Not Analyzing Your Production Costs: Can Your Business Afford It?

By Kristen Schneider, Presales Engineer - Financial Solutions, Marcum Technology

Perhaps it seems like your business is too small or simple, or that the time and expense involved in tracking and analyzing your true production costs outweighs the benefits of doing so. It may feel like you just can’t afford to do it, but the question is: Can you really afford not to?

As a manufacturer, do you know what it actually costs you to produce each and every item that comes out of your production processes? Many manufacturers only track production costs at a high level because they believe it’s too complicated or too expensive to track actual costs at an item level. For example, manufacturers often only look at material and labor costs as a whole, concluding that they spent ‘x’ amount on labor this year and ‘y’ on materials, and their overheads were ‘z.’

Yes, you can determine your overall profitability using this approach. But what isn’t clear is the cost of making each specific item. And this lack of visibility into product-specific costs affects your ability to determine the profit margin, or lack thereof, on each product you produce.

According to the National Federation of Independent Business’s December 2021 report:

Among the owners reporting lower profits, 29% blamed the rise in the cost of materials, 22% blamed weaker sales, 17% cited labor costs, 10% cited the usual seasonal change, 8% cited lower prices, and 4% cited higher taxes or regulatory costs.

For owners reporting higher profits, 63% credited sales volumes, 11% cited usual seasonal change, and 15% cited higher prices.

Why is it so important to understand what the true cost of producing each item really is? Well, understanding the profit margin on each product produced, every time you produce it, enables you to see how rising costs are affecting your profit margin and set effective pricing strategies accordingly.

In today’s current economic environment, where inflation is rising and material and labor rates are continually increasing, understanding your actual cost of manufacturing is more critical than ever to ensure you continue to recognize a profit. When costs change frequently, real-time visibility into how those changes affect the margin on each item allows you to adjust pricing before incurring losses.

In addition, understanding the true margin on each of your products allows you to better plan your marketing strategy. Knowing which specific products, or product lines, produce higher margins than others means you can focus more of your efforts on those high-margin items.

Selling and producing more of those higher-margin items will increase profitability for your company as a whole. But increasing sales volumes won’t necessarily translate into increased margins, and could potentially result in decreased margins if you don’t have full visibility of your costs and margins for each product.

What costs are important to track?

Materials

Materials are clearly a large part of manufacturing costs. Monitoring the fluctuating cost of components, consumables, and packaging materials is critical to understanding your total product cost. Not only is it important to understand the purchase cost of those items, and to factor that into your cost of production, but it’s also important to make sure the costs you use are the landed costs.

Landed cost is the total cost of obtaining the material. It includes the purchase price as well as the costs incurred in obtaining it: freight, customs, duties, insurance, etc. These additional costs are often treated as expense items and not incorporated into inventory costs. That can have a significant impact on the final selling margins of each product.

Labor

As labor shortages continue, costs will keep increasing as employers have to offer higher wages and augmented benefits to compete for qualified employees. Not only is it important to track the cost of labor, but knowing how much time is actually spent producing each item is key to calculating the total cost of production.

Understanding the time and cost components of labor enables you to adjust selling prices according to the margin you need to achieve, and it also allows you to analyze your employees’ productivity levels.

When you monitor the productivity levels of individuals, you can add training or incentives to bring employees with lower outputs to a higher level, or reward your high achievers. In the current labor market, employee retention is vital. Employees often report that they leave jobs because their managers tolerate underperforming employees, so the ability to identify and address those situations is highly beneficial to retaining your workforce.

Overheads

Fixed

Fixed overheads are generally straightforward to calculate because they don’t change based on what or how many items are produced. This includes office expenses, administrative salaries, etc. They are fixed because they always remain the same. They may make up a very small portion of your overall production costs, but they are still a factor.

Variable

Variable overheads can have a far more significant impact on the true cost of production. Variable overheads fluctuate depending on the item you’re producing and the quantity of items you make.

An example of a variable overhead cost is machine setup or takedown costs. A company that manufactures paint might need to purge mixing machines after each run, and that process could take up to an hour depending on the type of paint. In this example, if the company makes 10 gallons of paint, then the cost for that hour (which could include labor, utilities, cleaning supplies, disposal, and other components) is distributed across a quantity of 10, meaning each gallon of paint bears 1/10th of the overhead cost. However, if the company makes 1,000 gallons of paint, then each gallon bears 1/1000th of the cost.

Add equipment depreciation, quality assurance costs, utilities, etc., to that example and it quickly becomes clear that production costs can change a great deal depending on the quantity in the production run. In this example, the cost per gallon when you only make 10 gallons is far greater than the cost per gallon when you make 1,000.

Say one of your key customers asks for an expedited short run (essentially asking you to produce a quantity that is less than your usual production batch). If you know how those variable overheads affect your product cost, then you can decide whether fulfilling that request would be profitable for you or not. You may still decide to proceed, but you would be doing so from an informed position and with an understanding of the impacts.

How can you stay on top of it all?

Yes, it’s a lot of information to track. And yes, trying to do this in spreadsheets using data from timesheets, production travelers/tickets, information from supplier invoices, etc., would likely be a daunting task.

This is where ERP software with manufacturing management comes in. ERP stands for enterprise resource planning, and a robust system incorporates all of your accounting needs. This includes a general ledger, accounts receivable and accounts payable perspectives, and all of the functionality needed to manage your customer orders and fulfillments, inventory, purchasing, and warehouse operations.

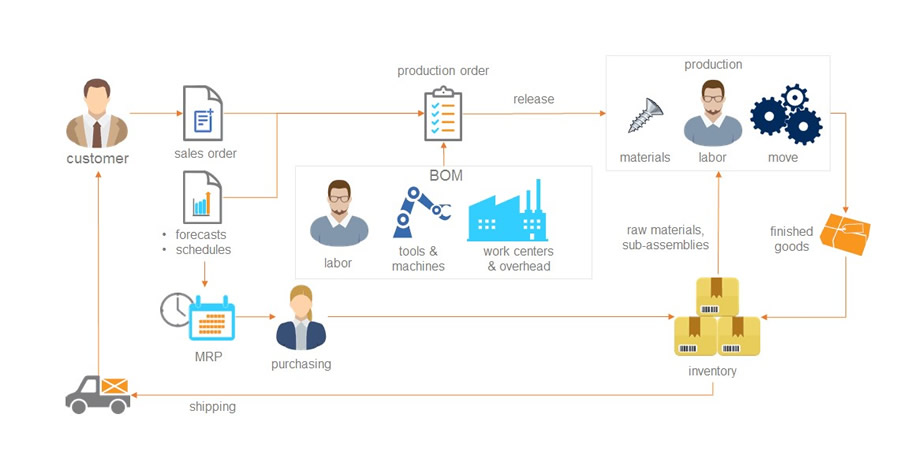

In addition, an ERP that includes manufacturing functionality for managing bills of material (BOMs), production processes, material consumption, labor tracking, production scheduling, and material requirements planning (MRP) will ensure that you can effectively and efficiently track all your costs.

Figure 1: Acumatica amflow

Not only is the right ERP solution an effective tool for managing costs, but it also provides visibility of the materials you need by calculating demand, lead times, safety stock, etc., to avoid under- or over-carrying your inventory — reducing costs in the process.

Visibility of inventory and production scheduling with capability-to-promise can also improve your customer relationships by helping you meet request dates, reduce stock-outs and backorders, and provide accurate information about lead times.

A fully integrated solution allows all the parts of the business to interact in real-time, without redundant data entry or silos of information. This means customer information flows into order taking, customer orders flow into inventory and affect available quantities and demand, and inventory information flows into purchasing. In turn, inventory (or possibly sales orders) flows into manufacturing, affecting production scheduling and processes. Ultimately, that can affect inventory and/or purchasing. Meanwhile, sales order invoicing updates AR, supplier bills from purchase orders and purchase receipts update AP, and of course, everything ends up in the GL for financial reporting.

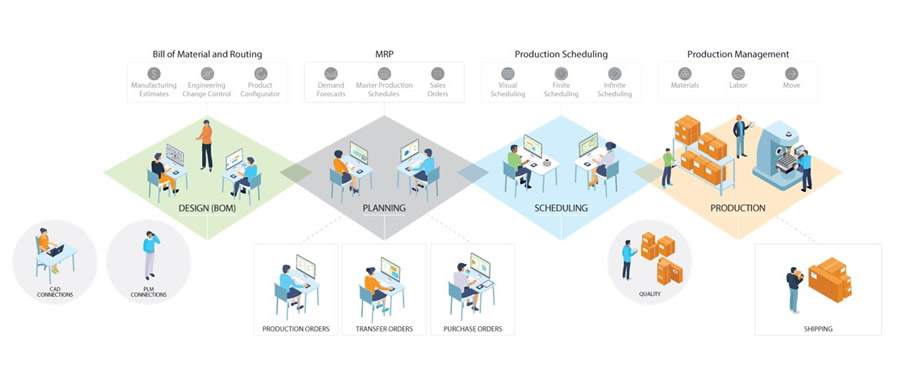

Figure 2: Acumatica manufacturing workflow

A modular ERP system allows you to pick and choose from the available system components to design a solution that is specifically suited to your requirements. In addition to the accounting, order processing, inventory, purchasing, and manufacturing modules mentioned, it may also include additional functionality, such as:

- A CRM to manage your sales and marketing operations;

- Expense management;

- Fixed assets for depreciation;

- Project accounting for managing all the moving parts and reporting on a project; and

- Field service for managing mobile or field-based operations.

Whether you are a repetitive manufacturer making the same items all the time, a job shop making items that are engineered to order, or a company making items created based on customer-selected configurable options, the ability to track and analyze the cost of production down to the item level in a timely and cost-efficient manner is fundamental to effectively understanding your true costs — and therefore your true profit margins.

Selecting an ERP system that will scale as your business grows will ensure long-term success. For more information, contact [email protected].