Marcum’s Industrial Products Practice Group serves manufacturing driven and consumer-pulled businesses.

Within these diverse markets, Marcum delivers an array of financial reporting, tax compliance and business consulting services linked by common supply chain principals. More than ever before, companies are subject to regulatory scrutiny, global competitive pressures and an ever increasing pace of technological change. Marcum’s industry professionals guide clients through personalized, innovative strategies to increase profitability and maximize their competitive advantage.

Marcum is uniquely qualified to serve manufacturers and distributors with seasoned professionals who understand the industry and specific market forces that are driving business decisions.

Scope of Services

Revenue & Accounts Receivable

- Optimizing accounts receivable management by creating the proper balance between maximizing sales and profits and minimizing risk while retaining customer goodwill.

Inventory Management

- Managing inventory to maximize its return on the sale of available inventory, while maintaining overall inventory at an optimum level.

Purchasing and Receiving

- Developing purchasing and receiving systems that enhance business performance, including the ability to evaluate the performance of suppliers and quality of goods, the capacity to identify and quantify purchase requirements, and establish or enhance procedures to monitor purchase orders and open commitments.

Manufacturing and Production

- Controlling the physical production and cost of inventory to meet customer demands through desired inventory levels. This includes the ability to develop dependable sales forecasts and production plans and a system to control production and inventory levels.

Business Process Improvement

- Producing effective and reliable financial data to manage day-to-day business more efficiently.

Financial Management

- Providing financial management skills needed to control a business and anticipate its capital and finance requirements.

Accounting, Assurance and SEC Services

- Maintaining the technical expertise of Generally Accepted Accounting Principles, SEC Rules and Regulations and Internal Revenue Code Tax Rulings.

Case Study

Marcum Provides Strategic Business Advice to Manufacturer Seeking International Growth

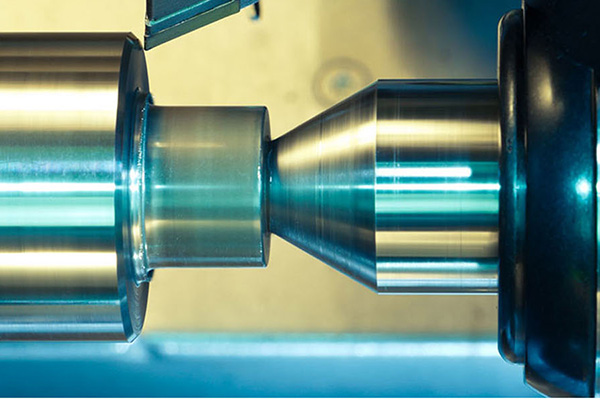

Founded in 1992, this Midwest-based medical manufacturer produces thousands of highly engineered implants and instruments. The company was at the forefront of many early spine systems and has evolved with the industry, expanding its scope and breadth of operations into other orthopedic disciplines.

Insights & News

Contacts

Select the region to view contacts.