Strategic Accounting Methods for Businesses: Identifying Opportunities to Defer Income and Save on Taxes

By Kayla Lau, Senior Manager, Tax & Business Services & Mike McDonald, Director, Tax & Business Services

Accounting methods are essential for each type of business and determine the timing of when income is recognized and expenses can be deducted. Along with considering an overall method of accounting, there are numerous other specific accounting methods to consider for items such as depreciation, inventory, prepaid and accrued expenses, and repairs, among others. Reviewing current accounting methods may identify opportunities for method changes to defer income and save taxes. Companies can generally change their tax accounting methods to take advantage of more favorable methods via Form 3115, Application for Change in Accounting Method. While there are hundreds of method changes taxpayers can file for, we will discuss some of the more common changes below.

Overall Method of Accounting (Cash, Accrual, or Hybrid)

Most taxpayers fall under either the cash or accrual method of accounting, although a hybrid method, i.e., a combination of certain cash and accrual items, is also available. Under the cash method of accounting, income and expenses are recognized when cash is received and paid. Generally, the cash method is only available to small businesses, with certain exceptions. Alternatively, the accrual method allows taxpayers to accrue deductions for various expenses and receive a deduction currently even if the items are not paid until the following year (please see further discussion below).

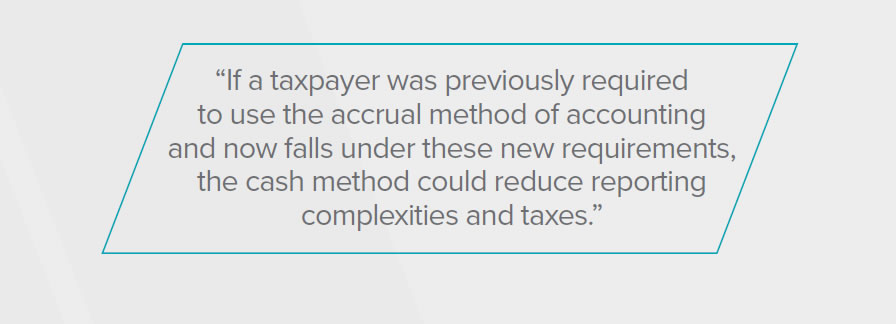

Before the Tax Cuts and Jobs Act (TCJA), taxpayers with gross receipts exceeding $5 million were not considered “small” taxpayers and were required to use the accrual method of accounting. The TCJA amended the definition of a small taxpayer to include those corporations and certain partnerships with average annual gross receipts for the prior three-year period of less than $25 million. This number is adjusted each year for inflation and is currently at $29 million for tax years beginning in 2023. In calculating a taxpayer’s average annual gross receipts, it is crucial to keep in mind the various aggregation rule requirements. If a taxpayer was previously required to use the accrual method of accounting and now falls under these new requirements, the cash method could reduce reporting complexities and taxes. Conversely, a taxpayer could subsequently become subject to the accrual accounting method, also requiring a change in accounting method request.

There are many pros and cons to both accounting methods, with some to consider highlighted below:

Pros |

Cons |

|

|---|---|---|

Cash Method |

|

|

Accrual Method |

|

|

Inventories and Uniform Capitalization (UNICAP)

The UNICAP rules require certain taxpayers to capitalize into inventory certain direct and indirect costs associated with the production and sale of inventory. Just like the overall cash and accrual methods of accounting, the TCJA drastically changed which taxpayers were subject to these rules. Prior to TCJA, taxpayers with average annual gross receipts exceeding $10 million were subject to UNICAP. Post TCJA, that number has also increased to $25 million (or inflation-adjusted $29 million for tax years beginning in 2023). For taxpayers previously subject to these rules, filing a change in accounting method could result in a current-year benefit by allowing the previously capitalized costs to be recognized as an expense.

Fixed Assets and Depreciation

Fixed asset purchases could be a significant expenditure for a taxpayer. A majority of fixed asset purchases are capitalized and depreciated over the applicable life of the asset as determined by regulations (e.g., computers and equipment over 5 years, furniture and fixtures over 7 years, qualified improvement property over 15 years, commercial building property over 39 years, among others). While fixed assets are required to be capitalized, certain charges for repairs and maintenance can be expensed as incurred. The tangible property regulations (TPRs) updated the requirements for determining capitalization or expensing an expenditure.

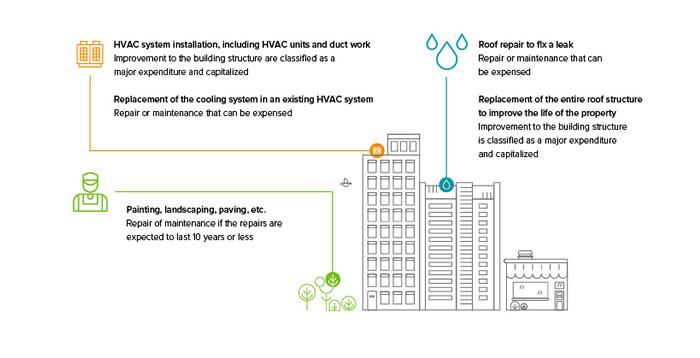

In deciding whether an expenditure should be capitalized, it is essential to consider whether it was a betterment, restoration, or adaptation of the property. The following are a few examples of items to consider when differentiating between routine repairs and maintenance and major renovations (betterment/restoration/adaptation):

A careful review of a taxpayer’s fixed asset listing could identify previously capitalized assets that could be classified as repairs.

A cost segregation study could further identify beneficial method changes. Such studies are typically used for real estate purchases. When a taxpayer purchases a building, the building is capitalized as an asset and depreciated over 27.5 years for residential or 39 years for commercial property. However, a cost segregation study reviews the various building aspects to assign costs to shorter-lived assets, such as fixtures, equipment, and communications systems. Not only can these items have a shorter depreciation life, but they may also be eligible for bonus depreciation, enhancing the initial year deductions available for taxpayers.

Prepaid Expenses

Under income tax accounting rules, expenses are considered deductible when economic performance has occurred. When a company pre-pays for expenses, these expenditures are reported as an asset on the balance sheet rather than a current period deduction. The expense is then recognized as the benefit is realized. For certain expenses that are prepaid for 12 months or less, economic performance can occur at the time of payment, thus accelerating the deduction. The taxpayer can realize a current-year expense benefit rather than capitalizing these expenses for income tax purposes. Certain expenses, such as rent, are not eligible for this acceleration, so keeping track of prepaid expenses separately by category is important to maximize the deduction available.

Accrued Expenses

For taxpayers utilizing the accrual method of accounting, there is greater flexibility in accounting for future expenses not yet paid at year-end. Items such as wages, bonuses, interest, and other expenses paid in the following year can potentially be accrued and deducted currently. The type of accrued expense will determine the timing of the deduction. For instance, accrued payroll would need to be paid within 3½ months of year-end to be deducted. The payroll, including bonuses, must be considered fixed and determinable at year-end to qualify for a deduction. Any non-payroll accrued expenses would need to be paid within 8½ months of year-end to qualify for a current period deduction.

Code Section 266

Section 266 is a provision in the Internal Revenue Code that allows taxpayers to capitalize items such as taxes, interest, and carrying costs to the basis of property rather than expensing the items currently. While this may seem counterintuitive on the surface, capitalizing costs may yield beneficial results in the future. For example, in certain instances, capitalizing interest can help avoid or reduce the Section 163(j) business interest expense limitation (see more on this subject in the Summary below). Property under development is another example. In a year with minimal receipts but large expenses, capitalizing costs under Section 266 would save these expenses to offset income when the property is ultimately sold. Whereas recognizing the expenses currently could yield a loss, that loss may be limited due to basis limitations or subject to a net operating loss deduction limitation in a future year. Capitalizing these costs could help yield a larger tax deduction in a future year, recognizing additional expenses in a year in which you may be subject to a higher tax rate.

How to request and report a change

Each accounting method change requires filing Form 3115, Application for Change in Accounting Method. These forms can be complex, and in most instances, a separate form is required for each type of change. Accounting method changes result in a Section 481(a) adjustment, the cumulative impact of the respective method change. These changes can either be favorable, resulting in additional deductions available, or unfavorable, resulting in additional income to be reported. All favorable and unfavorable adjustments resulting in income of $50,000 or less can be recognized in the year of the change. Unfavorable adjustments exceeding $50,000 are recognized ratably over four years, thus deferring some taxable impacts to future periods.

Summary

While many additional accounting method changes are available, this discussion has provided some of the more common method changes used. In considering any accounting method change, it is essential to evaluate the impact such a change could have on other items, such as state tax implications and the interplay with the Section 163(j) business interest expense limitation. Discussing all options with your tax advisor to ensure appropriate implications are considered to maximize tax savings is vital. Marcum’s accounting methods team is available to assist with analyzing how the above items may benefit you and your company.