues to follow SRI investment parameters.

During the Vietnam War, thanks to negative media coverage and a war-weary society, investors impacted corporate bottom lines by selling off shares of companies involved in that particular war effort. When apartheid became a hot-button issue in the 1980s, investors again applied fiscal pressure, boycotting companies that did business in South Africa and ridding their portfolios of their interest in those companies.

More recently, investors have effectively pressured companies to stop doing business in Sudan or purchasing conflict diamonds and minerals from countries like Sierra Leone and Congo. Even China, known for low wages and less-than-ideal working conditions, has been shunned by groups of investors in favor of products that are “Made in America.”

A Growth Industry

While the feel-good factor matters a great deal to many impact investors, so ultimately does the bottom line. While money continues to pour into the SRI space as investors increasingly follow their hearts, those socially responsible investments are also making money. And not just a little.

In 1995, there were 55 SRI mutual funds across the U.S. with $12 billion in assets; by 2012, that number had risen to 333 funds with $640 billion in assets. And those assets have been growing. According to a survey conducted by Green America in June 2013, assets in SRI portfolios grew a whopping 32% between 2003 and 2013, while assets in more traditional investment portfolios grew a more modest 27%.

From 2011 to 2013, SRI jumped by more than 22% to $3.74 trillion in total managed assets. In 2014, nearly $1 of every $9 currently under professional management in the U.S. can claim to be a socially responsible investment.

It’s increasingly the case that leaders in SRI – mutual funds, indexes, companies – are also leading the way in stock performance, about 25% over the long term. And as bigger and more powerful players buy into the SRI space, they command greater influence with corporate management when it comes to ESG policies.

The fact is that when companies are working toward a more sustainable model, they tend to be more forward-thinking and more focused on the long term. If they’re involved in the environmental side of things, such as clean or renewable energy or emissions reduction, that reduces the risk of fines or liabilities, which can also have a positive impact on the bottom line. Companies with safe, well-managed and diverse workplaces usually have happy employees who tend to stay put; lower turnover can translate to higher profits. The same holds true for the governance piece of ESG. A cooperative, well-run board indicates stability, which then reduces the risk of financial surprises.

Upsides & Challenges

As with anything, SRI offers numerous benefits. Thanks to the prevalence of discussions about climate change, the latest focus for many impact investors is how to avoid fossil fuel companies while reaping the high returns typically associated with fossil fuel investments.

Fortunately, that’s not a problem. According to a report by Cleantech Group, an international market intelligence and consulting group based in San Francisco, global investment in clean technology (cleantech) is on the rise. In 2013, for example, investment in all cleantech-related sectors was $6.8 billlion; that investment continued to increase – 14.5% for the entire year – while compounding from quarter to quarter.

Over the past five years, cleantech beat fossil fuel investments by being both lower risk and higher return. Since 2012, oil services exchange traded funds (ETFs) were down 8%, while coal ETFs were down 28%. And that slump could continue. As energy efficiency improves and climate change marches on, valuations of fossil fuel companies could take as much as a 60%-80% hit, according to a 2013 report by HSBC Global Research.

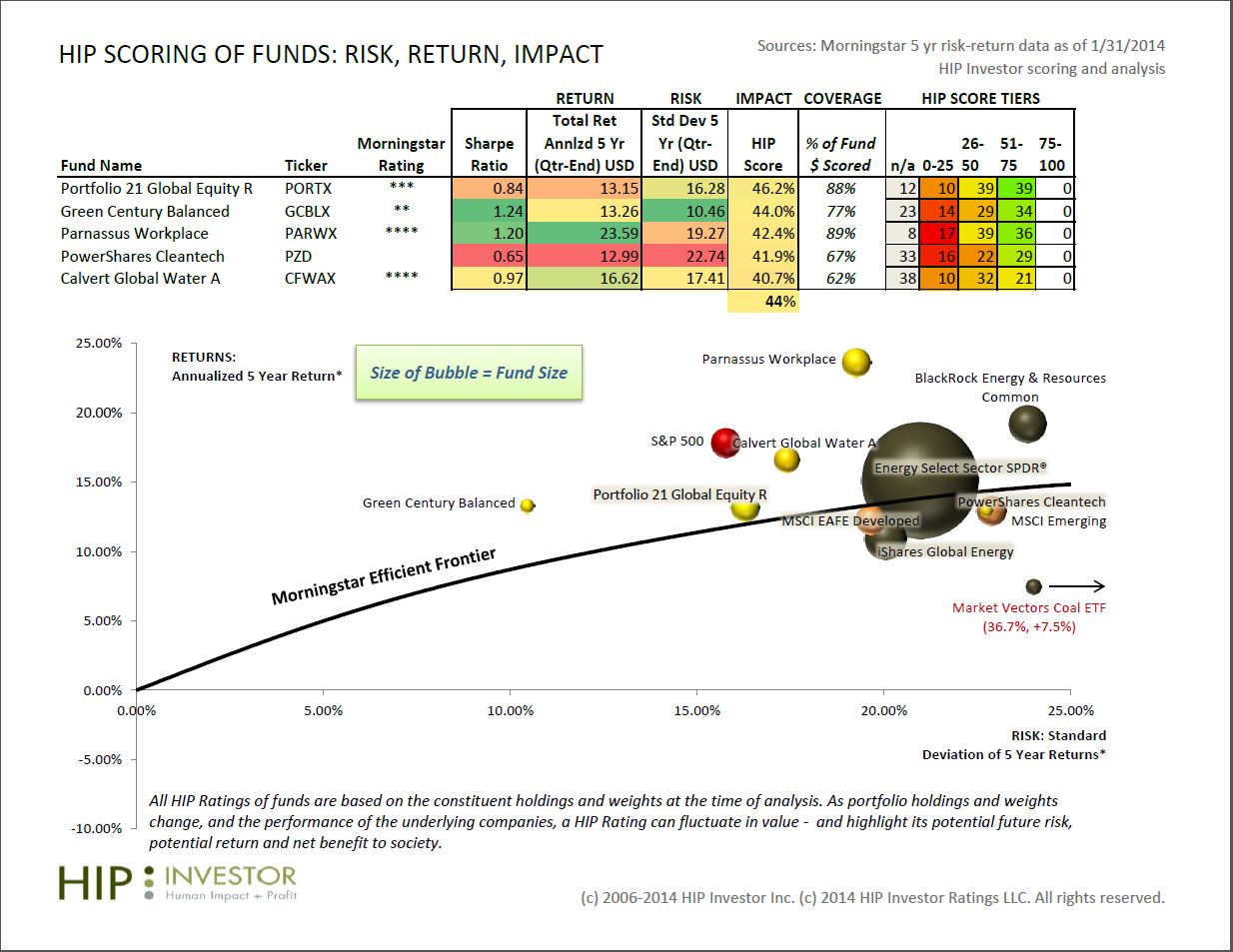

This investor scorecard tracks Morningstar’s five-year risk-return performance data on a sample of ESG-screened funds versus traditional energy-driven funds.

There are also other ways to encourage corporate responsibility. Shareholders can attend annual meetings and propose resolutions. Any shareholder who has owned more than $2,000 in a company for at least one year can offer up a resolution. Even if it doesn’t pass, if it gets enough support, there’s a good chance it will get noticed. As impact investing increasingly takes center stage, the business world is paying close attention.

Of course, this burgeoning movement also has its challenges. Companies – and their management – can change, as can business models. Inexperienced investors might miss the signs and therefore the opportunity to shift their money to a more profitable investment that follows their values. While there are many good private investments, liquidity can be a challenge, and investment in some companies can also be restricted.

A World of Opportunity

If you’re serious about boosting your participation in SRI, there are a number of things you can do to broaden your knowledge of the funds, indexes and companies out there and what kind of ROI they offer.

In my own practice at Auctus Wealth Management, we collaborate with our clients to review their investments and realign those investments with their financial goals and personal beliefs. We also work with a hedge fund to analyze their investments for ESG factors, and actively manage their equity investments in public companies.

Once you’ve done enough research to your satisfaction, set up a meeting with your financial advisor to re-evaluate your portfolio and determine how you can strengthen it with some socially responsible investments in private companies, public companies, mutual funds or ETFs.

If you have signed on to your employer’s 401K plan, look into whether or not it offers SRI funds as investment options. Many companies are adding new options that feature platforms with a variety of SRI mutual funds or ETFs. The great news is that as an employee, you can allocate your funds however you choose.

When buying into any mutual fund, ETF, or Separately Managed Account, it’s also important to keep an eye on the fees. Many investors believe that charges are higher at the specialized socially responsible funds than at traditional asset management funds. That may have been true in the past when SRI was more of a novelty, but not anymore. Many managers are offering funds and portfolios for similar costs to non-SRI funds.

Moving Ahead

SRI may be grabbing headlines and attention; however, it is still a relatively small part of the bigger investment picture. But that’s changing. As more investors and investment advisors explore the many socially responsible options available to them, social screening is maturing into a financial force to be reckoned with. Investors may have to expend a little more effort, do a little more research in order to make informed decisions, they’ll find the extra effort is worth it. As the sector grows, so do the possibilities for robust returns. And that’s something every investor can feel good about.

About Lara Coviello:

Ms. Coviello began her career as a research and statistical analyst in 2004. She started in the financial services industry doing risk assessment and market analysis, researching public and privately held companies, and soon expanded her role to include portfolio management. As lead portfolio manager at Auctus, Ms. Coviello specializes in looking at the client’s big picture and financial goals, and tailoring his or her investments accordingly. In addition to being a CFA Charter Holder, she is a member of the American Statistical Association, The CFA Society, and Rotary International. Ms. Coviello holds a Master’s degree in statistics from Columbia University and completed the Private Equity and Venture Capital Executive Education course at Harvard Business School.

About Auctus Wealth Management:

Auctus Wealth Management is an independent, full-service investment advisory and wealth management firm dedicated to growing and preserving the wealth of its clients through customized portfolio solutions. www.auctuswealth.com