Financial Fortitude for Faith

Recommendations for faith-based organizations during the coronavirus era

By Jake Greene, II, CPA, Manager, Managed Services - Accounting

As we all are aware, the coronavirus is affecting our world unlike any other event in recent history. Amidst this pandemic, individuals are returning to or have become open to the healing power and message of hope garnered through faith-based organizations. A recent survey performed by the Pew Research Center found that about 24% of Americans say their faith has become stronger because of the coronavirus pandemic. COVID-19 has severely impacted the financial structures of faith-based organizations, and many may not survive. Now, potentially more than ever, it is critical that faith-based organizations properly align their missions with solid financial practices and procedures. Here are a few considerations FBOs can make given the effects of the pandemic:

Develop and grow online giving platforms

One survey conducted by Christianity Today showed that 41% of faith-based organizations either experienced the same level of giving or, in fact, experienced even more giving in the month following stay-at-home orders. However, it is the FBOs that had built solid platforms for online giving prior to the pandemic that are seeing increased giving. Consequently, FBOs that lacked the resources to build a robust online platform are experiencing significant declines in giving. Whether through your organization’s website, or apps like Givelify, FBOs need to establish solid and user-friendly mechanisms for online giving. Though it seems that some of the quarantine restrictions are lifting, a rise in COVID-19 cases has been identified in states where restrictions are the most lax. For that reason, FBOs should make online giving mechanisms a top priority. In addition, establishing online giving will ensure that the tracking, receiving, and recordkeeping of funds received are not only more efficient, but safer. Given the highly contagious nature of the coronavirus, online giving is less dangerous for volunteers and staff members who may help with the collection of live cash offerings during a service or meeting. These individuals would not have to handle money and other property that could easily be contaminated by the virus.

Reforecast the organizational budget

The pandemic has had a financial impact on every faith-based organization in one way or another. Even if giving has not been affected significantly (or is even growing), the nature of how to manage expenses under our current “normal” has changed drastically. FBOs should consider the following when reforecasting their budgets:

- Monitor trends in general giving. In the midst of the pandemic, FBOs might be receiving special gifts for support related to the pandemic. In general, this revenue should be considered as gifts received under special circumstance, and not as a part of general giving. Organizations should assess the reality and trends of general giving to have reasonable data to support ongoing operations.

- Identify the largest and most important expenditures of the organization and match revenue to these expenditures appropriately. Can general giving cover these expenditures? If not, the FBO should develop a plan as to how it will cover or minimize these expenditures.

- Create multiple budget scenarios to help with future events. What would the organization expend at 30% capacity? At 60%? Plan for revenue scenarios at these various capacities.

Reassess liquidity

If a faith-based organization has experienced some type of significant shift in giving, whether more or less, the cash flow of the organization has inevitably been affected. Preserving cash will become a priority for FBOs. Therefore, FBOs should be asking themselves what needs to be paid in the next 30, 60, 90 days and whether the due dates can be negotiated. This may require communication with various vendors to adjust payment terms. Many are sympathetic to the realities of the pandemic and are willing to work with flexible payment terms. FBOs should assess which vendors they have the strongest relationships with, then reach out for a conversation. Intentional communication will serve to make the relationship stronger and allow for rapport, should future emergencies affecting cash flows arise. Also, FBOs can access funds through the Small Business Association’s PPP and EIDL programs. However, June 30, 2020, is the last day to apply for these funds. The SBA did address specific PPP/EIDL items related to faith-based organizations, referenced here.

Consider accounting treatment for canceled events

One of the most significant pandemic consequences for nonprofit organizations (faith-based or not) is the cancellation of significant events. Events like mission trips, summer camps, and even school events within the faith-based space have been terminated at worst, or significantly curtailed at best. Considering the monies received for these specific purposes and what to now do about those resources is important. Here are some steps to consider:

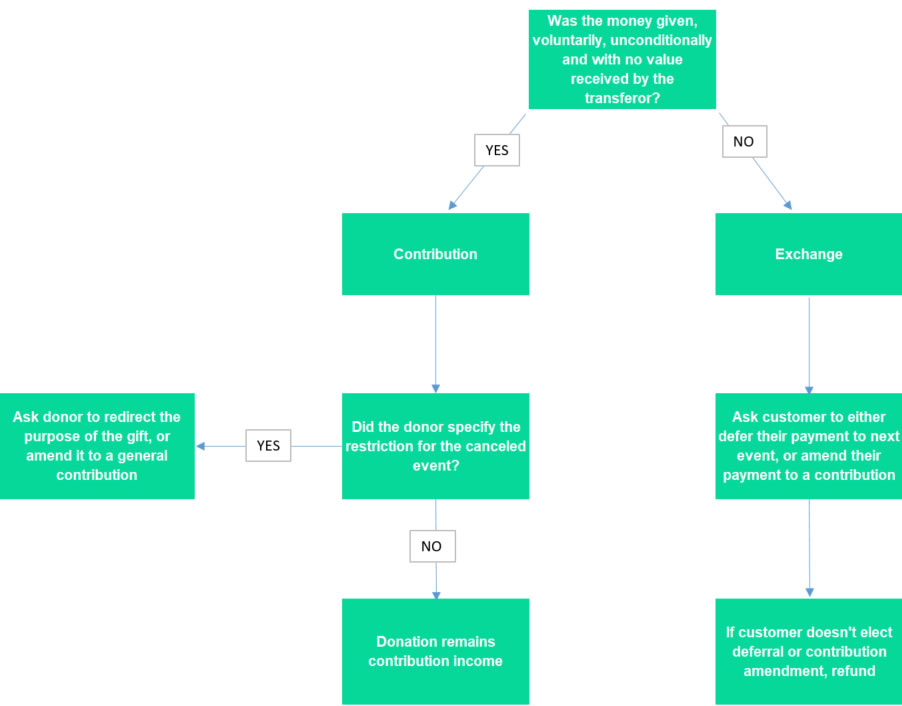

- Determine if the money given was a contribution or exchange. ASU 2018-08 defines a contribution as “an unconditional transfer of cash or other assets, as well as unconditional promises to give, to an entity, or a reduction, settlement, or cancellation of its liabilities in a voluntary nonreciprocal transfer by another entity acting other than as an owner.” In general, if donors gave money voluntarily for, say, a mission trip, without any intention of receiving anything of commensurate value in return, it was likely a contribution. Taking the same example, if a participant in a mission trip paid for his or her travel through the FBO, it would most likely be considered an exchange transaction.

- If the monies received are determined to be an exchange transaction, the payer has the right to expect the funds to be returned. However, in FBOs, many payers would be willing to convert their funds into contributions, rather than requesting the money back. FBOs should talk with individuals who have money due back to them and request the funds to be converted. The worst they could say is no. Alternatively, they may ask for the funds to be held for a future activity.

- If the transaction is considered a contribution, an FBO must determine if the funds are restricted or can be used for general operating expenses. To determine whether funds are restricted, FBOs must ask if the donor intended the gift for a specific event is now canceled because of the pandemic. If so, there may need to be communication with the donor to either redirect the purpose of the gift or convert it to a general donation for the FBO. Donations restricted specifically for the canceled event should remain restricted until the donor has specified a change in purpose. The FBO should also document the donor’s amended restriction terms. A refund may be requested; however, if the donation was made in a previous tax year and the donor took the charitable deduction in that year, the refund would count as income to the donor on his or her current year tax return.

The diagram below illustrates the best next steps to take regarding canceled events.

Framework for Determining Adjustments to Transactions for Canceled Events

Where will faith-based organizations be after the pandemic subsides? Financial practices put in place now, while still navigating through the pandemic, will be a significant determinant of their fate. Setting up efficient giving mechanisms, strategic budgeting, assessing cash flows, and considering financial impacts of events altered by COVID-19 will all prove to be invaluable in getting through this unique time.