What the New FASB Disclosure Rules Could Mean for Your Company

By Martin Martinez, Partner, Tax & Business Services, ASC 740 National Leader

On March 15th, 2023, The Financial Accounting Standards Board (“FASB”) proposed enhancements related to income tax disclosures (otherwise known as the “Improvements to Income Tax Disclosures). On August 30, 2023, the Board unanimously voted to finalize the proposed Accounting Standards Update (“ASU”) disclosure rules in income taxes. The proposed ASU is part of the FASB’s broader disclosure framework project aimed at enhancing the transparency and decision usefulness of annual and interim income tax disclosures. Various stakeholders indicated that the existing income tax disclosures should be improved to provide information to better assess how an entity’s multi-jurisdictional operations and related tax risks and tax planning and operational opportunities affect its tax rate and prospects for future cash flows.

These enhancements were primarily focused on the following income tax information: Income taxes paid and the rate reconciliation table. The final standard will require entities to disclose more detailed information in reconciling their statutory tax rate to their effective tax rate. Public business entities (“PBEs”) will be required to provide this incremental detail in a numerical, tabular format, while all other entities will do so through enhanced qualitative disclosures.

Rate Reconciliation Disclosure

The final standard will require PBEs to disclose the following specific categories:

- State and local income tax, net of federal (national) income tax effect

- Foreign tax effects

- Enactment of new tax laws

- Effect of cross-border tax laws

- Tax credits

- Valuation allowances

- Nontaxable or nondeductible items

- Changes in unrecognized tax benefits

The Board affirmed its decision to require that an entity use 5 percent of the amount computed by multiplying the income (or loss) from continuing operations before tax by the applicable statutory income tax rate as the threshold (5 percent threshold) for further disaggregation of reconciling items.

Income Taxes Paid

Under the final standard, all entities will be required to make additional disclosures on the amount of income taxes paid (net of refunds received) disaggregated by federal (national), state, and foreign.

The Board affirmed its decision to require that all entities disclose the amount of income taxes paid disaggregated by individual jurisdictions in which income taxes paid (net of refunds received) is equal to or greater than 5 percent of total income taxes paid (net of refunds received).

The Board decided to require that all entities disclose income taxes paid disaggregated by federal(national), state, and foreign and individual jurisdiction on an annual basis.

Effective Date

The Board decided that all entities should apply the amendments on a prospective basis, with a retrospective option.

The Board decided that the amendments will be effective for public business entities for fiscal years beginning after December 15, 2024, and interim periods within fiscal years beginning after December 15, 2025. The Board decided that the amendments will be effective for entities other than public business entities for fiscal years beginning after December 15, 2025, and interim periods within fiscal years beginning after December 15, 2026. The Board also decided that early adoption will be permitted.

Reception and Response

The FASB’s changes have been met with mixed reviews. Major financial entities like American Express aired concerns about the frequency of disclosures. Furthermore, 15 Republican House members expressed apprehension that the extensive disclosures might put US multinationals at a disadvantage against foreign counterparts.

However, FASB’s Board Chair Richard Jones emphasized the project’s primary aim: “providing investors with essential insights into a multifaceted area.”

As we see it, multinational companies will struggle when it comes to gathering the data, transposing the data, and especially communicating with foreign parties to obtain their data timely. Additionally, companies may lose some of their competitive advantage and face more scrutiny from authorities due to the new information revealed in their financial disclosures.

Analysis and Adaptation

For businesses, now is the time to take stock of existing methods and make sure they align with the updated standards. If not, there’s still time to make new infrastructure investments. Some challenges you’ll need to meet under the new rules center on:

- Scrutiny and Competitive Position: Nuanced disclosures might open companies to undue examination, potentially undermining their competitive standing.

- Resource Limitations: Meeting these standards might require recruiting additional personnel and/or revamping existing operations.

- Time Considerations: Retroactively applying these changes could lead to the restatement of previous periods, affecting compliance timelines.

Technological Integration and Tax Readiness

As reporting expands globally and the amount of additional detail required to be disclosed under the proposed ASU, businesses need to consider using technology to collect and incorporate data into reporting mechanisms to bolster precision and efficiency. Companies will have to find effective ways to improve their existing tax accounting processes and reduce the risk for the organization by utilizing technology to capture data at its source and directly integrate it into financial reporting systems.

Corporate tax departments tend to be small, which makes each team member’s time critical. Based on our observations, many business processes today are primarily driven by the need to find, extract, and manipulate data. Thus, the bulk of the tax practitioner’s day is spent moving data into and out of Excel, manipulating data using human resources, and calculating the income tax disclosure using an Excel format.

Technology can take these low-value tasks and leverage tax applications and reporting engines to free up tax personnel to focus on high-value “thought-work.” Rather than using the limited tax resources available in-house on low-volume tasks, a company should begin the process of tax automation by automating low-value tasks such as organizing that data to complete one of a number of commonly used calculations and using that calculation to meet a reporting obligation. Effective use of technology can free up tax team members to identify tax opportunities, challenge auditors on issues, or work with business partners to tax-optimize transactions in process. These strategic tasks require real thought from tax personnel with a deep understanding of the tax law and accounting literature.

As the proposed regulations are finalized, it’s the perfect time to review current processes and consider implementing or upgrading your technology to automate income tax disclosures.

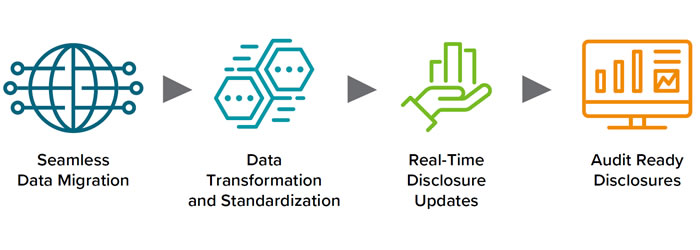

Below is an example of an efficient income tax disclosure life cycle.

An efficient income tax disclosure lifecycle will make the companies process data a lot simpler while allowing for more time and resources to be used for management review or resources spent elsewhere. This is achieved by:

Seamless Data Migration: Proper ERP implementation will allow for management and categorization of data to promote ease of delivery of such data, which will enable the company to achieve a seamless data transformation. This will save the company resources that would otherwise be spent digging through data and will allow the company to spend more time looking at the bigger picture.

Data Transformation & Standardization: Using automation tools and trusted tax software, companies can rely on technology to transform their data based on standardized fields. This allows more time to be spent in management review stages and keeping up with the latest rules and regulations. Depending on the software, companies can rely on the software to adopt the formatting of the income tax disclosure for the company.

Real-Time Disclosure Updates: It’s important that companies have real-time disclosure updates during the provision process so there is ample time to discuss any unusual or material changes with the auditors in a timely matter. Companies can address issues more promptly with automated, data-optimized processes.

Audit Ready Disclosures: Using tax provision software and automation, companies can build much more reliable SOX controls, increasing shareholder confidence and increasing audit reliability.

How Can Marcum Help

It’s essential to have a trusted advisor who can guide you through the changes and either create a new tax process, build upon the current approach using market-leading trusted technology, or create custom technology to meet the company’s needs.

At Marcum, our first step is to review the current tax system and processes used to make sure that we can efficiently compile the data necessary to meet the disclosure requirements. Our technology group has been working with our tax teams to significantly improve accounting and tax processes for our clients, often customizing solutions to work with client-specific software. Some of the processes include the usage of OneSource Tax Provision (“OTP”), OneSource Income Tax (“OIT”), Alteryx, Excel Macro, and custom to the client API. Our automated process increases the efficiency and accuracy of the data. This allows Marcum and our clients to spend more time on technical analysis and tax planning strategies and less time on data review.

Conclusion

The newly approved standards mark a significant paradigm shift in tax disclosure norms. To make the transition seamless, companies should review their current tax systems soon, as the effective date for public companies is just around the corner. Assess your company’s readiness by completing our 8-question evaluation.

If you have any questions about the adaptation process or how to streamline it, contact a Marcum professional today.